Form CT 1040ES Form CT 1040ES CT Gov 2017

What is the Form CT 1040ES?

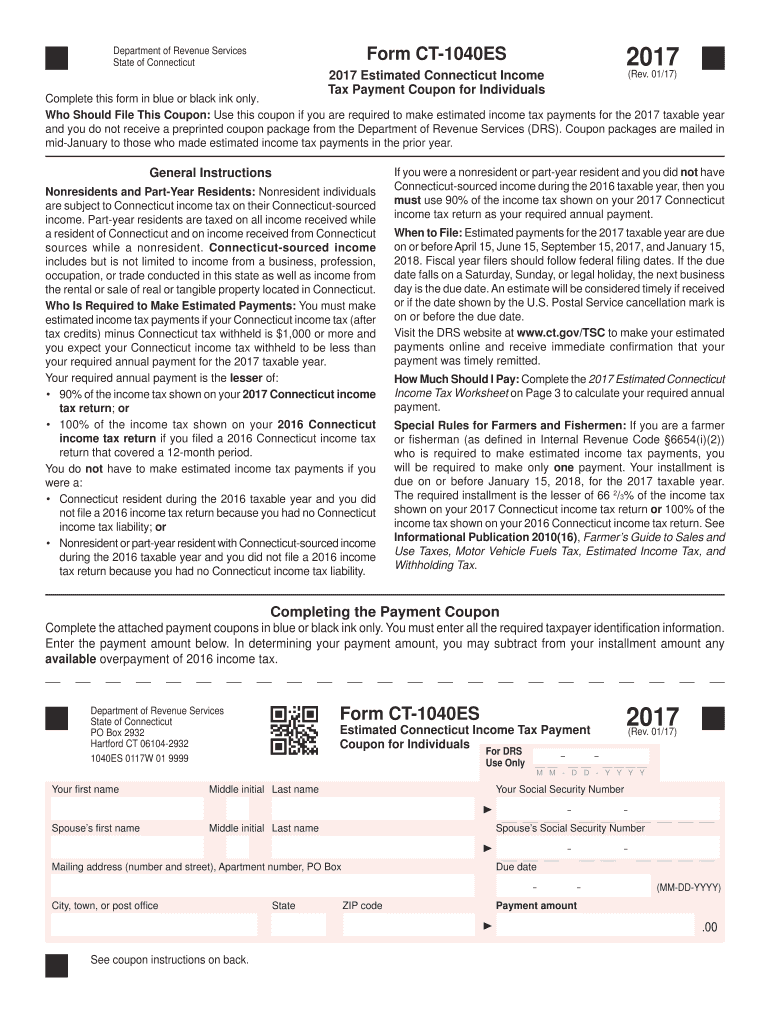

The Form CT 1040ES is a state-specific tax form used by residents of Connecticut to make estimated income tax payments. This form is essential for individuals who expect to owe tax of $1,000 or more when filing their annual income tax return. The CT 1040ES allows taxpayers to pay their estimated taxes in four installments throughout the year, helping to avoid underpayment penalties and manage tax liabilities effectively.

How to use the Form CT 1040ES

Using the Form CT 1040ES involves calculating your estimated tax liability for the year and determining how much you should pay in each installment. Taxpayers can utilize the worksheet provided with the form to estimate their income, deductions, and credits. Once the estimated tax is calculated, payments can be made using the payment vouchers included with the form, which can be submitted via mail or electronically, depending on the taxpayer's preference.

Steps to complete the Form CT 1040ES

Completing the Form CT 1040ES requires several key steps:

- Gather financial information, including income, deductions, and credits.

- Use the worksheet to calculate your estimated tax liability.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form along with the payment voucher by the due date.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form CT 1040ES. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely submission is essential for compliance.

Required Documents

To complete the Form CT 1040ES, taxpayers should have the following documents ready:

- Previous year’s tax return for reference.

- Income statements such as W-2s and 1099s.

- Documentation for any deductions or credits claimed.

- Any relevant financial records that may impact estimated tax calculations.

Legal use of the Form CT 1040ES

The Form CT 1040ES is legally recognized by the Connecticut Department of Revenue Services. It is designed to facilitate the timely payment of estimated taxes, ensuring compliance with state tax laws. Taxpayers must use this form correctly to avoid potential legal issues and penalties associated with underpayment or late payment of taxes.

Quick guide on how to complete form ct 1040es form ct 1040es ctgov

Your assistance manual on how to prepare your Form CT 1040ES Form CT 1040ES CT gov

If you’re unsure about how to complete and submit your Form CT 1040ES Form CT 1040ES CT gov, here are some quick pointers on how to simplify tax filing.

