Form 1040 Es 2018

What is the Form 1040 ES

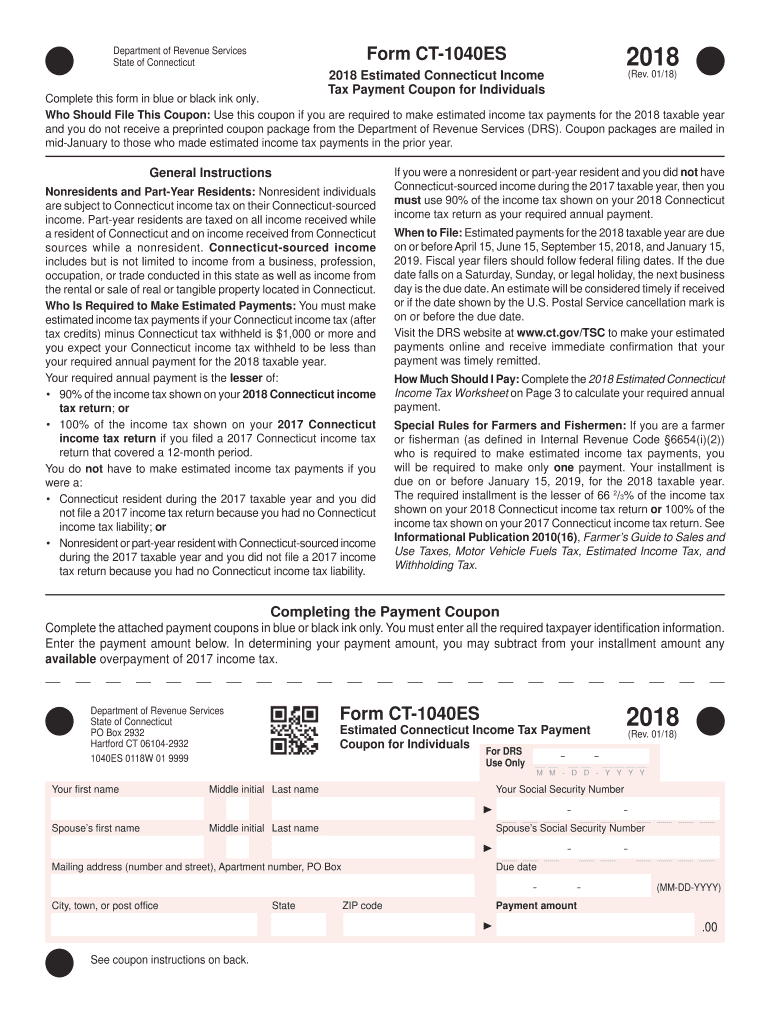

The 2018 Form 1040 ES is a crucial tax document used by individuals to estimate and pay their federal income tax. This form is particularly important for those who do not have taxes withheld from their income, such as self-employed individuals or those with significant investment income. By submitting the Form 1040 ES, taxpayers can avoid penalties for underpayment and ensure they meet their tax obligations throughout the year.

How to use the Form 1040 ES

Using the 2018 Form 1040 ES involves several key steps. First, taxpayers must estimate their total income for the year, considering all sources such as wages, dividends, and self-employment income. Next, they calculate their estimated tax liability based on current tax rates. The form provides four payment vouchers, allowing taxpayers to submit payments quarterly. It is essential to keep track of these payments to avoid any discrepancies when filing the annual tax return.

Steps to complete the Form 1040 ES

Completing the 2018 Form 1040 ES requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Estimate your total income for the current tax year.

- Calculate your estimated tax liability using the IRS tax tables.

- Fill out the form, ensuring all fields are completed accurately.

- Detach the payment vouchers and submit them along with your payment by the due dates.

Legal use of the Form 1040 ES

The 2018 Form 1040 ES is legally recognized by the IRS as a valid method for taxpayers to report and pay estimated taxes. It is important to complete the form accurately and submit it on time to avoid penalties. Taxpayers should retain copies of their submitted forms and payment confirmations for their records, as these documents may be needed for future reference or audits.

Filing Deadlines / Important Dates

For the 2018 tax year, the deadlines for submitting payments with the Form 1040 ES are typically set for April 15, June 15, September 15, and January 15 of the following year. These dates ensure that taxpayers stay compliant with their estimated tax obligations throughout the year. Missing a deadline can result in penalties and interest on unpaid taxes, making it essential to adhere to these important dates.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 2018 Form 1040 ES. The form can be filed online using the IRS e-file system, which is a secure and efficient method. Alternatively, individuals can mail their completed forms and payment vouchers to the designated IRS address based on their state of residence. For those who prefer in-person submissions, visiting a local IRS office is also an option, though appointments may be required.

Quick guide on how to complete form 1040 es 2018

Your assistance manual on how to prepare your Form 1040 Es

If you’re curious about how to finalize and submit your Form 1040 Es, here are some brief tips on how to simplify tax processing signNowly.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document tool that enables you to modify, draft, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify answers as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form 1040 Es in no time:

- Create your account and start editing PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; review various versions and schedules.

- Click Get form to access your Form 1040 Es in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to place your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may lead to more errors and delay refunds. Moreover, prior to electronically filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 es 2018

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I file form 1040-ES and how does it work?

File Form 1040 - ES only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to “United States Treasury.” Write your social security number and “2017 Form 1040-ES” on your check or money order.If you have your own business, you need to make estimated tax payments to the IRS throughout the year in order to avoid paying interest and penalties on top of your taxes.Follow the below example for filing and Paying of the Estimated TaxesExample:For Tax Year 2017 you can pay all of your estimated tax by April 18, 2017, or in four equal amounts by the dates shown below.1st payment April 18, 20172nd payment June 15, 20173rd payment Sept. 15, 20174th payment Jan. 16, 2018

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es 2018

How to create an electronic signature for the Form 1040 Es 2018 online

How to create an electronic signature for the Form 1040 Es 2018 in Chrome

How to make an eSignature for signing the Form 1040 Es 2018 in Gmail

How to generate an eSignature for the Form 1040 Es 2018 from your smartphone

How to create an electronic signature for the Form 1040 Es 2018 on iOS

How to generate an electronic signature for the Form 1040 Es 2018 on Android

People also ask

-

What is Form 1040 Es and why is it important?

Form 1040 Es is a crucial tax form used by self-employed individuals and those who expect to owe tax of $1,000 or more when filing their return. This form allows taxpayers to make estimated tax payments throughout the year. Understanding how to properly use Form 1040 Es can help avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 1040 Es?

airSlate SignNow streamlines the process of completing and submitting Form 1040 Es by allowing users to easily eSign and send documents electronically. Our platform eliminates the hassle of printing and mailing forms, making it simple to manage your tax documents efficiently. With airSlate SignNow, you can focus on your business while we handle your Form 1040 Es.

-

What features does airSlate SignNow offer for managing Form 1040 Es?

airSlate SignNow provides features like document templates, customizable workflows, and secure cloud storage specifically designed for forms like Form 1040 Es. Users can quickly create, send, and track the status of their forms, ensuring that all necessary steps are completed on time. Our user-friendly interface makes it easy to manage all your tax documentation in one place.

-

Is airSlate SignNow affordable for small businesses handling Form 1040 Es?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses using Form 1040 Es. We provide various subscription options that cater to different business needs and budgets, ensuring that all users can access our comprehensive eSigning services without breaking the bank. Sign up today to discover how affordable managing your tax documents can be.

-

Can airSlate SignNow integrate with accounting software for Form 1040 Es?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your Form 1040 Es alongside your financial records. This integration allows for automated document sharing and reduces the chances of errors, enhancing your overall efficiency during tax season.

-

What are the benefits of using airSlate SignNow for Form 1040 Es?

Using airSlate SignNow for your Form 1040 Es offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security for your sensitive tax information. Our platform also provides a clear audit trail, so you can track changes and signatories, ensuring transparency and compliance. Experience peace of mind knowing your forms are handled securely and efficiently.

-

How does airSlate SignNow ensure the security of my Form 1040 Es?

airSlate SignNow prioritizes security with advanced encryption standards and secure cloud storage, protecting your Form 1040 Es and other sensitive documents. We comply with industry regulations to ensure your data is safe from unauthorized access. You can trust us to keep your tax information confidential and secure throughout the process.

Get more for Form 1040 Es

- Jury humboldt courts ca gov form

- Employer job interview evaluation form project wild projectwild

- Attending physicianamp39s statement sun life grepa financial form

- Pe1309s eczema action plan spanish form

- Family home declaration form

- Pakistan visa application form 18501040

- Arizona board of pharmacy form

- Fee sharing agreement template form

Find out other Form 1040 Es

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document