Irs Form 8863 Online

What is the IRS Form 8863 Online

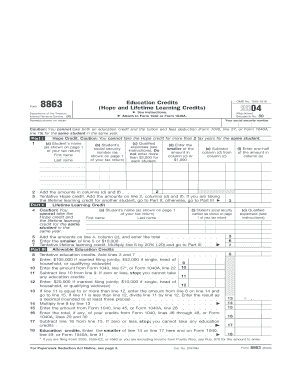

The IRS Form 8863, also known as the Education Credits form, is used by taxpayers to claim education credits for qualified education expenses. This form allows you to apply for two significant tax credits: the American Opportunity Credit and the Lifetime Learning Credit. Both credits can help reduce your tax liability, making higher education more affordable. Completing Form 8863 online streamlines the process, ensuring accuracy and compliance with IRS regulations.

How to Use the IRS Form 8863 Online

Using the IRS Form 8863 online involves several steps. First, gather all necessary information regarding your education expenses, including tuition, fees, and other related costs. Next, access the form through a reliable e-signature platform, which ensures that your submission is secure and legally binding. Fill out the form with accurate details, ensuring you meet the eligibility criteria for the education credits. Finally, submit the completed form electronically to the IRS for processing.

Steps to Complete the IRS Form 8863 Online

Completing the IRS Form 8863 online can be done efficiently by following these steps:

- Gather documentation: Collect all relevant documents, such as Form 1098-T, which reports tuition payments.

- Access the form: Use an online platform that supports e-signatures to ensure compliance with legal standards.

- Fill out the form: Input your personal information, education expenses, and the credits you are claiming.

- Review your entries: Double-check all information for accuracy to avoid delays in processing.

- Submit the form: Send the completed form electronically to the IRS.

Key Elements of the IRS Form 8863 Online

Several key elements must be included when filling out the IRS Form 8863 online:

- Personal Information: Your name, Social Security number, and filing status.

- Qualified Expenses: Detailed information about tuition and related fees.

- Education Institution Details: Name and address of the educational institution attended.

- Credit Amounts: Calculation of the American Opportunity Credit and Lifetime Learning Credit you are eligible for.

Eligibility Criteria for the IRS Form 8863 Online

To qualify for the education credits claimed on the IRS Form 8863, you must meet specific eligibility criteria. The student must be enrolled at an eligible educational institution and pursuing a degree or recognized credential. Additionally, the taxpayer's modified adjusted gross income must fall within established limits to claim the full credits. Understanding these criteria is essential for a successful submission.

Legal Use of the IRS Form 8863 Online

When using the IRS Form 8863 online, it is crucial to ensure that you comply with legal requirements. Electronic submissions are legally binding, provided they meet the standards set by the ESIGN Act and UETA. Utilizing a secure e-signature platform enhances the legitimacy of your submission, allowing you to sign and submit the form confidently. This compliance protects your rights and ensures the IRS recognizes your claim.

Quick guide on how to complete irs form 8863 online

Complete Irs Form 8863 Online effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to produce, alter, and eSign your documents quickly without delays. Manage Irs Form 8863 Online on any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The simplest way to modify and eSign Irs Form 8863 Online without stress

- Locate Irs Form 8863 Online and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of your documents or hide sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Irs Form 8863 Online and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8863 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8863, and why is it important?

Form 8863 is a tax form used to claim education credits for qualified tuition and related expenses. It's important for individuals seeking to lower their tax burden while supporting their educational investments. Understanding how to complete Form 8863 can signNowly impact your tax refund, making it vital for eligible students and parents.

-

How can airSlate SignNow help me with Form 8863?

airSlate SignNow streamlines the process of completing and eSigning Form 8863. Our user-friendly platform allows you to easily fill out and send the form digitally, ensuring that all necessary signatures are collected. Make the tax filing process more efficient and error-free with our electronic solution.

-

Is there a cost associated with using airSlate SignNow for Form 8863?

Yes, airSlate SignNow offers flexible pricing plans tailored to cater to different business needs. Whether you're an individual or a larger organization, you can choose a plan that suits your budget. Investing in our service to handle Form 8863 can save you valuable time and resources.

-

What features does airSlate SignNow provide for managing Form 8863?

airSlate SignNow provides features such as document templates, organization tools, and secure eSignature capabilities that simplify managing Form 8863. You can also track the status of your document and receive notifications, ensuring that your filing is timely and accurate. These features enhance efficiency, making tax time less stressful.

-

Can I integrate airSlate SignNow with other software to manage Form 8863?

Absolutely! airSlate SignNow seamlessly integrates with popular software such as Google Drive, Dropbox, and various CRM systems. This allows for easy access to your documentation and enhances your workflow when managing Form 8863. Streamline your processes by connecting all your necessary tools.

-

What are the benefits of using airSlate SignNow for tax documents like Form 8863?

Using airSlate SignNow for Form 8863 offers numerous benefits, including increased accuracy, reduced processing time, and enhanced security. Our platform ensures that your documents are signed and stored safely, minimizing the risk of loss or theft. Experience the convenience and efficiency that airSlate SignNow brings to your tax filings.

-

Is airSlate SignNow compliant with tax regulations for filing Form 8863?

Yes, airSlate SignNow is fully compliant with electronic signature laws and regulations, ensuring that your Form 8863 is legally valid when signed electronically. Our platform stays up-to-date with compliance standards, giving you peace of mind during the filing process. Trust airSlate SignNow for secure and compliant document management.

Get more for Irs Form 8863 Online

- Deed of trust sec form

- Recording a land document clark county recorder form

- Quitclaim deed faq united states form

- Carver county quit claim deed divorce formminnesota

- Utah deed formsget a deed to transfer utah real estate

- Partial release of property from deed of trust corporation form

- Partial release of property from deed of trust individual form

- Agreement for sale of real property form

Find out other Irs Form 8863 Online

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word