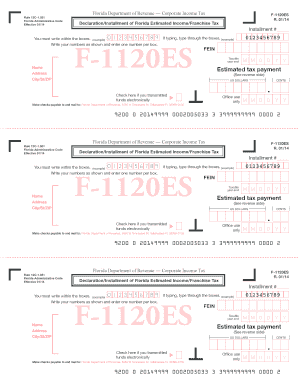

1120es Form

What is the 1120es

The 1120es form, officially known as the Estimated Tax for Corporations, is used by corporations to report and pay estimated taxes on their income. This form is essential for businesses that expect to owe tax of $500 or more when they file their annual tax return. By submitting the 1120es, corporations can ensure they meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax year.

How to use the 1120es

To use the 1120es form effectively, corporations should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax amount is established, corporations can fill out the 1120es form, reporting their estimated tax payments for each quarter. It is important to submit the form and payments on time to avoid penalties and interest charges.

Steps to complete the 1120es

Completing the 1120es form involves several key steps:

- Gather financial information, including projected income and expenses.

- Calculate the estimated tax liability based on the expected taxable income.

- Fill out the 1120es form with the calculated estimated tax amounts for each quarter.

- Review the form for accuracy before submission.

- Submit the form and make the necessary payments by the due dates.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the 1120es form. The estimated tax payments are typically due on the 15th day of April, June, September, and December for most corporations. It is crucial to mark these dates on the calendar to ensure timely payments and avoid penalties.

Legal use of the 1120es

The 1120es form is legally binding when completed and submitted according to IRS guidelines. Corporations must ensure that the information provided is accurate and reflects their true financial situation. Failure to comply with the legal requirements can result in penalties, including interest on unpaid taxes and potential audits from the IRS.

Key elements of the 1120es

Key elements of the 1120es form include:

- Identification Information: Name, address, and Employer Identification Number (EIN) of the corporation.

- Estimated Tax Calculation: Detailed calculations of the estimated tax liability for the year.

- Payment Information: Amounts due for each quarter and total estimated tax payments.

- Signature: Authorized signature certifying the accuracy of the information provided.

Quick guide on how to complete 1120es

Complete 1120es effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage 1120es across any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to adjust and eSign 1120es with ease

- Find 1120es and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign 1120es to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1120es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1120es and how does it relate to airSlate SignNow?

The 1120es form is an essential document used by corporations to make estimated tax payments. airSlate SignNow simplifies the process of signing and sending 1120es electronically, ensuring businesses can manage their tax obligations efficiently while maintaining compliance.

-

How does airSlate SignNow enhance the 1120es submission process?

airSlate SignNow enhances the 1120es submission process by providing a smooth, user-friendly interface for document eSigning. This allows users to quickly fill out and sign their 1120es forms, speeding up the submission and payment process signNowly.

-

Is there a free trial available for using airSlate SignNow with 1120es?

Yes, airSlate SignNow offers a free trial for new users looking to manage their 1120es documents. This trial enables potential customers to explore the platform's features and see how seamlessly they can handle their tax documentation.

-

What are the pricing options for airSlate SignNow when using it for 1120es?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes needing to manage 1120es and other documents. Pricing is based on the features you need, and you can choose a plan that works best for your organization's requirements.

-

Can airSlate SignNow integrate with accounting software for 1120es?

Absolutely! airSlate SignNow provides integrations with popular accounting software, allowing users to streamline their 1120es document management directly from their existing platforms. This integration helps ensure all financial data remains synchronized and accessible.

-

What security measures does airSlate SignNow provide for 1120es documents?

airSlate SignNow prioritizes security with a range of measures including encryption and secure cloud storage for all 1120es documents. This ensures that sensitive tax information remains protected during transmission and storage.

-

What features of airSlate SignNow are best suited for handling 1120es?

airSlate SignNow includes features such as templates, bulk sending, and real-time tracking, which are ideal for managing 1120es forms. These functionalities help streamline workflows, reduce errors, and enhance overall efficiency in tax document handling.

Get more for 1120es

Find out other 1120es

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement