Missouri Unemployment Tax Registration Form

What is the Missouri Unemployment Tax Registration

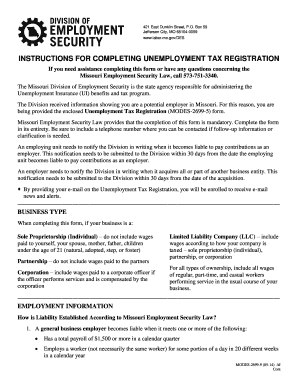

The Missouri unemployment tax registration is a critical process for businesses operating within the state. This registration enables employers to contribute to the state's unemployment insurance program, which provides financial assistance to workers who lose their jobs through no fault of their own. By registering, employers ensure compliance with state laws and contribute to a fund that supports unemployed individuals, helping them during their transition to new employment opportunities.

Steps to complete the Missouri Unemployment Tax Registration

Completing the Missouri unemployment tax registration involves several key steps to ensure accurate submission. First, gather necessary information about your business, including the Employer Identification Number (EIN), business structure, and contact details. Next, access the registration form, which can typically be completed online. Fill out the required fields carefully, ensuring all information is accurate. Once completed, review the form for any errors before submitting it electronically. After submission, keep a copy of the confirmation for your records.

Required Documents

When registering for Missouri unemployment tax, certain documents are essential for a smooth process. Employers should prepare the following:

- Employer Identification Number (EIN)

- Legal business name and address

- Type of business entity (e.g., LLC, corporation)

- Contact information for the business

- Payroll records and estimated number of employees

Having these documents ready can expedite the registration process and help avoid delays.

Legal use of the Missouri Unemployment Tax Registration

The Missouri unemployment tax registration serves a legal purpose by ensuring that employers contribute to the unemployment insurance system. This registration is not only a legal requirement but also a safeguard for employees, providing them with access to benefits in times of need. Employers must adhere to state regulations regarding tax contributions, as failure to register or comply can result in penalties and fines.

Form Submission Methods

Employers can submit the Missouri unemployment tax registration form through various methods to accommodate different preferences. The primary method is online submission, which is efficient and allows for immediate confirmation. Alternatively, employers may choose to mail the completed form to the appropriate state office. In-person submission is also an option, where employers can receive assistance if needed. Each method has its advantages, so employers should select the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with the Missouri unemployment tax registration requirements can lead to significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. Additionally, non-compliance can affect an employer's ability to access certain benefits, such as unemployment insurance for their employees. It is crucial for businesses to stay informed about their obligations to avoid these consequences.

Quick guide on how to complete missouri unemployment tax registration

Complete Missouri Unemployment Tax Registration effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents swiftly and without holdups. Manage Missouri Unemployment Tax Registration on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest method to modify and eSign Missouri Unemployment Tax Registration without any hassle

- Find Missouri Unemployment Tax Registration and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form exploration, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device of your preference. Alter and eSign Missouri Unemployment Tax Registration and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri unemployment tax registration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri unemployment tax registration?

Missouri unemployment tax registration is a process that businesses must complete to report and pay unemployment taxes in the state of Missouri. This registration is essential for compliance with state laws and to ensure businesses can provide benefits to eligible employees. Understanding this process is crucial for any business operating in Missouri.

-

How can airSlate SignNow assist with Missouri unemployment tax registration?

airSlate SignNow provides a streamlined solution to help businesses efficiently manage their Missouri unemployment tax registration documents. With its easy-to-use e-signature features, businesses can quickly send, sign, and store necessary forms, reducing administrative burdens and ensuring compliance. This enhances overall operational efficiency while managing important compliance tasks.

-

Is there a fee for using airSlate SignNow for Missouri unemployment tax registration?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, enabling businesses to manage their Missouri unemployment tax registration and other document-related tasks without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Missouri unemployment tax registration?

airSlate SignNow offers various features that simplify the management of Missouri unemployment tax registration, such as document templates, customizable workflows, and secure e-signature solutions. These features allow businesses to create, edit, and manage forms with ease, enhancing the efficiency of the registration process. Additionally, the platform provides tracking features to monitor document status.

-

How does airSlate SignNow ensure the security of documents related to Missouri unemployment tax registration?

Security is a top priority for airSlate SignNow, especially when handling important documents like those required for Missouri unemployment tax registration. The platform employs advanced encryption protocols to protect data and ensures compliance with industry standards. This gives businesses peace of mind knowing that their sensitive information is secure.

-

Can airSlate SignNow integrate with other tools for Missouri unemployment tax registration?

Yes, airSlate SignNow offers integrations with various software and tools that can enhance the process of Missouri unemployment tax registration. This includes accounting and HR software, making it easier to manage payroll and tax documentation collectively. These integrations help streamline workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Missouri unemployment tax registration?

Using airSlate SignNow for Missouri unemployment tax registration provides numerous benefits, including saving time, increasing accuracy in documentation, and ensuring compliance with state regulations. The platform's intuitive interface makes it easy for teams to collaborate on important tax-related documents. Additionally, the ability to manage everything digitally reduces the reliance on paper, promoting sustainability.

Get more for Missouri Unemployment Tax Registration

- How to enforce a garnishee order lexology form

- Form 3dc28

- Property accountability receipt of property and services form

- Judgment debtorss motion returnrelease of wages form

- Attorney registration ampamp disciplinary commission form

- Clerks officethird circuitunited states court of appeals form

- Form 3dc35

- Justia motion to set aside default or judgment or form

Find out other Missouri Unemployment Tax Registration

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online