State ConnecticutForm CT 1040ES 2021Connecticut Department of Revenue ServicesIndividual Income Tax Forms Connecticut 2022-2026

Understanding Connecticut Form CT-1040ES

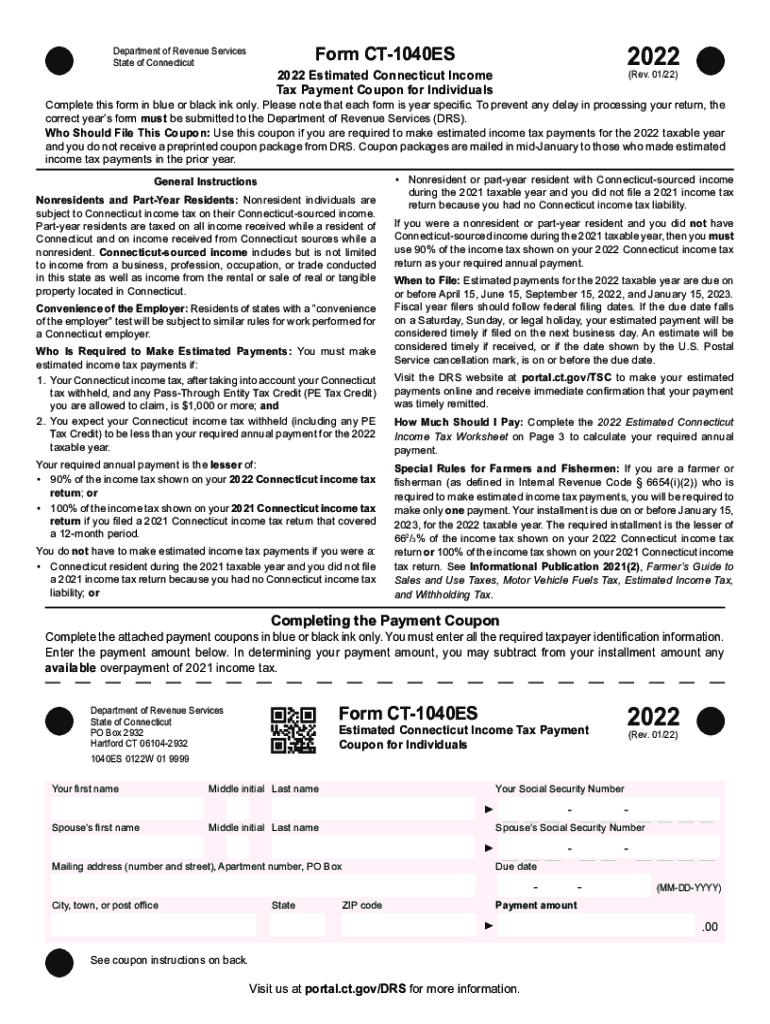

The Connecticut Form CT-1040ES is used for making estimated tax payments for individuals. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual income tax return. It allows individuals to pay their estimated taxes in four installments throughout the year, ensuring compliance with state tax laws and avoiding penalties for underpayment.

Steps to Complete Connecticut Form CT-1040ES

Completing the Connecticut Form CT-1040ES involves several steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected tax liability for the year using the Connecticut tax tables.

- Divide your total estimated tax by four to determine the amount due for each installment.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form and payment by the due dates to avoid penalties.

Filing Deadlines for Connecticut Estimated Tax Payments

Estimated tax payments for Connecticut are due in four installments throughout the year. The typical due dates are:

- April 15 for the first installment

- June 15 for the second installment

- September 15 for the third installment

- January 15 of the following year for the fourth installment

It is important to adhere to these deadlines to avoid interest and penalties.

Methods for Submitting Connecticut Form CT-1040ES

Taxpayers in Connecticut have several options for submitting Form CT-1040ES:

- Online: Payments can be made electronically through the Connecticut Department of Revenue Services website.

- Mail: Completed forms can be mailed to the appropriate address provided by the state.

- In-Person: Taxpayers may also choose to deliver their forms and payments in person at designated state offices.

Key Elements of Connecticut Form CT-1040ES

When filling out Form CT-1040ES, ensure you include the following key elements:

- Your name, address, and Social Security number.

- The estimated tax amount for the year.

- The payment amount for each installment.

- Signature and date to validate the submission.

Penalties for Non-Compliance with Connecticut Tax Payments

Failure to file Form CT-1040ES or to make timely estimated tax payments can result in penalties. The state may impose:

- Interest on any unpaid taxes.

- Penalties for underpayment, which can be a percentage of the unpaid tax amount.

It is advisable to stay informed about your tax obligations to avoid these consequences.

Quick guide on how to complete state connecticutform ct 1040es 2021connecticut department of revenue servicesindividual income tax forms connecticut

Effortlessly Prepare State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut on Any Device

Web-based document administration has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and eSign your documents promptly without any holdups. Manage State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Tips for Adjusting and eSigning State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut with Ease

- Locate State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state connecticutform ct 1040es 2021connecticut department of revenue servicesindividual income tax forms connecticut

Create this form in 5 minutes!

People also ask

-

What is the process for making a connecticut tax payment using airSlate SignNow?

To make a connecticut tax payment using airSlate SignNow, simply create or upload your tax document onto our platform. Our eSigning feature allows you to securely sign your document digitally, ensuring compliance and efficiency. Once completed, you can easily send the signed documents to the appropriate tax authority.

-

Are there any fees associated with using airSlate SignNow for connecticut tax payments?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including options for making connecticut tax payments. While there may be a subscription fee, the user-friendly features and savings on time can make it a cost-effective choice. We recommend reviewing our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other financial software for connecticut tax payments?

Yes, airSlate SignNow easily integrates with various financial software, making it simple to manage your connecticut tax payments. These integrations streamline your workflow, allowing you to optimize your accounting and tax filing processes. Check our integrations page for a list of supported applications.

-

What are the benefits of using airSlate SignNow for connecticut tax payment management?

The primary benefits of using airSlate SignNow for connecticut tax payment management include enhanced security, easy document workflows, and legally binding eSignatures. Our solution saves you time and reduces paperwork, allowing for faster processing of your tax payments. This empowers you to focus on your business rather than administrative tasks.

-

Is airSlate SignNow compliant with connecticut tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant connecticut tax regulations. Our platform ensures that your eSigned documents are legally binding and meet the standards required by tax authorities. This compliance helps prevent issues and ensures that your connecticut tax payments are processed smoothly.

-

How does airSlate SignNow ensure the security of my connecticut tax payment documents?

airSlate SignNow prioritizes the security of your connecticut tax payment documents with advanced encryption and secure data storage. We implement rigorous security measures to protect sensitive information, including access controls and audit trails. You can trust that your tax documents remain confidential and secure throughout the signing process.

-

Can I track the status of my connecticut tax payment documents in airSlate SignNow?

Yes, airSlate SignNow offers features that allow you to track the status of your connecticut tax payment documents easily. You can receive notifications when your documents are opened, signed, or completed. This feature provides transparency and helps you stay informed about your tax payment process.

Get more for State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut

- North carolina property 497317284 form

- Annual minutes for a north carolina professional corporation north carolina form

- North carolina a corporation form

- Nc professional corporation form

- Nc corporation 497317288 form

- Sample transmittal letter for articles of incorporation north carolina form

- New resident guide north carolina form

- Satisfaction deed trust form

Find out other State ConnecticutForm CT 1040ES 2021Connecticut Department Of Revenue ServicesIndividual Income Tax Forms Connecticut

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document