What is Classstrata in Homestead Exemption Form 2015

What is the Classstrata in Homestead Exemption Form

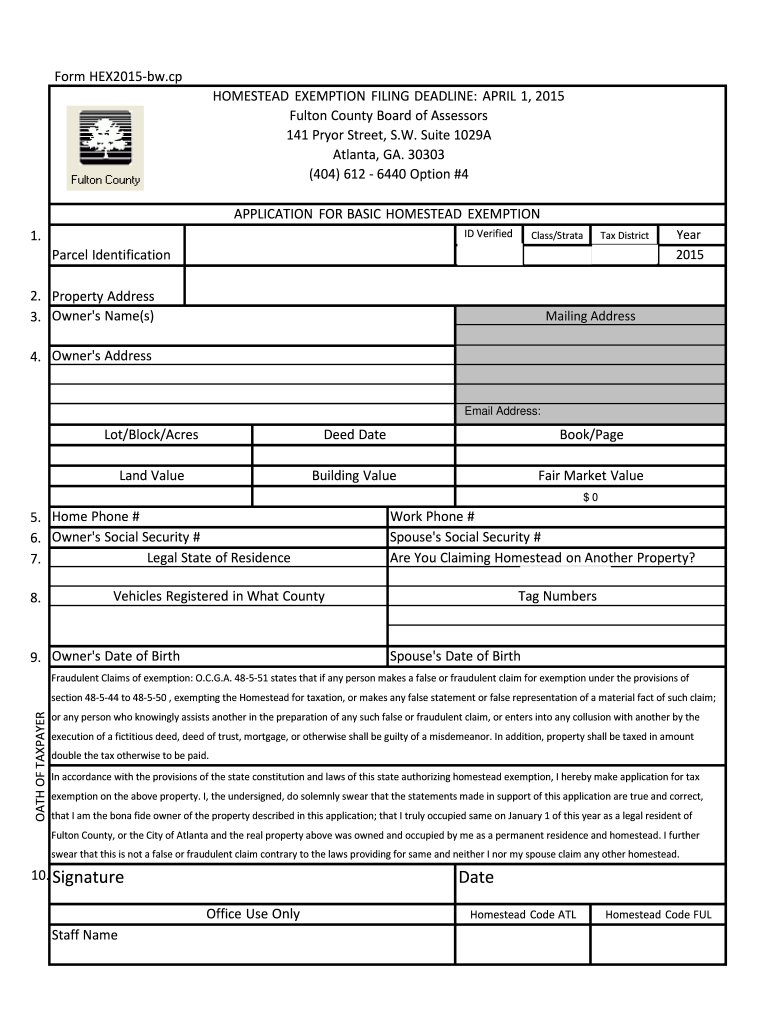

The Classstrata in Homestead Exemption Form is a document used by property owners to apply for a homestead exemption, which can reduce property taxes on their primary residence. This form typically requires details about the homeowner, the property, and any qualifying criteria that must be met to receive the exemption. Understanding the purpose and requirements of this form is essential for homeowners looking to benefit from tax savings.

How to use the Classstrata in Homestead Exemption Form

Using the Classstrata in Homestead Exemption Form involves several steps. First, gather all necessary information, including proof of residence and identification. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, submit it to the appropriate local tax authority, either online or via mail, depending on the jurisdiction's guidelines. It is crucial to follow any specific instructions provided by your local government to ensure successful processing.

Steps to complete the Classstrata in Homestead Exemption Form

Completing the Classstrata in Homestead Exemption Form can be broken down into clear steps:

- Gather necessary documents, such as proof of ownership and identification.

- Access the form from your local tax authority's website or office.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline to the appropriate office.

Eligibility Criteria for the Classstrata in Homestead Exemption Form

Eligibility for the Classstrata in Homestead Exemption Form varies by state but generally includes criteria such as being a legal resident of the property, occupying it as your primary residence, and not having claimed a homestead exemption on another property. Some jurisdictions may have additional requirements, such as income limits or age restrictions, which should be reviewed before applying.

Required Documents for the Classstrata in Homestead Exemption Form

When applying for the homestead exemption using the Classstrata in Homestead Exemption Form, you may need to provide several documents, including:

- Proof of identity (e.g., driver's license or state ID).

- Proof of residency (e.g., utility bill or lease agreement).

- Property deed or tax bill to verify ownership.

- Any additional documentation required by local authorities.

Form Submission Methods for the Classstrata in Homestead Exemption Form

The Classstrata in Homestead Exemption Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax authority's website.

- Mailing the completed form to the designated office.

- In-person submission at local tax offices during business hours.

Quick guide on how to complete what is classstrata in homestead exemption form

Complete What Is Classstrata In Homestead Exemption Form with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without delays. Handle What Is Classstrata In Homestead Exemption Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign What Is Classstrata In Homestead Exemption Form effortlessly

- Find What Is Classstrata In Homestead Exemption Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from a device of your choice. Edit and eSign What Is Classstrata In Homestead Exemption Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is classstrata in homestead exemption form

FAQs

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

What are the exemptions for a W2 form? How do you fill one in?

Send it to your employees as well as governmental and state institutions by US mail or by electronic mail. It is also possible to complete the sample electronically and print it on a blank piece of paper.Those who have many employees, more than two hundred and twenty, are required to file the form digitally, as it is much easier for the IRS to process numerous electronic documents than paper copies. Additionally, e-filing will save you time and the templates are easy to review thanks to the printed text format. With this printable sample, W-2 submission form will be generated automatically by the Social Security Administration.More info: http://bit.ly/2NjjlJi

-

How is home equity determined in regard to the Homestead Exemption in bankruptcy?

You need to determine the current market value of your home. It doesn't matter how much you paid for it.For example: Suppose your home would sell for $200,000 right now. If so, your equity is $200,000 - $168,000 = $32,000 of equity.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the what is classstrata in homestead exemption form

How to make an eSignature for your What Is Classstrata In Homestead Exemption Form in the online mode

How to create an electronic signature for the What Is Classstrata In Homestead Exemption Form in Chrome

How to make an eSignature for signing the What Is Classstrata In Homestead Exemption Form in Gmail

How to generate an eSignature for the What Is Classstrata In Homestead Exemption Form from your smartphone

How to make an electronic signature for the What Is Classstrata In Homestead Exemption Form on iOS

How to create an eSignature for the What Is Classstrata In Homestead Exemption Form on Android

People also ask

-

What is Classstrata in the Homestead Exemption Form?

Classstrata in the Homestead Exemption Form refers to the classification system used to determine eligibility and benefits for property tax exemptions. It categorizes properties based on their use, providing essential insights for homeowners. Understanding what Classstrata in the Homestead Exemption Form entails can help you maximize your tax savings.

-

How do I apply for the Homestead Exemption Form using Classstrata?

Applying for the Homestead Exemption Form using Classstrata involves completing the necessary documentation accurately. You'll need to provide proof of residence and select the appropriate class for your property. Ensuring your application correctly reflects 'What Is Classstrata In Homestead Exemption Form' can signNowly impact your tax liability.

-

What are the benefits of understanding Classstrata in the Homestead Exemption Form?

Understanding Classstrata can help you optimize your property tax exemptions and ensure that you're taking full advantage of available savings. It allows for better financial planning and can lead to substantial reductions in your property taxes. Ultimately, knowing what Classstrata in the Homestead Exemption Form is essential for homeowners seeking to reduce their fiscal burden.

-

Are there any costs associated with filing the Homestead Exemption Form?

Typically, there are no fees associated with filing the Homestead Exemption Form itself, but some local jurisdictions may charge for related services. Being aware of these potential costs can help you budget accordingly. The value gained from understanding what Classstrata in Homestead Exemption Form can far outweigh any minor fees.

-

Can I use airSlate SignNow to eSign the Homestead Exemption Form?

Yes, airSlate SignNow provides a user-friendly platform to electronically sign the Homestead Exemption Form. This streamlined process makes it easier to manage your documentation without the hassle of paper forms. Utilizing airSlate SignNow ensures that your application is processed swiftly while understanding what Classstrata in the Homestead Exemption Form entails.

-

Is Classstrata easy to understand for new homeowners?

Yes, Classstrata can be easily understood by new homeowners with the right resources and guidance. Various online platforms and guides provide explanations of the classification process for the Homestead Exemption Form. By educating yourself on what Classstrata in Homestead Exemption Form means, you can make informed decisions about your property taxes.

-

How can I seek assistance regarding Classstrata in the Homestead Exemption Form?

You can seek assistance from local tax assessors, real estate professionals, or online resources focused on property tax exemptions. Many communities also offer workshops or seminars to help homeowners understand the nuances of the Homestead Exemption Form. Knowing what Classstrata in Homestead Exemption Form is will enable you to ask informed questions and get better support.

Get more for What Is Classstrata In Homestead Exemption Form

- Administrators deed form 45491864

- To form excise islamabad

- Roundpoint mortgage third party authorization form

- Nishmat kol chai printable form

- Va form 0750

- 21 0296a form

- Parental permission form for work

- Form 5805 underpayment of estimated tax by individuals and fiduciaries form 5805 underpayment of estimated tax by individuals

Find out other What Is Classstrata In Homestead Exemption Form

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later