Payoff Letter Template Form

What is the payoff letter template

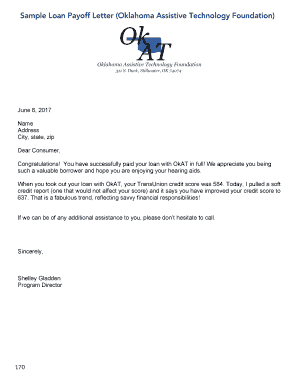

A payoff letter template is a formal document that outlines the details of a loan payoff. It serves as a request to the lender for the exact amount needed to pay off a loan, including any interest and fees that may apply. This template is crucial for borrowers who want to ensure that they settle their debts accurately and efficiently. The payoff letter typically includes information such as the loan account number, the borrower’s name, and the date by which the payment must be made.

How to use the payoff letter template

Using a payoff letter template involves several straightforward steps. First, gather all necessary information, including your loan details and lender contact information. Next, fill out the template with accurate data, ensuring that you include your account number and any specific instructions from your lender. After completing the document, review it for accuracy before sending it to your lender via your preferred method, whether electronically or by mail. Keeping a copy for your records is also advisable.

Key elements of the payoff letter template

Several key elements must be included in a payoff letter template to ensure its effectiveness. These elements typically consist of:

- Borrower's Information: Full name, address, and contact details.

- Lender's Information: Name, address, and contact details of the lending institution.

- Loan Details: Loan account number, type of loan, and current outstanding balance.

- Payoff Amount: The exact amount required to pay off the loan, including any applicable fees or interest.

- Request for Confirmation: A request for the lender to provide written confirmation of the payoff amount.

- Date of Request: The date on which the request is made.

Steps to complete the payoff letter template

Completing a payoff letter template requires careful attention to detail. Follow these steps:

- Gather your loan documents and lender information.

- Open the payoff letter template and enter your personal information at the top.

- Fill in the lender's details accurately.

- Clearly state the loan account number and current balance.

- Specify the exact payoff amount, including any additional fees.

- Request confirmation of the payoff amount and include a deadline for the response.

- Review the document for any errors and save a copy for your records.

Legal use of the payoff letter template

The legal use of a payoff letter template is essential for ensuring that both the borrower and lender are protected during the loan payoff process. This document serves as a formal request and can be used as evidence in case of disputes. It is important to comply with any state-specific regulations regarding loan payoffs and to retain copies of all correspondence related to the loan. Utilizing a digital signing solution can enhance the legal validity of the document, ensuring compliance with eSignature laws.

Examples of using the payoff letter template

Examples of using a payoff letter template can provide clarity on its application. For instance, a borrower who has sold their vehicle may need to pay off an auto loan. They would use the template to request the exact payoff amount from their lender. Another example is a homeowner looking to refinance their mortgage. They would send a payoff letter to their current lender to obtain the necessary payoff details. These examples illustrate the versatility and importance of the payoff letter template in various financial situations.

Quick guide on how to complete payoff letter template 441597735

Easily Set Up Payoff Letter Template on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Payoff Letter Template on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign Payoff Letter Template Effortlessly

- Obtain Payoff Letter Template and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Payoff Letter Template and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payoff letter template 441597735

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payoff letter template?

A payoff letter template is a formal document that outlines the remaining balance owed on a loan or mortgage. This template serves as a crucial resource for lenders and borrowers, as it clearly states the amount required to settle the debt. Utilizing a payoff letter template can streamline communication and enhance the efficiency of the loan payoff process.

-

How can I create a payoff letter template using airSlate SignNow?

Creating a payoff letter template with airSlate SignNow is straightforward and user-friendly. Simply select a customizable template, fill in the necessary details, and you can easily save it for future use. Our platform ensures that your payoff letter template is accessible and editable whenever needed.

-

Is there a cost associated with using the payoff letter template feature?

airSlate SignNow offers competitive pricing plans, including access to the payoff letter template feature. Users can choose from various subscription options tailored to their business needs. Our cost-effective solution ensures that you can create and manage payoff letter templates without exceeding your budget.

-

Can I integrate my payoff letter template with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing the functionality of your payoff letter template. Whether you're using CRM systems or accounting software, our platform supports integration to streamline your workflows. This makes managing documents and financial processes much more efficient.

-

What are the benefits of using a payoff letter template?

Using a payoff letter template simplifies the process of requesting and sending payoff amounts about loans. It provides clarity and ensures that all necessary data is presented professionally. This not only saves time but also minimizes errors, making it a valuable tool for both lenders and borrowers.

-

Can I customize my payoff letter template in airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily customize your payoff letter template according to your preferences. This flexibility allows you to add your branding elements, specify loan details, or modify sections to better suit your needs. Customization enhances the template's effectiveness and professional appearance.

-

How secure is my information when using the payoff letter template on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using a payoff letter template, your information is protected with advanced encryption protocols and secure server architecture. This ensures that all sensitive data is kept safe while maintaining compliance with industry standards.

Get more for Payoff Letter Template

Find out other Payoff Letter Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast