Www Revenue State Mn Us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 and W 2c 2022

Key elements of the MN 2024 W-4 form

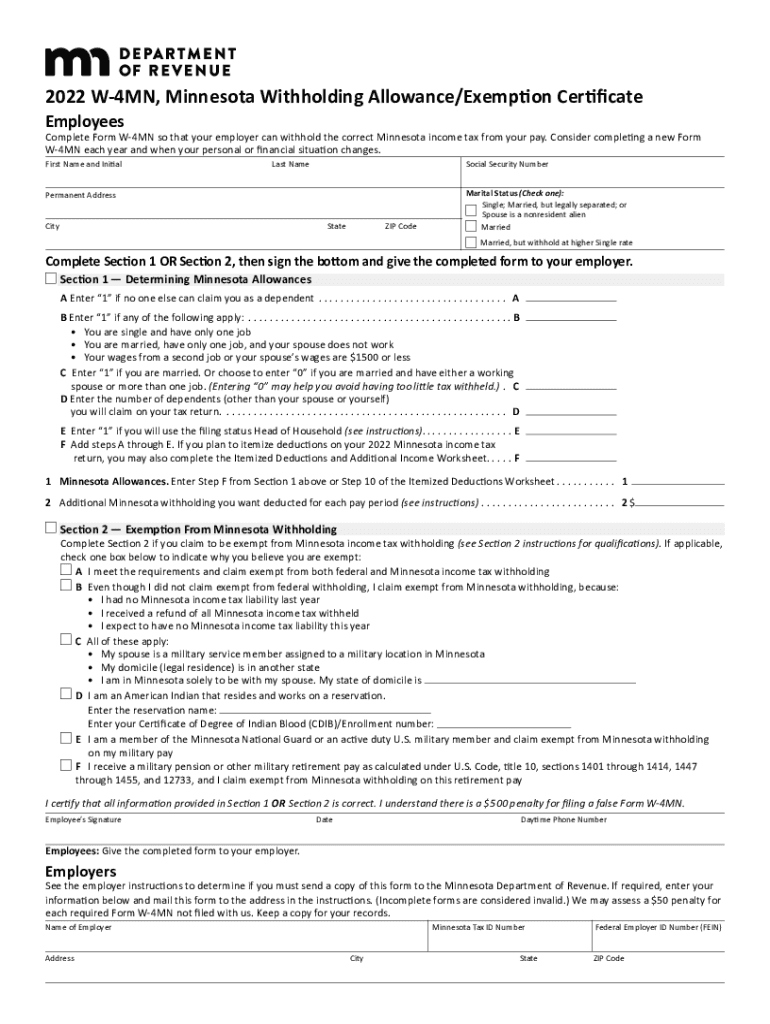

The MN 2024 W-4 form is essential for employees in Minnesota to determine the correct amount of state income tax withholding from their paychecks. This form includes critical sections such as:

- Personal Information: Employees must provide their name, address, and Social Security number.

- Filing Status: Individuals can select their filing status, which affects withholding rates.

- Allowances: Claiming allowances can reduce the amount withheld; the form provides guidance on how to calculate these.

- Additional Withholding: Employees may choose to have extra amounts withheld for various reasons.

Understanding these elements ensures accurate withholding and compliance with state tax regulations.

Steps to complete the MN 2024 W-4 form

Completing the MN 2024 W-4 form involves several straightforward steps:

- Gather Personal Information: Collect necessary details such as your Social Security number and filing status.

- Determine Allowances: Use the worksheet provided with the form to calculate the number of allowances you can claim.

- Fill Out the Form: Enter your personal information, filing status, and allowances on the form.

- Review for Accuracy: Ensure all information is correct to avoid issues with tax withholding.

- Submit the Form: Provide the completed form to your employer for processing.

Following these steps helps ensure that your tax withholding aligns with your financial situation.

IRS Guidelines for the MN 2024 W-4 form

The Internal Revenue Service (IRS) provides guidelines that govern the completion and submission of the MN 2024 W-4 form. Key points include:

- Accuracy: It's crucial to provide accurate information to avoid under-withholding or over-withholding taxes.