To get going, you simply need to create your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, produce, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Form CT 1040ES Form CT 1040ES CT gov in no time:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form CT 1040ES Form CT 1040ES CT gov in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, transmit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in writing can lead to increased return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1040es form ct 1040es ctgov

FAQs

-

When will I can fill the form of CT 1 as a non member in ifoa for 2017?

Registration starts on 30th January for April 2017 Exam. The process is simple.A link will show up on website (actuaries.org.uk) on 30th jan using which you will have to sign up filling in very basic details like name and DOB etc. Do not Forget to tick the option to apply for reduced rate fees if you are earning less than GBP 7140. If you forget to tick the option of reduced rate fees than you will have to pay almost twice after you sign up.Once you sign up, you will get ARN no on your registered email id within 48 hours. You will have to wait till then, It may drop in 5 mins as well sometimes.using this ARN no. you have to log in, select exam centre in India and make the payment.Fees is GBP 130 (if you are eligible for reduced fees i.e. Your annual income is less than GBP 7140, if you are earning more than your fees will be almost twice). You need to have international debit/credit card to make the payment. You can always call the institute for any help. They are very receptive.

-

How do I answer the profile detail form in the IMT Ghaziabad CT-GE-PI?

Keep your answers to the point, crisp and precise. Draft it in such a way where you can discuss the applicability part. For example, if you're work experience candidate, what kind of work experience you have and key deliverables, your functional roles and responsibilities for the same. If it comes to fresher, then particular subject grip or academic achievement or General Awareness part (Mind well, Not GK, it's different than GA) especially pertaining to corporate ones like mergers acquisition, any new disruptive Technology etc. You can expect such things even in your interview irrespective of which b school you have shortlisted for.Pertaining to your extra curricular activities, any national state participation/achievement should be pointed out. If there is no national state achievement in any extra curricular, write more about your undergraduate extra curricular, then HSC and at last SSC time (though not suggested). Other than that, don't talk or write about something which you would have done in class 6th or say 8th but haven't opted then after. It's simple redundant to talk or even write about.If you have no particular achievement or extra curricular to talk about, fine be ready for GA as I said or your undergraduate subject or in case of work experience, your roles and responsibilities.PS : This is irrespective of IMT Ghaziabad profile details form. This is simple enough procedure to make it parallel (in sync and uniform) profile in across all b school forms so that it would be easy to prepare for. Keep it simple, precise and talk only which you actually have done or can produce some kind of paper evidence like certificate. Talk what you know and deny what you don't. Be yourself by all means.Best of luck

-

How does a radiologist tell from CT coronary scan results whether an atherosclerotic plaque is calcified or not? How accurate is a CT scan to work out a calcium score?

CT is exquisitely sensitive to differences in x-ray attenuation. So, in the case of coronary artery plaque, it is relatively easy to quantify (and see) how much calcium is present versus how much soft tissue. I think, therefore,that coronary artery calcium score is considered a pretty good predictor of cardiac risk. In addition, however, there are features of the plaque such as remodelling and low attenuation that can be seen that cause the plaque to be considered 'high risk plaque’ that can also add to the predictve value of the test. Overall, I think coronary artery calcium scoring is considered a reliable test.

-

How can I get interested MRI and CT scan engineers to form a maintenance group to serve a fast growing African market?

Cash and equity in the company.There is a huge number of older service engineers who have been waiting decades to move up, manage, or do more. They are excellent teachers, know the depths of the system, can scrounge parts when customers sell old machines for scrap. They usually feel highly undervalued.Cash, Equity, and Respect. Don’t BS them, explain the risk reward, give them cash and a percentage of the business, don’t micromanage them. They tend to be easy to find on LinkedIn, especially with smaller companies.If you need some references, let me know.

-

Do non profit corporations in New York have to file a form each year after filing the ct-247 the first year?

The non-profit does not have to file CT-247 each year; it only needs to refile if its Federal exemption is revoked, and later restored. However, a non-profit with unrelated business income from New York state activities will have to file Form CT-13 for any year in which the corporation had such income.There is also a separate form (ST-119.2) to file for an exemption from state and local sales taxes.

-

Given that the Australian 2nd Commando Regiment now has organic CT capabilities in the form of TAG (East), why do men still wish to join the SASR?

The TAG East and West teams are made up of special operations members from 1st Commando Regiment, 2nd Commando Regiment, the Special Air Service Regiment, Royal Australian Navy clearance divers and other elements of the Australia Special Operations Command. 2CDO provides the bulk of TAG East and the SASR provides the bulk of TAG West. The existence of TAG East does not make joining the SASR less coveted or prestigious, the SASR’s roles are not limited solely to counter- terrorism, and the Australian Federal Government and State governments all also have organisations that include counter terrorism roles, such as the Australian Federal Police and the various State Police’s tactical units.

