Do I Need to Do a State Income Tax If I Only Made 600 Dollars 2021

Understanding State Income Tax Requirements for Low Income

Many individuals wonder whether they need to file a state income tax return if their earnings are minimal, such as only six hundred dollars. Generally, states have specific income thresholds that determine whether a tax return is required. If your income falls below these thresholds, you may not be obligated to file a state income tax return. However, it is essential to check the specific regulations for your state, as these can vary significantly. Some states may still require a return to be filed even if no tax is owed.

Steps to Complete Your State Income Tax Return

Filing your state income tax return, even with a low income, can be straightforward. Here are the steps to follow:

- Gather necessary documents, including any W-2 forms or 1099 forms that report your income.

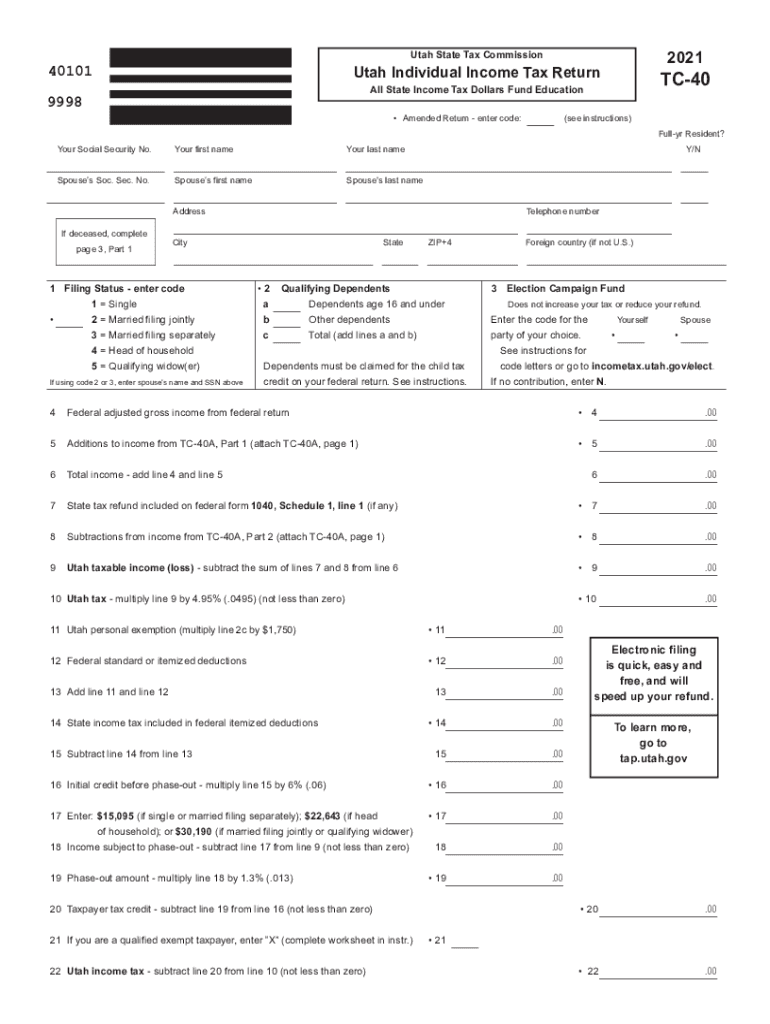

- Visit your state’s tax website to access the appropriate forms, such as the Utah TC-40 for Utah residents.

- Fill out the form accurately, ensuring that all income is reported, even if it is below the taxable threshold.

- Review your completed form for accuracy and completeness.

- Submit your form either electronically through the state’s online portal or by mailing a physical copy.

Required Documents for Filing

When preparing to file a state income tax return, it is important to have the necessary documentation on hand. Commonly required documents include:

- W-2 forms from employers, detailing your earnings and withheld taxes.

- 1099 forms if you received income as an independent contractor or from other sources.

- Any documentation related to deductions or credits you plan to claim.

Having these documents ready will streamline the filing process and ensure you have all the information needed to complete your return accurately.

Filing Deadlines and Important Dates

Each state has specific deadlines for filing income tax returns. Typically, the deadline for filing state income tax returns aligns with the federal deadline, which is usually April fifteenth. However, some states may have different deadlines or offer extensions. It is crucial to be aware of these dates to avoid penalties for late filing. Check your state’s tax authority website for the most accurate and up-to-date information regarding deadlines.

IRS Guidelines for State Income Tax

The IRS provides guidelines that can help clarify how state income tax interacts with federal tax obligations. While the IRS does not directly manage state taxes, understanding federal tax rules can aid in determining your overall tax responsibilities. For example, if you are required to file a federal tax return, you may also need to file a state return, even if your income is low. Familiarizing yourself with IRS guidelines can help ensure compliance with both federal and state tax laws.

Penalties for Non-Compliance

Failing to file a required state income tax return can lead to various penalties, including fines and interest on unpaid taxes. Each state has its own set of penalties that can apply if you do not comply with filing requirements. Even if you believe you do not owe taxes, it is advisable to file a return if required to avoid potential repercussions. Understanding the penalties associated with non-compliance can motivate timely and accurate filing.

Quick guide on how to complete do i need to do a state income tax if i only made 600 dollars

Effortlessly Prepare Do I Need To Do A State Income Tax If I Only Made 600 Dollars on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Do I Need To Do A State Income Tax If I Only Made 600 Dollars on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign Do I Need To Do A State Income Tax If I Only Made 600 Dollars with Ease

- Obtain Do I Need To Do A State Income Tax If I Only Made 600 Dollars and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to store your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Do I Need To Do A State Income Tax If I Only Made 600 Dollars and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do i need to do a state income tax if i only made 600 dollars

Create this form in 5 minutes!

How to create an eSignature for the do i need to do a state income tax if i only made 600 dollars

The best way to make an e-signature for a PDF document in the online mode

The best way to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to UT income tax?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. When it comes to managing UT income tax documents, SignNow streamlines the process, ensuring compliance and reducing the time spent on paperwork.

-

How can airSlate SignNow help with UT income tax filings?

Using airSlate SignNow, businesses can gather necessary signatures and approvals for UT income tax filings quickly. This digital solution enhances accuracy and reduces delays, ensuring that all documentation is submitted in a timely manner.

-

What are the pricing options for airSlate SignNow when handling UT income tax documentation?

airSlate SignNow offers flexible pricing plans tailored to business needs. Whether you're a small business or a large enterprise, you can find a plan that suits your budget while effectively managing UT income tax documentation.

-

Does airSlate SignNow integrate with accounting software for UT income tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This integration makes it easier to manage UT income tax records and streamline the filing process directly from your accounting systems.

-

What features does airSlate SignNow offer that are beneficial for UT income tax management?

airSlate SignNow provides features such as document templates, automated workflows, and secure storage. These features are invaluable for managing UT income tax documents efficiently, reducing errors, and ensuring compliance.

-

Can airSlate SignNow help in maintaining compliance with UT income tax regulations?

Absolutely! airSlate SignNow ensures that all eSigned documents comply with legal standards, which is crucial for UT income tax regulations. The platform helps maintain an audit trail that can be vital for compliance assessments.

-

Is airSlate SignNow user-friendly for individuals managing their UT income tax?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, even for those unfamiliar with digital signature tools. This simplicity makes it easier for individuals managing their UT income tax to navigate the system and complete their tasks effectively.

Get more for Do I Need To Do A State Income Tax If I Only Made 600 Dollars

Find out other Do I Need To Do A State Income Tax If I Only Made 600 Dollars

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed