Form 4361 Rev December IRS Irs

What is the Form 4361 Rev December IRS

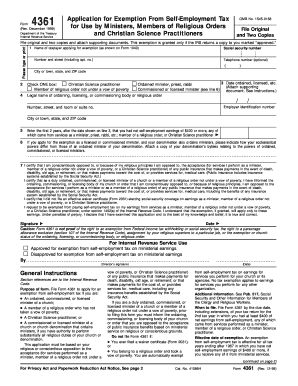

The Form 4361 Rev December IRS is a tax form used by certain religious organizations and their members to apply for exemption from self-employment tax. This form is specifically designed for ministers and members of religious orders who meet specific criteria set by the IRS. By filing this form, eligible individuals can formally request to be exempt from paying self-employment tax on their income derived from religious services.

How to use the Form 4361 Rev December IRS

To use the Form 4361 Rev December IRS effectively, individuals must first determine their eligibility based on the IRS guidelines. Once eligibility is confirmed, the form can be completed by providing personal information, details about religious duties, and the basis for the exemption request. After filling out the form, it must be submitted to the IRS for review. It is important to retain a copy for personal records and to ensure compliance with any follow-up requirements from the IRS.

Steps to complete the Form 4361 Rev December IRS

Completing the Form 4361 Rev December IRS involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Provide details about your religious organization, including its name and address.

- Describe your duties as a minister or member of a religious order.

- Indicate the reasons for requesting the exemption from self-employment tax.

- Sign and date the form to certify the information is accurate.

Once completed, the form should be mailed to the address specified in the instructions provided with the form.

Legal use of the Form 4361 Rev December IRS

The legal use of the Form 4361 Rev December IRS is governed by IRS regulations that outline the criteria for exemption from self-employment tax. To be legally valid, the form must be completed accurately and submitted within the designated timeframe. Failure to adhere to these regulations may result in denial of the exemption request, and individuals may be held liable for unpaid taxes. It is crucial to understand the legal implications and ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4361 Rev December IRS are critical to ensure timely processing of the exemption request. Generally, the form should be filed by the due date of the tax return for the year in which the exemption is sought. If you are applying for the exemption for the first time, it is advisable to submit the form as soon as you determine your eligibility to avoid any delays in processing. Keeping track of these important dates helps ensure compliance with IRS regulations.

Required Documents

When submitting the Form 4361 Rev December IRS, certain documents may be required to support your exemption request. These documents can include:

- Proof of your status as a minister or member of a religious order.

- Documentation of your religious duties and responsibilities.

- Any previous correspondence with the IRS regarding your tax status.

Having these documents ready can facilitate the review process and help ensure that your application is processed smoothly.

Eligibility Criteria

Eligibility for the Form 4361 Rev December IRS exemption is based on specific criteria established by the IRS. Generally, to qualify, you must be a minister or a member of a religious order who has taken a vow of poverty. Additionally, your income must primarily come from religious services. It is important to review the detailed eligibility requirements outlined by the IRS to ensure that you meet all necessary conditions before submitting your application.

Quick guide on how to complete form 4361 rev december irs irs

Prepare Form 4361 Rev December IRS Irs effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 4361 Rev December IRS Irs on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form 4361 Rev December IRS Irs seamlessly

- Obtain Form 4361 Rev December IRS Irs and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Form 4361 Rev December IRS Irs and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4361 rev december irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4361 Rev December IRS Irs?

The Form 4361 Rev December IRS Irs is a tax exemption application used by individuals who want to claim exemption from self-employment tax. This form is essential for eligible members of specific religious groups or sects, allowing them to maintain their financial independence while still complying with IRS regulations.

-

How can airSlate SignNow help with filing the Form 4361 Rev December IRS Irs?

airSlate SignNow provides a streamlined platform that enables users to complete and eSign the Form 4361 Rev December IRS Irs efficiently. With our user-friendly interface and document management tools, you can ensure that your form is filled out accurately and submitted on time.

-

Is there a cost to use airSlate SignNow for processing the Form 4361 Rev December IRS Irs?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our pricing is cost-effective, ensuring that you can manage your document signing, including the Form 4361 Rev December IRS Irs, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form 4361 Rev December IRS Irs?

airSlate SignNow includes features such as custom templates, reusable forms, and secure eSigning options for handling the Form 4361 Rev December IRS Irs. Additionally, our platform provides tracking capabilities to monitor the status of your documents, ensuring that nothing gets lost in the process.

-

Can I integrate airSlate SignNow with other tools when handling the Form 4361 Rev December IRS Irs?

Absolutely! airSlate SignNow offers seamless integrations with various popular business applications, making it easy to incorporate the Form 4361 Rev December IRS Irs into your existing workflow. Whether it's CRM software or project management tools, our platform can enhance your productivity.

-

What are the benefits of using airSlate SignNow for the Form 4361 Rev December IRS Irs?

Using airSlate SignNow for the Form 4361 Rev December IRS Irs provides multiple benefits, including improved efficiency and reduced paper clutter. Our platform ensures secure eSigning, gives you full control over your documents, and helps you maintain compliance with IRS regulations effortlessly.

-

Is it easy to eSign the Form 4361 Rev December IRS Irs with airSlate SignNow?

Yes, eSigning the Form 4361 Rev December IRS Irs with airSlate SignNow is simple and intuitive. Our electronic signature process is designed for users of all tech backgrounds, making it easy for you to sign and send forms within minutes.

Get more for Form 4361 Rev December IRS Irs

- Judgment and decree determining heirs or devisees or both and of form

- Information about the applicant

- Petition for final settlement pursuant to 15 12 1001 c form

- Single pdf file stategov form

- Personal property held by or in the possession of the decedent as fiduciary or trustee exempt property family form

- Record packet copy this is not the california coastal commission form

- The petitioner makes the following statements form

- Ni 43 101 technical report on resources and reserves bolivar mine form

Find out other Form 4361 Rev December IRS Irs

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement