1099 Div Fillable Form 2011

What is the 1099 Div Fillable Form

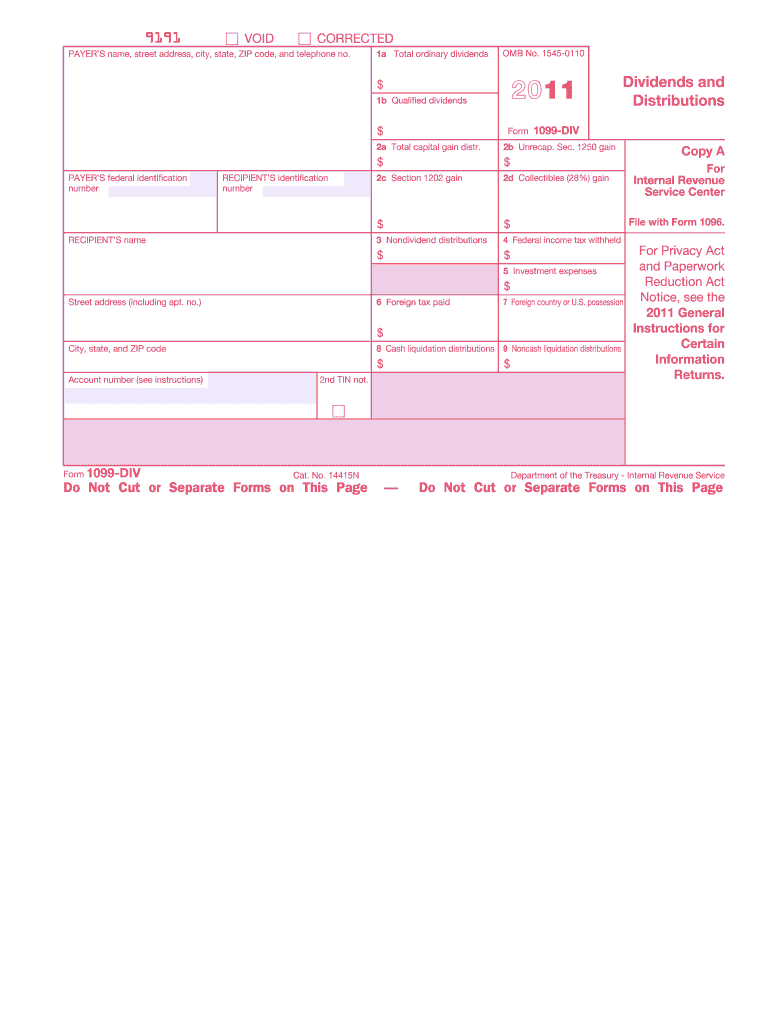

The 1099 Div Fillable Form is a tax document used in the United States to report dividends and distributions received by individuals from various sources, such as stocks and mutual funds. This form is essential for taxpayers who have received at least ten dollars in dividends during the tax year. It provides the Internal Revenue Service (IRS) with information about the income received, ensuring that individuals accurately report their earnings when filing taxes. The 1099 Div Fillable Form is typically issued by financial institutions and companies that have paid dividends to their shareholders.

How to use the 1099 Div Fillable Form

Using the 1099 Div Fillable Form involves several steps to ensure accurate reporting of dividend income. First, obtain the form from a reliable source, such as the IRS website or a tax software program. Next, fill in your personal information, including your name, address, and Social Security number. Then, enter the details of your dividend income as reported by the issuer, including the total amount of dividends received and any foreign tax paid. Finally, keep a copy for your records and submit the form along with your tax return to the IRS.

Steps to complete the 1099 Div Fillable Form

Completing the 1099 Div Fillable Form requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or access it through tax software.

- Provide your personal information, including your name and Social Security number.

- Input the payer's information, including their name and taxpayer identification number.

- Enter the total dividends received in the appropriate box.

- If applicable, include any amounts for foreign tax paid.

- Review the form for accuracy before saving or printing.

Legal use of the 1099 Div Fillable Form

The 1099 Div Fillable Form is legally binding when used correctly. It must be filled out accurately to reflect the income received, as the IRS requires this information for tax purposes. Both the issuer and the recipient must retain copies of the form for their records. Failure to report income accurately can lead to penalties, so it is essential to ensure that all information is complete and correct before submission. Utilizing a reliable e-signature solution can also enhance the legal standing of the form when completing it digitally.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div Fillable Form are crucial to avoid penalties. Typically, the form must be sent to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Recipients should receive their copies by January 31 of the following year. It is important to keep these dates in mind to ensure compliance with IRS regulations and to avoid any potential late fees.

Who Issues the Form

The 1099 Div Fillable Form is issued by financial institutions, corporations, and other entities that pay dividends to shareholders. This includes banks, investment firms, and mutual funds. These issuers are responsible for providing accurate information regarding the dividends paid, which is then reported to the IRS. Recipients of the form should ensure they receive it from the appropriate issuer to accurately report their income during tax season.

Quick guide on how to complete 1099 div fillable form 2011

Effortlessly Prepare 1099 Div Fillable Form on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a remarkable eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle 1099 Div Fillable Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and eSign 1099 Div Fillable Form with Ease

- Find 1099 Div Fillable Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign 1099 Div Fillable Form and assure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 div fillable form 2011

Create this form in 5 minutes!

How to create an eSignature for the 1099 div fillable form 2011

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is a 1099 Div Fillable Form and why is it important?

The 1099 Div Fillable Form is a tax document that reports dividends and distributions to taxpayers. It's essential for accurately reporting income to the IRS and ensuring compliance with tax regulations. Using an editable form can streamline the process, making it easier to fill out and submit.

-

How can airSlate SignNow help with filling out the 1099 Div Fillable Form?

airSlate SignNow provides an intuitive platform that allows users to create and edit the 1099 Div Fillable Form easily. With our electronic signing feature, you can quickly fill out the form and send it for signatures, ensuring a smooth transaction. Our user-friendly interface makes completing your tax documents hassle-free.

-

Is there a cost associated with using the 1099 Div Fillable Form on airSlate SignNow?

Yes, while the 1099 Div Fillable Form can be accessed through airSlate SignNow, there are subscription plans that may incur costs. However, our pricing model is competitive and designed to provide businesses with a cost-effective solution for document management. You can review our pricing plans on our website to find one that suits your needs.

-

What features does airSlate SignNow offer for the 1099 Div Fillable Form?

airSlate SignNow offers several features for the 1099 Div Fillable Form, including easy document creation, electronic signatures, and secure cloud storage. Additionally, our platform supports collaboration, allowing multiple users to work on the form simultaneously. These features enhance productivity while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other software for managing the 1099 Div Fillable Form?

Yes, airSlate SignNow offers integrations with popular accounting and business management software. This allows for seamless data transfer and management of the 1099 Div Fillable Form alongside your existing tools. Our integration capabilities help streamline your workflow, making it easier to manage tax documents and client information.

-

Is the 1099 Div Fillable Form compatible with different devices?

Absolutely! The 1099 Div Fillable Form provided by airSlate SignNow is fully compatible with various devices, including desktops, tablets, and smartphones. This ensures that you can fill out, sign, and send your tax documents anytime, anywhere. Our responsive design enhances user experience across all platforms.

-

What are the benefits of using airSlate SignNow for my 1099 Div Fillable Form?

Using airSlate SignNow for your 1099 Div Fillable Form offers numerous benefits, such as speeding up the signing process and reducing paper usage. Our e-signature solution is legally binding, making it a reliable choice for tax documents. Additionally, you gain access to features like reminders and automated workflows that simplify document management.

Get more for 1099 Div Fillable Form

- New resident guide indiana form

- Satisfaction release or cancellation of mortgage by corporation indiana form

- Satisfaction release or cancellation of mortgage by individual indiana form

- Partial release of property from mortgage for corporation indiana form

- Partial release form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy indiana form

- Warranty deed for parents to child with reservation of life estate indiana form

- Warranty deed for separate or joint property to joint tenancy indiana form

Find out other 1099 Div Fillable Form

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple