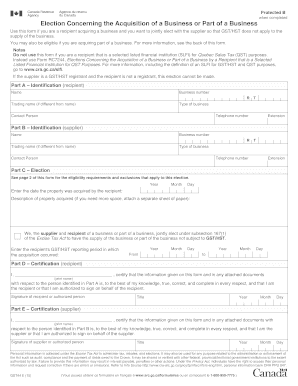

Election Concerning the Acquisition of a Business Form

What is the Election Concerning The Acquisition Of A Business Form

The Election Concerning the Acquisition of a Business Form, commonly referred to as the gst44, is a crucial document used primarily in the context of Goods and Services Tax (GST) in the United States. This form allows businesses to make an election regarding the GST treatment of certain acquisitions. By completing this form, businesses can clarify their tax obligations and ensure compliance with federal regulations. Understanding the purpose and implications of the gst44 is essential for any business involved in acquisitions, as it directly affects their tax responsibilities and financial planning.

Steps to Complete the Election Concerning The Acquisition Of A Business Form

Completing the gst44 form requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps to follow:

- Gather Required Information: Collect all necessary data, including the details of the business being acquired and relevant financial information.

- Fill Out the Form: Accurately complete all sections of the gst44 form, ensuring that all information is correct and up to date.

- Review for Accuracy: Double-check all entries for any errors or omissions that could affect the validity of the form.

- Submit the Form: Follow the appropriate submission methods, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the Election Concerning The Acquisition Of A Business Form

The gst44 form is legally binding when completed correctly and submitted according to the established guidelines. To ensure its legal standing, businesses must adhere to the relevant laws governing GST and eSignature regulations. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is vital for the form to be recognized in legal contexts. This legal framework supports the use of digital signatures, making it essential for businesses to utilize trusted eSignature solutions like signNow to maintain the integrity and legality of their documents.

Key Elements of the Election Concerning The Acquisition Of A Business Form

Several key elements must be included in the gst44 form to ensure its effectiveness and compliance:

- Identification of Parties: Clearly state the names and details of all parties involved in the acquisition.

- Description of the Transaction: Provide a detailed account of the business acquisition, including the nature of the assets being acquired.

- Election Statement: Include a clear statement indicating the election being made concerning the GST treatment of the acquisition.

- Signature: Ensure that the form is signed by authorized representatives of the involved parties to validate the election.

Filing Deadlines / Important Dates

Timely submission of the gst44 form is crucial to avoid penalties and ensure compliance. Generally, the form must be filed within a specific timeframe following the acquisition date. It is essential to be aware of any relevant deadlines, which may vary depending on the nature of the transaction and applicable state laws. Businesses should consult the IRS guidelines and local regulations to confirm the exact filing deadlines associated with the gst44 form.

Form Submission Methods

The gst44 form can be submitted through various methods, allowing flexibility for businesses. Common submission options include:

- Online Submission: Many businesses opt for online submission to expedite the process. Utilizing eSignature platforms like signNow can streamline this method.

- Mail Submission: The form can be printed and mailed to the appropriate tax authority, ensuring it is sent well before the deadline.

- In-Person Submission: Some businesses may choose to deliver the form in person, providing immediate confirmation of receipt.

Quick guide on how to complete election concerning the acquisition of a business form

Effortlessly Prepare Election Concerning The Acquisition Of A Business Form on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Election Concerning The Acquisition Of A Business Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and Electronically Sign Election Concerning The Acquisition Of A Business Form

- Locate Election Concerning The Acquisition Of A Business Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Election Concerning The Acquisition Of A Business Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the election concerning the acquisition of a business form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst44 and how does it relate to airSlate SignNow?

Gst44 refers to a specific feature within airSlate SignNow that streamlines the electronic signing process. This feature is designed to enhance document management for businesses, making it easy to send and eSign documents securely and efficiently.

-

How much does it cost to use the gst44 features in airSlate SignNow?

The gst44 features are part of the airSlate SignNow pricing plans, which are designed to meet various business needs. Depending on the plan you choose, you can benefit from cost-effective solutions that provide great value for electronic signatures and document management.

-

What benefits can I expect from using gst44 with airSlate SignNow?

By utilizing gst44 with airSlate SignNow, businesses can enjoy faster turnaround times for document processing, improved accuracy in eSigning, and enhanced collaboration among teams. This results in increased productivity and a reduction in the time spent on administrative tasks.

-

Can gst44 integrate with other software applications?

Yes, gst44 supports integration with a variety of software applications, enabling seamless workflows. This compatibility allows businesses to connect airSlate SignNow with other tools they already use, streamlining operations and improving efficiency.

-

Is the gst44 feature user-friendly for new users?

Absolutely! The gst44 feature within airSlate SignNow is designed with user experience in mind. New users will find it easy to navigate and utilize, allowing them to quickly start sending and eSigning documents without extensive training.

-

How secure is the gst44 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow's gst44 feature. The platform employs encryption and various security protocols to ensure that all documents and signatures are protected throughout the signing process, giving users peace of mind.

-

What types of documents can be signed using gst44?

Gst44 enables the signing of a wide range of document types, from contracts and agreements to invoices and consent forms. This versatility makes airSlate SignNow a comprehensive solution for all your electronic signing needs.

Get more for Election Concerning The Acquisition Of A Business Form

Find out other Election Concerning The Acquisition Of A Business Form

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast