Tax Return Documents Form

What is the Tax Return Document

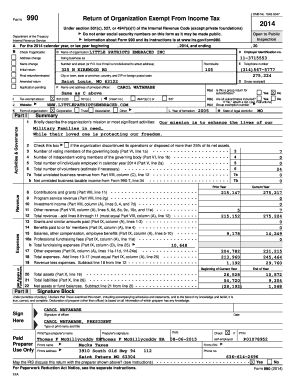

A tax return document is a formal record submitted to the Internal Revenue Service (IRS) that reports income, expenses, and other relevant tax information for a specific tax year. This document serves as a basis for calculating tax liability or refund eligibility. It typically includes various forms, such as the 1040, W-2, and other schedules that detail income sources and deductions. Understanding what a tax return document entails is essential for ensuring accurate reporting and compliance with federal tax laws.

How to Complete the Tax Return Document

Completing a tax return document involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and receipts for deductible expenses.

- Choose the appropriate tax return form based on your filing status and income level.

- Accurately report all income, deductions, and credits to ensure compliance with IRS guidelines.

- Review the completed document for accuracy before submission.

Utilizing digital tools can simplify this process, allowing for easy data entry and error checking.

Key Elements of the Tax Return Document

Key elements of a tax return document include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: All sources of income, including wages, interest, and dividends.

- Deductions and Credits: Eligible deductions that reduce taxable income and credits that lower tax liability.

- Tax Calculation: The total tax owed or refund due based on reported information.

Understanding these elements helps taxpayers accurately complete their forms and maximize potential refunds.

Filing Deadlines / Important Dates

Tax return documents must be filed by specific deadlines to avoid penalties. For most individuals, the deadline is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension, allowing up to six additional months to file, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

IRS Guidelines

The IRS provides detailed guidelines for completing and submitting tax return documents. These guidelines include information on eligibility for various deductions and credits, the importance of accurate reporting, and the consequences of non-compliance. Taxpayers are encouraged to review these guidelines thoroughly to ensure they meet all requirements and deadlines.

Required Documents

To complete a tax return document, several key documents are typically required:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Last year's tax return for reference.

Having these documents organized and readily available can streamline the tax filing process and reduce the risk of errors.

Digital vs. Paper Version

Tax return documents can be submitted either digitally or via paper. Digital submissions through e-filing are often faster and more secure, allowing for quicker processing and refunds. Paper submissions may take longer to process and can be more prone to errors. Choosing the digital option can enhance the filing experience and ensure compliance with IRS requirements.

Quick guide on how to complete tax return documents

Effortlessly Prepare Tax Return Documents on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, enabling you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the essential tools to create, revise, and eSign your documents swiftly without delays. Manage Tax Return Documents on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Optimal Method to Edit and eSign Tax Return Documents with Ease

- Obtain Tax Return Documents and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download to your PC.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Tax Return Documents to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return documents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax return paperwork and how can airSlate SignNow help with it?

Tax return paperwork refers to the documents needed to file taxes, including forms, receipts, and supporting information. airSlate SignNow streamlines the process by allowing you to electronically sign and send these documents, ensuring secure and efficient transactions.

-

How much does it cost to use airSlate SignNow for managing tax return paperwork?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Depending on the features you require for managing your tax return paperwork, you can choose a plan that is both effective and budget-friendly.

-

What features does airSlate SignNow provide for handling tax return paperwork?

Key features include customizable templates, document sharing, electronic signatures, and secure data storage. These features signNowly simplify the management of tax return paperwork, allowing for quick access and efficient collaboration.

-

Can airSlate SignNow integrate with other financial software for tax return paperwork?

Yes, airSlate SignNow integrates smoothly with various accounting and financial software, enhancing your ability to manage tax return paperwork alongside your other financial processes. This integration helps in reducing errors and improving workflow efficiency.

-

Is airSlate SignNow compliant with legal standards for tax return paperwork?

Absolutely! airSlate SignNow complies with major eSignature laws, making it a reliable choice for managing tax return paperwork. This ensures that your signed documents hold legal validity in case of audits or disputes.

-

How does airSlate SignNow enhance the security of tax return paperwork?

airSlate SignNow employs advanced encryption and secure access controls to protect your tax return paperwork. This level of security is vital for maintaining the confidentiality of sensitive financial information.

-

Can I track the status of my tax return paperwork with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their tax return paperwork in real time. This feature helps you monitor document progress, ensuring that you never miss a deadline.

Get more for Tax Return Documents

- Retake possession of the property form

- The undersigned hereby certifyies that heshethey have been informed that

- The remaining amount owed under the contract is form

- Fillable online iowa buyers home inspection checklist fax email print pdffiller form

- Provide appraisal to name and address of lender if selling form

- Prenup templates mt fill online printable fillable blank form

- Except as otherwise provided in this agreement the premarital agreement referenced form

- Creating a prenuptial agreementwoodmen financial form

Find out other Tax Return Documents

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile