Irs Determination Letter Sample Form

What is the IRS determination letter sample

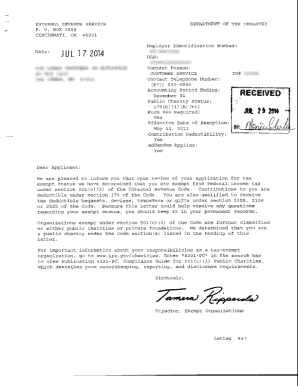

The IRS determination letter sample is a formal document issued by the Internal Revenue Service that confirms an organization's tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This letter serves as proof that the organization qualifies for federal tax exemption, allowing it to receive tax-deductible contributions from donors. The sample typically includes essential information such as the organization's name, address, and the effective date of the tax-exempt status. Understanding this document is crucial for non-profits and charitable organizations seeking to establish credibility and attract funding.

How to obtain the IRS determination letter sample

To obtain an IRS determination letter sample, organizations must first apply for tax-exempt status by submitting Form 1023 or Form 1023-EZ, depending on their size and complexity. Upon approval, the IRS issues the determination letter, which can be requested through the IRS website or by contacting the IRS directly. Organizations should ensure they provide all necessary documentation and follow the application guidelines closely to avoid delays in receiving their letter.

Key elements of the IRS determination letter sample

An IRS determination letter sample contains several key elements that are important for understanding its significance. These elements include:

- Organization Information: The name and address of the organization.

- Tax Identification Number: The unique number assigned to the organization for tax purposes.

- Effective Date: The date on which the tax-exempt status became effective.

- Type of Exemption: A statement indicating the specific section of the Internal Revenue Code under which the organization is exempt.

- Limitations: Any limitations or conditions imposed on the organization regarding its tax-exempt status.

Steps to complete the IRS determination letter sample

Completing the IRS determination letter sample involves several steps to ensure accuracy and compliance. First, gather all necessary information about the organization, including its mission, structure, and financial data. Next, fill out the appropriate IRS forms, such as Form 1023 or Form 1023-EZ, providing detailed descriptions of the organization's activities and finances. After submitting the forms, monitor the application status and respond promptly to any IRS requests for additional information. Once approved, review the determination letter sample carefully to ensure it accurately reflects the organization's status.

Legal use of the IRS determination letter sample

The legal use of the IRS determination letter sample is significant for organizations seeking to operate as tax-exempt entities. This letter is often required when applying for grants, soliciting donations, or establishing credibility with stakeholders. It serves as a legal document that confirms the organization's compliance with federal tax laws. Organizations must keep the determination letter on file and present it when necessary to demonstrate their tax-exempt status. Failure to maintain this documentation can lead to challenges in securing funding or facing audits.

Examples of using the IRS determination letter sample

Organizations can use the IRS determination letter sample in various scenarios. For instance, when applying for grants from foundations or government agencies, the letter may be required to prove tax-exempt status. Additionally, when soliciting donations from individuals or corporations, presenting the determination letter can enhance credibility and encourage contributions. Non-profits may also need to provide this letter when filing annual tax returns or during audits to confirm their tax-exempt status.

Quick guide on how to complete irs determination letter sample

Complete Irs Determination Letter Sample effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed materials, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Irs Determination Letter Sample on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The ultimate method to edit and eSign Irs Determination Letter Sample seamlessly

- Obtain Irs Determination Letter Sample and then click Get Form to initiate.

- Utilize the features we provide to complete your document.

- Emphasize relevant parts of your documents or remove sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Determination Letter Sample while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs determination letter sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS determination letter sample?

An IRS determination letter sample is a document that confirms an organization’s tax-exempt status. It serves as proof that your entity complies with IRS regulations. Receiving an IRS determination letter is critical for nonprofits seeking to validate their tax-exempt status.

-

How can airSlate SignNow help with obtaining an IRS determination letter?

airSlate SignNow simplifies the process of sending and obtaining documents, including applications for IRS determination letters. By utilizing our eSignature features, organizations can efficiently gather signatures required for submission. This streamlines the entire process, reducing time and effort involved.

-

Is there a cost associated with using airSlate SignNow for IRS determination letter samples?

Yes, airSlate SignNow offers various pricing plans to suit different needs, ensuring accessibility for all businesses. Our plans are designed to be cost-effective, making it easy for organizations to manage their documentation, including IRS determination letters. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS determination letters?

airSlate SignNow provides several features including document templates, customizable workflows, and secure electronic signatures. Our platform allows you to save IRS determination letter samples for future use, making it easier to handle similar requests. Additionally, our audit trail feature ensures that all actions are tracked for compliance.

-

Can I integrate airSlate SignNow with other tools to manage IRS determination letters?

Absolutely! airSlate SignNow offers integrations with various third-party applications that facilitate the management of IRS determination letters and other documents. These integrations enable seamless workflows, allowing users to connect with tools they already utilize. This enhances productivity and ensures all documentation is in one place.

-

How secure is airSlate SignNow for handling IRS determination letter samples?

Security is a priority at airSlate SignNow, especially when dealing with sensitive documents like IRS determination letters. We implement advanced encryption protocols and compliance measures to safeguard your information. Our platform is designed to protect your data while providing a user-friendly experience.

-

What are the benefits of using airSlate SignNow for IRS determination letters?

Using airSlate SignNow for IRS determination letters offers numerous benefits such as increased efficiency, reduced paperwork, and fast turnaround times. By leveraging our eSignature capabilities, organizations can expedite the approval process. This ensures timely submissions and keeps your operations running smoothly.

Get more for Irs Determination Letter Sample

Find out other Irs Determination Letter Sample

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement