8453 Form 2011

What is the 8453 Form

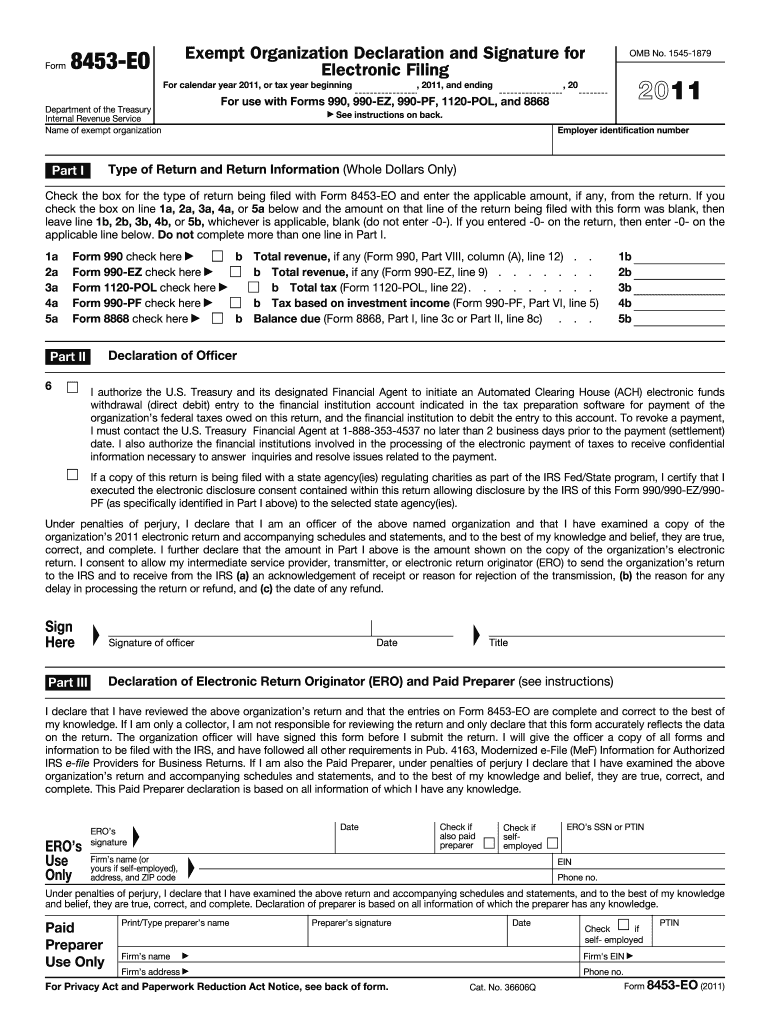

The 8453 Form, officially known as the U.S. Individual Income Tax Declaration for an IRS e-File Return, is a crucial document used by taxpayers in the United States. This form serves as a declaration that the taxpayer has submitted their tax return electronically. It is primarily utilized for e-filing purposes, allowing individuals to confirm that they have provided the necessary information to the IRS. The 8453 Form is essential for maintaining compliance with tax regulations and ensuring that all electronic submissions are properly documented.

How to use the 8453 Form

Using the 8453 Form involves several key steps that ensure proper submission and compliance with IRS requirements. Initially, taxpayers must complete their tax return using approved e-filing software. Once the electronic return is prepared, the 8453 Form should be printed, signed, and submitted. This form acts as a cover sheet for the electronic submission, confirming the authenticity of the return. It is important to retain a copy of the signed form for personal records, as it may be needed for future reference or in case of an audit.

Steps to complete the 8453 Form

Completing the 8453 Form requires careful attention to detail. The following steps outline the process:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are filing.

- Provide details regarding your e-filed return, including the total income and any tax owed or refund expected.

- Sign and date the form to validate your submission.

- Keep a copy of the completed form for your records.

Legal use of the 8453 Form

The 8453 Form holds legal significance as it serves as a declaration of the taxpayer's intent to file electronically. For the form to be legally binding, it must be signed by the taxpayer. The IRS recognizes the 8453 Form as a valid document that supports the electronic filing process. Compliance with IRS regulations regarding the use of this form is essential, as failure to adhere to these guidelines may result in penalties or delays in processing the tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the 8453 Form. Taxpayers must ensure that they are using the most current version of the form and that it is completed accurately. The IRS also outlines the requirements for electronic signatures and the conditions under which the 8453 Form must be submitted. Familiarizing oneself with these guidelines is crucial for ensuring that all submissions are compliant and accepted by the IRS.

Form Submission Methods

The 8453 Form can be submitted through various methods, depending on the taxpayer's preferences and circumstances. While the primary method is electronic submission alongside the e-filed return, taxpayers may also choose to mail the signed form to the IRS if required. It is important to verify the submission method that aligns with the specific tax situation and to ensure that all deadlines are met to avoid penalties.

Quick guide on how to complete 2011 8453 form

Complete 8453 Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed papers, enabling you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 8453 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered procedure today.

The easiest way to alter and electronically sign 8453 Form without hassle

- Find 8453 Form and then click Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your edits.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it onto your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign 8453 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8453 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8453 form

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 8453 Form and how is it used?

The 8453 Form is an important document used in electronic tax filing for various forms. It serves as a signature document to authenticate your e-filed returns. Businesses using airSlate SignNow can easily send and eSign the 8453 Form, ensuring compliance and streamlining the e-filing process.

-

How does airSlate SignNow help with the 8453 Form?

AirSlate SignNow streamlines the process of completing and signing the 8453 Form electronically. Users can quickly upload, edit, and send the form for e-signatures, reducing the time and effort needed for traditional paper-based methods. This electronic signing process enhances security and ensures you stay compliant.

-

Is there a cost associated with using airSlate SignNow for the 8453 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan allows users to eSign documents like the 8453 Form while benefiting from additional features. Be sure to check our pricing page for details on the plans that suit your budget.

-

What features does airSlate SignNow offer for the 8453 Form?

AirSlate SignNow provides multiple features for handling the 8453 Form, including customizable templates, document tracking, and automated reminders for signers. These features ensure that your documents are processed efficiently and securely, saving you time and effort during tax season.

-

Can I integrate airSlate SignNow with other software for the 8453 Form?

Certainly! AirSlate SignNow offers numerous integrations with popular business applications, making it easy to incorporate the 8453 Form into your existing workflows. This flexibility allows you to streamline document management and e-signature processes within your preferred platforms.

-

What benefits does using airSlate SignNow for the 8453 Form provide?

Using airSlate SignNow for the 8453 Form ensures faster turnaround times and improved document security. By utilizing electronic signatures, businesses can minimize paperwork and administrative burdens, leading to increased efficiency. This ultimately results in a better overall experience during the tax filing process.

-

Is the 8453 Form legally binding when signed with airSlate SignNow?

Yes, the 8453 Form signed through airSlate SignNow is legally binding and complies with all e-signature laws, including the ESIGN Act and UETA. This means businesses can confidently use our platform to manage their tax documents while remaining compliant with regulatory requirements.

Get more for 8453 Form

- Essential documents for the organized traveler package with personal organizer indiana form

- Postnuptial agreements package indiana form

- In letters recommendation form

- Indiana mechanics lien form

- Indiana corporation 497307205 form

- Storage business package indiana form

- Child care services package indiana form

- Special or limited power of attorney for real estate sales transaction by seller indiana form

Find out other 8453 Form

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free