-

How correct is it to criticise Jadeja so much after that run out in the CT 2017 final?

Place: - country full of Indian since 1600Event :- political cricketTime :- 2nd innings of Harassment.Over no. 26.3 - jadeja dabbed the the ball straight to fielder and a young hot blooded homosapien run almost blindly....and after that the whole started to so called "troll" jadeja....Its not the first time that this happens in indian cricket....Let's head back to 1975.....a young short heigheted without helmet man faced one of the best team and trying to chase 338 by making174 ball 36...In 2003 .... a master who couldn't be able to keep his promise which he made to indian cricket fansIn 2007 .... a flamboyant new indian batsmen who is yet to be so mature to understand the political system of Indian cricket supporters...was under the scrutiny of the so called indian fans ......In 2014 .... a former cancer patient who is redefining passion made a 21 ball 12 in a world TT finals.....In 2015 .... another bearded man faced the best team at that time and made a 10 ball 1 while chasing 326....Ok!!!! So don't scratch your head by thinking " why on earth this boy is mentioning these stats to me".....so as I know everybody almost follow cricket ...You know there were 2 common things between these players in the stats above....one, at that time they were playing one of their best cricket ever in their career ( eliminate 1975 as I was yet to come in the list of Indian cricket fans)....two, they were brutally criticised world wide for these acts ......Its quite funny that sometime your small decision can turn into a disaster for not only for you but also for your families....as an Indian cricket fan ...when I look back into these situation I feel sorry for the critics....because the irony is that the one who is criticising in their home or in a group in "chai pe charcha" or sitting in an ac chamber of a newsroom ( that not includes everyone ) is justifying the ones who are the worldwide recigonised legends of the game of cricket.....And for the upcoming indian legends I saw no hope for evasion either......But as a jharkhand citizen I learnt to hope , quite a bit....so I hope that may be some western breeze will blow our minds towards good fanaticism. ....

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1040es form ct 1040es ctgov

How to generate an electronic signature for the Form Ct 1040es Form Ct 1040es Ctgov online

How to make an eSignature for the Form Ct 1040es Form Ct 1040es Ctgov in Google Chrome

How to create an eSignature for putting it on the Form Ct 1040es Form Ct 1040es Ctgov in Gmail

How to make an electronic signature for the Form Ct 1040es Form Ct 1040es Ctgov from your mobile device

How to create an eSignature for the Form Ct 1040es Form Ct 1040es Ctgov on iOS devices

How to create an eSignature for the Form Ct 1040es Form Ct 1040es Ctgov on Android OS

People also ask

-

What is the Form CT 1040ES and how can I obtain it?

The Form CT 1040ES is an estimated tax payment form provided by the State of Connecticut. You can easily download it from the CT gov website or complete it using the airSlate SignNow platform for a streamlined user experience.

-

How can airSlate SignNow assist with submitting Form CT 1040ES?

airSlate SignNow simplifies the process of submitting Form CT 1040ES by allowing you to eSign and send documents securely. With our platform, you can fill out the form and ensure it's sent directly to the CT gov, all in one user-friendly interface.

-

What are the pricing options for using airSlate SignNow to manage Form CT 1040ES?

airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses. You can choose a plan that best fits your needs for handling documents like Form CT 1040ES, ensuring cost-effectiveness while accessing a range of features.

-

What features does airSlate SignNow offer for eSigning Form CT 1040ES?

With airSlate SignNow, you can eSign Form CT 1040ES efficiently. Key features include drag-and-drop document uploads, customizable templates, and real-time tracking of document status, making the eSigning process seamless and effective.

-

Can airSlate SignNow integrate with other software for managing Form CT 1040ES?

Yes, airSlate SignNow offers integration options with various business tools, allowing users to manage Form CT 1040ES alongside other essential applications. This seamless integration enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for Form CT 1040ES?

Using airSlate SignNow for Form CT 1040ES offers numerous benefits, including reduced processing times and enhanced security. Plus, you have the convenience of accessing your documents anywhere, anytime, which is especially valuable during tax season.

-

Is airSlate SignNow compliant with state regulations for Form CT 1040ES?

Yes, airSlate SignNow is designed to comply with state regulations, including those pertaining to Form CT 1040ES. Our platform ensures that your eSigned documents meet the legal requirements set by CT gov for validity and security.

Get more for Form CT 1040ES Form CT 1040ES CT gov

- Printable police misconduct complaint form to mail or fax english cabq

- Bolo template 58533715 form

- Request for rental increase the st louis housing authority slha form

- Bupa medical certificate form

- Trans ocean scholarship application lynden school district form

- Form 10133 32 printable online

- Appel program utah form

- Fee agreement template form

Find out other Form CT 1040ES Form CT 1040ES CT gov

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now