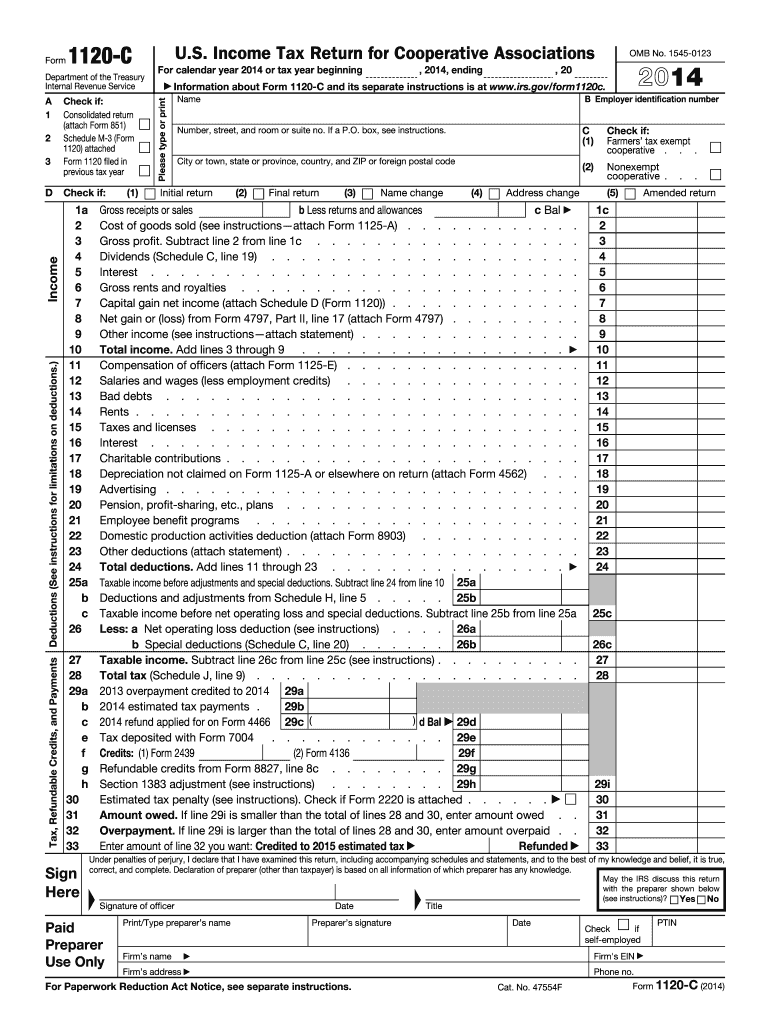

Taxable Income Before Adjustments and Special Deductions 2014

What is the taxable income before adjustments and special deductions?

The taxable income before adjustments and special deductions refers to the income amount calculated before any deductions or adjustments are applied. This figure is crucial for determining an individual’s or business’s tax liability. It includes wages, salaries, bonuses, interest income, and other earnings. Understanding this concept helps taxpayers accurately assess their financial situation and prepare for tax obligations.

How to use the taxable income before adjustments and special deductions

Using the taxable income before adjustments and special deductions involves several steps. First, gather all income sources, including employment earnings, investment returns, and any other taxable income. Next, compile this information into a comprehensive report. This total serves as the foundation for calculating any applicable deductions or adjustments, which will ultimately determine the final taxable income. Accurate reporting ensures compliance with tax regulations and helps avoid potential penalties.

Steps to complete the taxable income before adjustments and special deductions

Completing the taxable income before adjustments and special deductions requires careful attention to detail. Follow these steps:

- Collect all relevant income documents, such as W-2s, 1099 forms, and bank statements.

- Summarize total income from all sources, ensuring no income is overlooked.

- Record this total accurately on the appropriate tax form.

- Review the information for accuracy before submission.

By adhering to these steps, you can ensure that your taxable income is reported correctly, which is essential for proper tax calculations.

IRS guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxable income before adjustments and special deductions. These guidelines outline what constitutes taxable income and detail how to report it accurately. It is essential to refer to the latest IRS publications for updates and changes to tax laws. Following these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing deadlines / important dates

Filing deadlines for the taxable income before adjustments and special deductions vary based on the taxpayer's status. Generally, individual tax returns are due by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines depending on their structure. Staying aware of these important dates is crucial for timely filing and avoiding penalties.

Required documents

To accurately report taxable income before adjustments and special deductions, several documents are typically required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Bank statements showing interest income

- Documentation of any other income sources

Having these documents organized and readily available simplifies the reporting process and ensures accuracy.

Quick guide on how to complete taxable income before adjustments and special deductions

Complete Taxable Income Before Adjustments And Special Deductions effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly and without delays. Manage Taxable Income Before Adjustments And Special Deductions on any gadget using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest method to edit and eSign Taxable Income Before Adjustments And Special Deductions without effort

- Find Taxable Income Before Adjustments And Special Deductions and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important parts of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Taxable Income Before Adjustments And Special Deductions and guarantee outstanding communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxable income before adjustments and special deductions

Create this form in 5 minutes!

How to create an eSignature for the taxable income before adjustments and special deductions

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Taxable Income Before Adjustments And Special Deductions?

Taxable Income Before Adjustments And Special Deductions refers to the total income of an individual or business before any tax deductions or adjustments are applied. Understanding this figure is essential for accurate tax reporting and compliance, as it is a starting point for calculating the tax liability.

-

How can airSlate SignNow help with tax documents related to Taxable Income Before Adjustments And Special Deductions?

airSlate SignNow provides a seamless platform for eSigning and sending tax documents related to Taxable Income Before Adjustments And Special Deductions. Our solution ensures that your documents are secure, legally binding, and easily accessible, allowing for efficient management of tax-related paperwork.

-

What pricing plans does airSlate SignNow offer for businesses dealing with tax documents?

airSlate SignNow offers several pricing plans tailored to businesses of all sizes. Our plans include essential features like document templates and unlimited eSignatures, making it a cost-effective solution for managing Taxable Income Before Adjustments And Special Deductions and other financial documents.

-

Does airSlate SignNow integrate with accounting software for tax management?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, enabling you to manage your Taxable Income Before Adjustments And Special Deductions efficiently. This integration allows for streamlined workflows and better organization of your financial data.

-

What are the benefits of using airSlate SignNow for tax-related processes?

Using airSlate SignNow for tax-related processes simplifies document management and ensures compliance with tax regulations. Our platform allows for quick eSigning, tracking document status, and archiving important records related to Taxable Income Before Adjustments And Special Deductions.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security features, including encryption and multi-factor authentication, to protect your sensitive tax documents. You can confidently manage documents related to Taxable Income Before Adjustments And Special Deductions, knowing that your information is safe and secure.

-

Can I customize my documents for Taxable Income Before Adjustments And Special Deductions using airSlate SignNow?

Yes, airSlate SignNow allows users to customize document templates to suit specific needs related to Taxable Income Before Adjustments And Special Deductions. This flexibility ensures that you can tailor documents perfectly to adhere to your business requirements.

Get more for Taxable Income Before Adjustments And Special Deductions

Find out other Taxable Income Before Adjustments And Special Deductions

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation