Individual Income Tax Forms Connecticut 2020

What is the Individual Income Tax Forms Connecticut

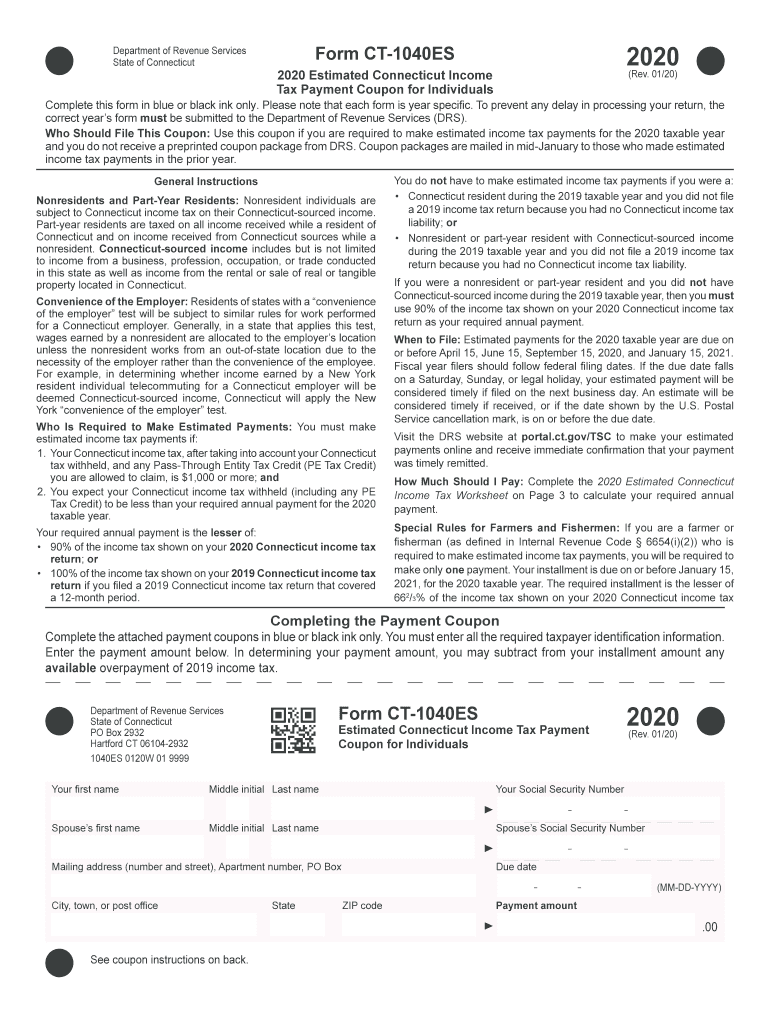

The Individual Income Tax Forms for Connecticut, including the ct estimated tax form 2019, are essential documents used by residents to report their income and calculate their tax obligations. These forms are part of the state's tax system, which is designed to collect revenue for public services and infrastructure. The forms typically include details about income, deductions, and credits that taxpayers may be eligible for, ensuring accurate tax calculations. Understanding the purpose and structure of these forms is crucial for compliance and effective tax management.

Steps to complete the Individual Income Tax Forms Connecticut

Completing the Individual Income Tax Forms in Connecticut involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any records of income or deductions. Next, download the appropriate forms, such as the ct estimated tax form 2019, from the Connecticut Department of Revenue Services website or utilize a reliable digital platform for ease of use. Fill out the forms carefully, ensuring all information is complete and accurate. After completing the forms, review them for any errors before submitting them electronically or by mail. Keeping a copy of the submitted forms for your records is also advisable.

Legal use of the Individual Income Tax Forms Connecticut

The legal use of the Individual Income Tax Forms in Connecticut ensures that taxpayers comply with state tax laws. These forms must be filled out accurately and submitted by the designated deadlines to avoid penalties. The ct estimated tax form 2019, like other tax forms, can be eSigned using a compliant digital signature solution, which is recognized under U.S. law. This means that as long as the eSignature meets the requirements set forth by the ESIGN Act and UETA, the completed forms are considered legally binding. It is essential to ensure that all signatures and submissions adhere to the legal standards to maintain the validity of the forms.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Forms in Connecticut are crucial for taxpayers to meet to avoid penalties. For the ct estimated tax form 2019, the estimated tax payments are typically due quarterly, with specific dates set by the Connecticut Department of Revenue Services. Generally, the deadlines for estimated payments fall on April 15, June 15, September 15, and January 15 of the following year. It is important for taxpayers to be aware of these dates to ensure timely submission of their forms and payments, thus avoiding interest and penalties for late filings.

Required Documents

To complete the Individual Income Tax Forms in Connecticut, certain documents are required. Taxpayers should gather income statements such as W-2 forms from employers and 1099 forms for any freelance or contract work. Additionally, documentation of any deductions, such as mortgage interest statements, property tax receipts, and records of charitable contributions, should be collected. For those filing the ct estimated tax form 2019, having a record of previous year’s tax returns can also be beneficial for estimating current tax obligations accurately.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Individual Income Tax Forms in Connecticut can be done through various methods. Taxpayers can file electronically using a secure online platform, which is often the fastest and most efficient option. Alternatively, forms can be printed and mailed to the Connecticut Department of Revenue Services. For those who prefer in-person submissions, visiting a local tax office may be an option, though it is advisable to check for any specific requirements or availability. Each submission method has its own processing times and requirements, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete individual income tax forms connecticut

Complete Individual Income Tax Forms Connecticut seamlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Individual Income Tax Forms Connecticut on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

The easiest method to modify and eSign Individual Income Tax Forms Connecticut effortlessly

- Obtain Individual Income Tax Forms Connecticut and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to secure your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to missing or misplaced papers, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Modify and eSign Individual Income Tax Forms Connecticut and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax forms connecticut

Create this form in 5 minutes!

How to create an eSignature for the individual income tax forms connecticut

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the CT estimated tax form 2019, and why is it important?

The CT estimated tax form 2019 is a tax document that helps taxpayers estimate their income tax obligations for the year. It is essential for individuals and businesses in Connecticut to accurately calculate their tax payable to avoid penalties and interest.

-

How can airSlate SignNow assist with submitting the CT estimated tax form 2019?

airSlate SignNow provides a seamless platform to eSign and send documents securely, including the CT estimated tax form 2019. Our user-friendly interface ensures that you can complete your tax forms efficiently and without hassle.

-

Are there any costs associated with using airSlate SignNow for the CT estimated tax form 2019?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans include features that optimize the eSigning process for documents like the CT estimated tax form 2019, ensuring you get the best value.

-

What features does airSlate SignNow offer for handling the CT estimated tax form 2019?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure storage to simplify managing the CT estimated tax form 2019. These tools help you stay organized and ensure your documents are compliant and accessible.

-

Can airSlate SignNow integrate with other software for managing taxes?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easy to manage your CT estimated tax form 2019 along with other tax documents. These integrations enhance your workflow and streamline the tax preparation process.

-

Is airSlate SignNow secure for sending the CT estimated tax form 2019?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure servers, to protect your sensitive information when sending the CT estimated tax form 2019. You can have peace of mind knowing your data is safe.

-

What benefits does airSlate SignNow provide for businesses filing the CT estimated tax form 2019?

Using airSlate SignNow for filing the CT estimated tax form 2019 allows businesses to save time and reduce errors with easy document management. The platform also enhances collaboration by enabling multiple users to sign and process documents electronically.

Get more for Individual Income Tax Forms Connecticut

- Quitclaim deed from individual to two individuals in joint tenancy utah form

- Ut lien form

- Quitclaim deed by two individuals to husband and wife utah form

- Warranty deed from two individuals to husband and wife utah form

- Ut llc company 497427395 form

- Utah disclaimer 497427396 form

- Cancellation of lien by individual utah form

- Quitclaim deed by two individuals to llc utah form

Find out other Individual Income Tax Forms Connecticut

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free