W4s Form

What is the W-4S?

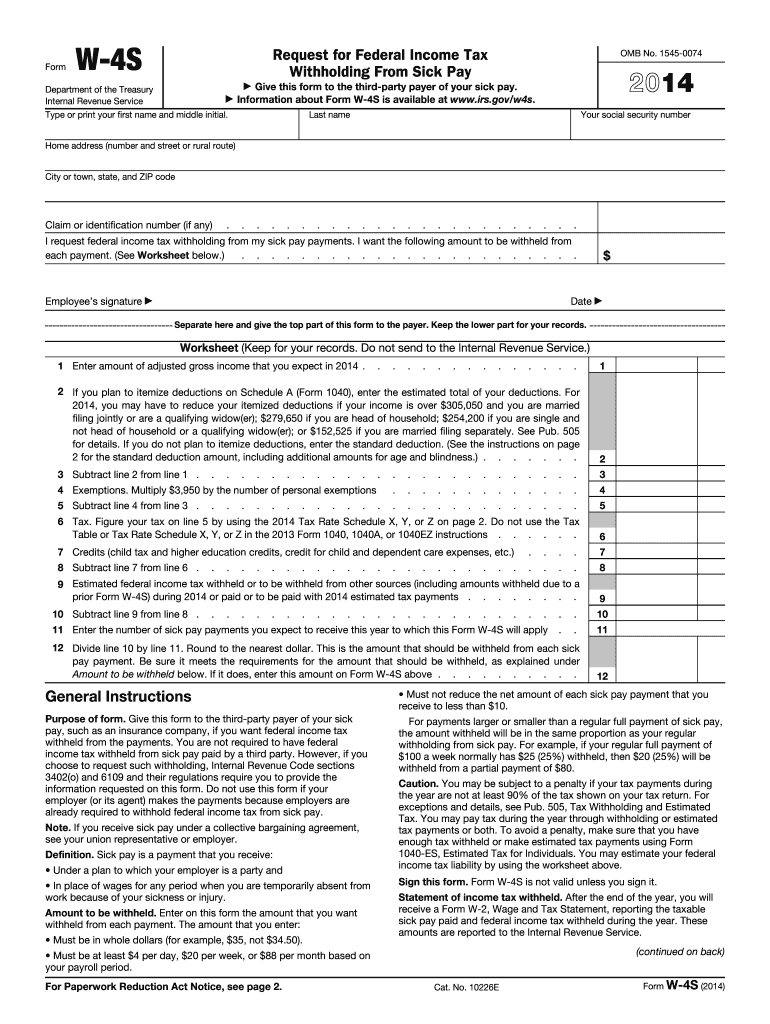

The W-4S form, officially known as the "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding," is a document used by non-resident aliens to certify their foreign status for tax purposes. This form is crucial for individuals who receive income from U.S. sources, as it helps determine the correct amount of tax withholding. The W-4S allows these individuals to claim any applicable tax treaty benefits, ensuring they are not overtaxed on income that may be exempt or subject to reduced rates under international agreements.

How to use the W-4S

Using the W-4S form involves several straightforward steps. First, individuals must accurately fill out the form, providing personal information such as name, address, and taxpayer identification number. Next, they should indicate their foreign status and any applicable tax treaty benefits. Once completed, the form should be submitted to the withholding agent or payer, who is responsible for withholding taxes on the income. It is important to keep a copy of the submitted form for personal records, as it may be needed for future reference or tax filings.

Steps to complete the W-4S

Completing the W-4S form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Indicate your foreign status by checking the appropriate box.

- Provide information about any applicable tax treaty benefits, including the country of residence and the specific article of the treaty.

- Sign and date the form to certify that the information provided is accurate and complete.

After completing these steps, submit the form to the relevant withholding agent or payer.

Legal use of the W-4S

The W-4S form is legally binding when completed correctly and submitted to the appropriate parties. It serves as a declaration of an individual's foreign status and eligibility for reduced tax withholding under tax treaties. To ensure legal compliance, it is vital to provide accurate information and maintain records of the submitted form. Failure to do so may result in incorrect tax withholding and potential penalties from the IRS.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the W-4S form. According to IRS regulations, non-resident aliens must submit this form to claim any tax treaty benefits. The IRS also outlines the requirements for maintaining foreign status and the documentation needed to support claims made on the W-4S. It is advisable for individuals to consult IRS publications or a tax professional to ensure compliance with all guidelines and avoid any issues during tax filing.

Form Submission Methods

The W-4S form can be submitted through various methods, depending on the preferences of the withholding agent or payer. Common submission methods include:

- Online submission through secure portals provided by the payer.

- Mailing a physical copy of the completed form to the payer's address.

- In-person delivery, if applicable, to the office of the withholding agent.

It is essential to confirm the preferred submission method with the payer to ensure timely processing of the form.

Quick guide on how to complete w4s

Complete W4s with ease on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly and without delays. Handle W4s on any device with airSlate SignNow’s Android or iOS applications and enhance your document-centric processes today.

How to edit and eSign W4s effortlessly

- Obtain W4s and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes a matter of seconds and carries the same legal standing as a traditional signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign W4s to guarantee effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is W4S and how does it relate to airSlate SignNow?

W4S stands for 'W4 sign'. It refers to the process of electronically signing W-4 forms using airSlate SignNow's platform. With airSlate SignNow, businesses can efficiently manage and send W4S documents for quick electronic signatures.

-

How does airSlate SignNow ensure security for W4S document processing?

airSlate SignNow employs industry-standard encryption protocols to protect W4S documents during transmission and storage. Our platform also includes additional security features such as multi-factor authentication, ensuring that your W4S documents are safe and secure.

-

What are the pricing options for using airSlate SignNow for W4S?

airSlate SignNow offers flexible pricing plans to accommodate various business needs regarding W4S document signing. Our pricing is competitive, catering to startups and established enterprises, providing a cost-effective solution for managing W4S signatures.

-

Can I integrate airSlate SignNow with other applications for handling W4S documents?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, making managing W4S documents more efficient. You can integrate with tools like Google Workspace, Salesforce, and many others to streamline your workflow.

-

What features does airSlate SignNow provide for W4S document management?

airSlate SignNow includes features designed specifically for W4S document management, such as customizable templates, automated workflows, and real-time tracking. These features help businesses ensure that their W4S documents are signed efficiently and accurately.

-

How can airSlate SignNow improve the workflow for handling W4S forms?

By utilizing airSlate SignNow, businesses can automate the sending and signing process of W4S forms, reducing manual effort and improving efficiency. This not only speeds up the overall process but also minimizes errors and ensures compliance.

-

Is it easy to use airSlate SignNow for W4S electronic signatures?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for users to manage W4S electronic signatures. The intuitive interface allows users to quickly navigate the platform and complete their tasks without extensive training.

Get more for W4s

- Tc 843pdf clear form utah state tax commission tc 843

- 2021 tc 65 utah partnershipllpllc return forms ampamp publications

- 2021 tc 20 utah corporation franchise or income tax return forms ampamp publications

- Do i need to do a state income tax if i only made 600 dollars form

- 2021 tc 20s utah s corporation tax return forms ampamp publications

- Wwwrevenuestatemnus2021 12m12102021 form m1 individual income tax return

- Minnesota form mwr reciprocity exemptionaffidavit of

- Wwwrevenuestatemnus sites defaultwithholding fact sheet 2 submitting form w 2 and w 2c

Find out other W4s

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form