- Updates: Employees should update their W-4 form whenever their financial situation changes, such as marriage or changes in dependents.

- Record Keeping: Keep a copy of the completed form for personal records and future reference.

Adhering to IRS guidelines ensures compliance and helps prevent potential tax issues.

Form Submission Methods for the MN 2024 W-4

Submitting the MN 2024 W-4 form can be done through various methods:

- Online Submission: Some employers allow for electronic submission through payroll systems.

- Mail: Employees can send the completed form via postal mail to their employer's human resources department.

- In-Person: Delivering the form directly to the HR department is also an option for those who prefer face-to-face interaction.

Choosing the right submission method can depend on employer preferences and personal convenience.

Penalties for Non-Compliance with the MN 2024 W-4 form

Failing to comply with the requirements of the MN 2024 W-4 form can lead to significant penalties, including:

- Underpayment Penalties: If too little tax is withheld, employees may face penalties from the state for underpayment.

- Interest Charges: Unpaid taxes may accrue interest until they are paid in full.

- Legal Consequences: Persistent non-compliance can result in legal action by tax authorities.

Understanding these penalties emphasizes the importance of accurate and timely submission of the W-4 form.

Eligibility Criteria for the MN 2024 W-4 form

To complete the MN 2024 W-4 form, individuals must meet certain eligibility criteria:

- Employment Status: The form is intended for employees receiving wages from an employer in Minnesota.

- Tax Residency: Individuals must be residents of Minnesota or working in the state to use this form.

- Income Level: Employees must have taxable income that requires withholding to complete the form accurately.

Meeting these criteria ensures that the W-4 form is applicable and relevant to the individual's tax situation.

Quick guide on how to complete wwwrevenuestatemnus sites defaultwithholding fact sheet 2 submitting form w 2 and w 2c

Complete Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documentation, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c across any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c without hassle

- Locate Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from a device of your choice. Edit and eSign Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuestatemnus sites defaultwithholding fact sheet 2 submitting form w 2 and w 2c

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuestatemnus sites defaultwithholding fact sheet 2 submitting form w 2 and w 2c

The best way to make an e-signature for your PDF file in the online mode

The best way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the mn 2024 W4 form?

The mn 2024 W4 form is a tax withholding document that employees in Minnesota need to fill out to determine the proper amount of income tax to withhold from their paychecks. Understanding how to fill out the mn 2024 W4 correctly is crucial for both employees and employers to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the mn 2024 W4?

airSlate SignNow simplifies the process of completing and signing the mn 2024 W4 form. With our platform, users can easily fill out the form electronically, ensuring that all necessary fields are completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for handling the mn 2024 W4?

Yes, airSlate SignNow offers cost-effective solutions for businesses looking to manage their document signing processes, including the mn 2024 W4. Our pricing plans are designed to fit the budgets of businesses of all sizes, ensuring that managing tax forms is affordable.

-

What features does airSlate SignNow offer for the mn 2024 W4?

airSlate SignNow provides features such as e-signatures, document templates, and real-time tracking for the mn 2024 W4 form. These features make it easy for users to create, send, and manage their tax documents while ensuring compliance and security.

-

Can I integrate airSlate SignNow with existing software for the mn 2024 W4?

Absolutely! airSlate SignNow can integrate seamlessly with various software applications to streamline the handling of mn 2024 W4 forms. This flexibility helps businesses automate their workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for the mn 2024 W4?

Using airSlate SignNow for the mn 2024 W4 offers numerous benefits, including enhanced security, speed, and ease of use. Our platform allows for efficient document management, helping users save time and reduce paper usage.

-

Is airSlate SignNow secure for handling the mn 2024 W4?

Yes, airSlate SignNow prioritizes security to protect sensitive information associated with the mn 2024 W4. We use industry-standard encryption and compliance measures to ensure that all documents are safe and secure.

Get more for Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c

Find out other Www revenue state mn us Sites DefaultWithholding Fact Sheet 2, Submitting Form W 2 And W 2c

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online