TC 20 Utah Corporation Franchise or Income Tax Return Forms & Publications 2021

What is the TC 20 Utah Corporation Franchise or Income Tax Return?

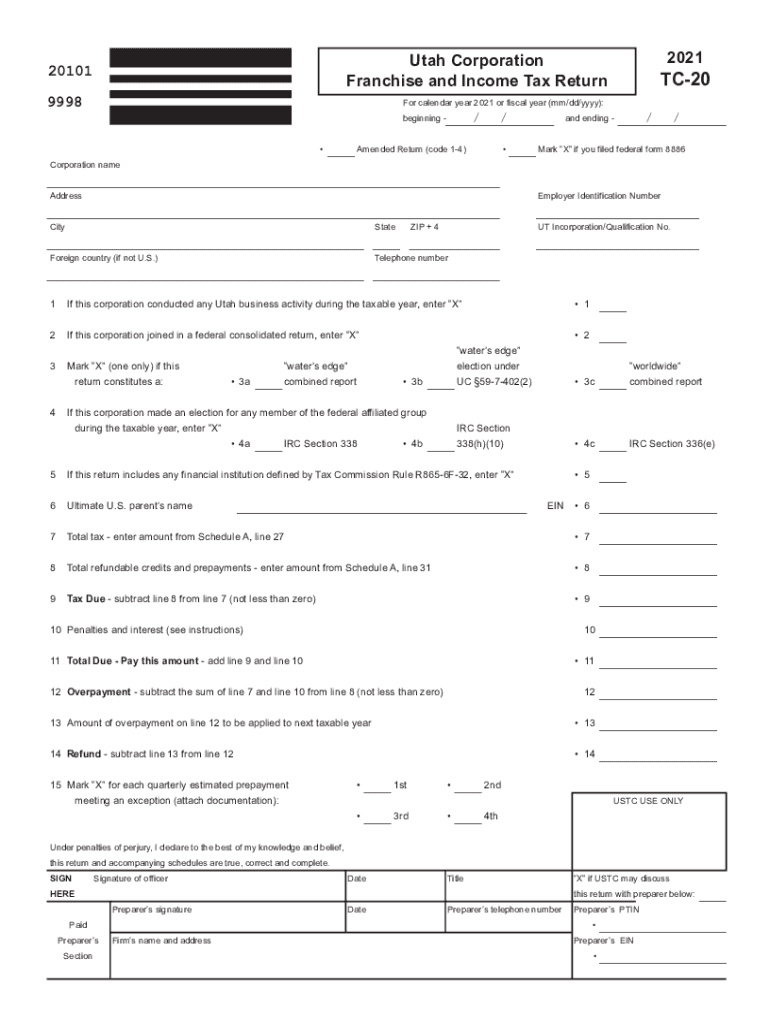

The TC 20 form is a crucial document for corporations operating in Utah, specifically designed for filing franchise or income taxes. This form is used by corporations to report their income, calculate their tax liability, and ensure compliance with state tax regulations. Understanding the TC 20 is essential for any business entity classified as a corporation in Utah, as it outlines the necessary financial information needed for accurate tax reporting.

Steps to Complete the TC 20 Utah Corporation Franchise or Income Tax Return

Completing the TC 20 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, follow these steps:

- Fill out the identification section, including your corporation's name, address, and federal employer identification number (EIN).

- Report your total income, including gross receipts and any other income sources.

- Calculate allowable deductions, such as business expenses and losses.

- Determine your taxable income by subtracting deductions from total income.

- Apply the appropriate tax rate to your taxable income to calculate your tax liability.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Legal Use of the TC 20 Utah Corporation Franchise or Income Tax Return

The TC 20 form is legally binding and must be completed in accordance with Utah state tax laws. It is essential for corporations to file this form accurately and on time to avoid penalties. The legal framework governing the use of this form ensures that all reported information is truthful and complete, which is vital for maintaining compliance with state regulations.

Filing Deadlines / Important Dates for the TC 20 Form

Corporations must adhere to specific deadlines when filing the TC 20 form. The standard due date for this form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by April 15. It is important to be aware of these deadlines to avoid late filing penalties and interest charges.

Required Documents for Completing the TC 20 Form

To accurately complete the TC 20 form, corporations need to gather various documents. Key documents include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and expenses.

- Any prior year tax returns for reference.

- Documentation for any credits or deductions claimed.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included on the TC 20 form.

Form Submission Methods for the TC 20

The TC 20 form can be submitted through various methods, providing flexibility for corporations. Options for submission include:

- Online filing through the Utah State Tax Commission's website, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax commission offices, if preferred.

Choosing the right submission method can help ensure timely processing and compliance with state tax regulations.

Quick guide on how to complete 2021 tc 20 utah corporation franchise or income tax return forms ampamp publications

Complete TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications effortlessly on any device

Digital document management has become a popular choice for businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Manage TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications with ease

- Obtain TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Alter and eSign TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 tc 20 utah corporation franchise or income tax return forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the 2021 tc 20 utah corporation franchise or income tax return forms ampamp publications

The best way to make an e-signature for a PDF document online

The best way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are Utah TC 20 instructions and why are they important?

Utah TC 20 instructions are essential guidelines for completing tax-related forms in Utah. They provide step-by-step procedures to ensure that filers correctly fill out their documents, which can prevent costly mistakes. Understanding these instructions is crucial for individuals and businesses looking to stay compliant with state tax regulations.

-

How can airSlate SignNow assist with completing Utah TC 20 instructions?

airSlate SignNow offers a user-friendly platform that enables you to easily fill out and eSign your Utah TC 20 instructions digitally. With features like templates and guided workflows, airSlate SignNow simplifies the completion of these important tax documents. This can save you time and reduce the stress of managing tax forms.

-

What features does airSlate SignNow provide for handling Utah TC 20 instructions?

airSlate SignNow includes features such as document templates, secure cloud storage, and real-time collaboration to assist users in managing their Utah TC 20 instructions. The platform also allows for electronic signatures, ensuring a fast and secure process. With airSlate SignNow, you can streamline document handling efficiently.

-

Is there a cost associated with using airSlate SignNow for Utah TC 20 instructions?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for individual users and larger teams. Each plan is designed to deliver value with features that aid in managing documents like the Utah TC 20 instructions. You can choose a plan that best meets your budget and requirements.

-

Can I integrate airSlate SignNow with other software for managing Utah TC 20 instructions?

Absolutely! airSlate SignNow supports integrations with various software applications to enhance your capabilities in handling Utah TC 20 instructions. Whether you use CRM systems or file storage solutions, integrating airSlate SignNow can create a seamless workflow for document management in your organization.

-

What are the benefits of using airSlate SignNow for Utah TC 20 instructions?

Using airSlate SignNow for your Utah TC 20 instructions offers numerous benefits, such as increased efficiency, reduced errors, and simplified document tracking. The platform enhances productivity by allowing you to manage all your documents digitally. This not only saves time but also contributes to a more organized approach to your tax filings.

-

Is airSlate SignNow compliant with regulations for eSigning Utah TC 20 instructions?

Yes, airSlate SignNow complies with state and federal regulations concerning electronic signatures, which includes the submission of Utah TC 20 instructions. The platform uses secure encryption and authentication methods to ensure that your eSigned documents are legally binding. This gives you peace of mind when managing sensitive tax information.

Get more for TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications

Find out other TC 20 Utah Corporation Franchise Or Income Tax Return Forms & Publications

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure