Mortgage Underwriting Checklist Template Form

What is the mortgage underwriting checklist template

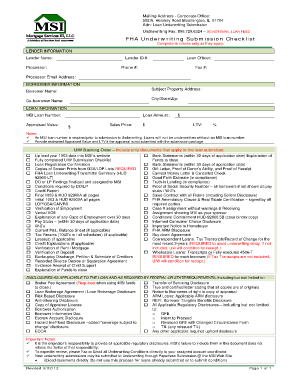

The mortgage underwriting checklist template is a structured document designed to assist mortgage underwriters in evaluating loan applications. It outlines the necessary documentation and criteria that must be met to approve a mortgage loan. This template typically includes sections for borrower information, property details, credit history, income verification, and debt-to-income ratio calculations. By using this checklist, underwriters can ensure that all essential elements are reviewed systematically, minimizing the risk of oversight during the underwriting process.

How to use the mortgage underwriting checklist template

Using the mortgage underwriting checklist template involves several key steps. First, gather all relevant documentation from the borrower, including identification, income statements, and credit reports. Next, systematically go through each section of the checklist to confirm that all required documents are present and complete. As you review each item, make notes regarding any discrepancies or additional information needed. Finally, ensure that all findings are documented clearly, allowing for a streamlined approval process. This methodical approach helps maintain compliance with lending standards and enhances the accuracy of the underwriting decision.

Key elements of the mortgage underwriting checklist template

The mortgage underwriting checklist template includes several critical elements that are essential for a thorough evaluation. Key components typically feature:

- Borrower Information: Personal details, including name, address, and Social Security number.

- Property Information: Details about the property being financed, including the address and type of property.

- Income Verification: Documentation of the borrower’s income, such as pay stubs, tax returns, and bank statements.

- Credit History: A review of the borrower’s credit report to assess creditworthiness.

- Debt-to-Income Ratio: Calculations to determine the borrower’s ability to manage monthly payments.

These elements are fundamental in ensuring a comprehensive assessment of the mortgage application.

Steps to complete the mortgage underwriting checklist template

Completing the mortgage underwriting checklist template involves a series of organized steps. Begin by collecting all necessary documents from the borrower. Next, review each section of the checklist methodically:

- Verify borrower identity and eligibility.

- Assess the property’s value and condition through appraisals.

- Evaluate the borrower’s credit history and score.

- Calculate the debt-to-income ratio to ensure it meets lender guidelines.

- Compile all findings and prepare a summary for approval or further action.

Following these steps ensures a thorough review process, contributing to informed lending decisions.

Legal use of the mortgage underwriting checklist template

The legal use of the mortgage underwriting checklist template is essential for compliance with federal and state regulations. It is crucial that the template adheres to guidelines set forth by the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA). These laws ensure that all borrowers are treated fairly and that their applications are evaluated based on consistent criteria. Additionally, using an electronic version of the checklist can enhance legal validity, provided it complies with the ESIGN Act and UETA, which govern electronic signatures and records. Ensuring legal compliance protects both lenders and borrowers throughout the mortgage process.

Examples of using the mortgage underwriting checklist template

Examples of using the mortgage underwriting checklist template can vary based on specific scenarios. For instance, a lender may utilize the checklist when processing a conventional loan application, ensuring that all required documentation is in order. In another case, a mortgage underwriter might reference the checklist while assessing an FHA loan, paying particular attention to additional requirements unique to government-backed loans. Each example highlights how the checklist serves as a valuable tool for maintaining consistency and thoroughness in the underwriting process.

Quick guide on how to complete mortgage underwriting checklist template 100079960

Effortlessly Prepare Mortgage Underwriting Checklist Template on Any Device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Mortgage Underwriting Checklist Template on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Modify and eSign Mortgage Underwriting Checklist Template with Ease

- Obtain Mortgage Underwriting Checklist Template and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight signNow sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Mortgage Underwriting Checklist Template to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage underwriting checklist template 100079960

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage underwriting checklist template?

A mortgage underwriting checklist template is a standardized document that outlines the necessary steps and documentation required to evaluate a mortgage application. It ensures that all critical information is collected for the underwriting process, making it easier for lenders to assess risk and make informed decisions.

-

How can I obtain a mortgage underwriting checklist template?

You can easily obtain a mortgage underwriting checklist template by signing up for airSlate SignNow. Our platform provides customizable templates that suit your specific needs, allowing you to streamline the underwriting process and improve efficiency.

-

What are the benefits of using a mortgage underwriting checklist template?

Using a mortgage underwriting checklist template helps ensure consistency and thoroughness in the underwriting process. It reduces the chances of missing critical information, thereby speeding up loan approvals and enhancing overall customer satisfaction.

-

Is the mortgage underwriting checklist template customizable?

Yes, the mortgage underwriting checklist template provided by airSlate SignNow is fully customizable. You can modify it to fit your specific underwriting criteria and client requirements, ensuring that you have all the necessary information tailored to your workflow.

-

What features does airSlate SignNow offer for mortgage underwriting?

AirSlate SignNow offers features like eSigning, document tracking, and secure cloud storage for your mortgage underwriting checklist template. These features facilitate efficient document handling while ensuring compliance and enhancing collaboration among your teams.

-

How does airSlate SignNow integrate with other software?

AirSlate SignNow easily integrates with popular CRM and document management software, allowing you to streamline your operations with the mortgage underwriting checklist template. This integration helps synchronize data and reduces manual entry, saving time and minimizing errors.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that provides access to the mortgage underwriting checklist template and other powerful features, ensuring you get the best value for your money.

Get more for Mortgage Underwriting Checklist Template

Find out other Mortgage Underwriting Checklist Template

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter