Il 501 Form

What is the Il 501

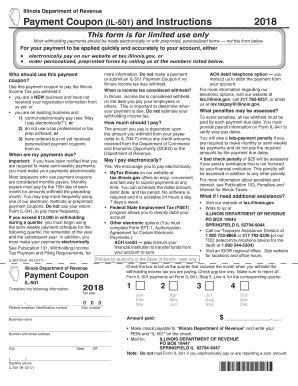

The Il 501 is a specific form used primarily for tax purposes in the United States. It serves as a payment coupon, allowing individuals or businesses to submit payments for various obligations, including taxes owed. Understanding the purpose and function of the Il 501 is essential for ensuring compliance with tax regulations and for maintaining accurate financial records.

How to use the Il 501

To effectively use the Il 501, individuals must first determine the specific payment they need to make. This form can be utilized for various tax payments, including income tax and other related obligations. Once the appropriate payment amount is established, users should fill out the form accurately, ensuring all required information is included. After completing the Il 501, it should be submitted along with the payment to the designated tax authority, either electronically or via mail.

Steps to complete the Il 501

Completing the Il 501 involves several key steps:

- Gather necessary information, including taxpayer identification numbers and payment details.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the information for accuracy to avoid any potential issues.

- Submit the Il 501 along with the payment, ensuring it reaches the appropriate tax authority by the deadline.

Legal use of the Il 501

The Il 501 is legally recognized as a valid method for submitting tax payments. To ensure its legal standing, it is important to follow the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state regulations. Proper use of the form protects taxpayers from potential penalties and ensures compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Il 501 can vary based on the type of payment being made. It is crucial to be aware of these dates to avoid late fees or penalties. Typically, tax payments are due on specific dates throughout the year, and taxpayers should consult the IRS guidelines or their state tax authority for the most accurate deadlines related to the Il 501.

Required Documents

When using the Il 501, certain documents may be required to support the payment. These can include:

- Tax returns or forms that indicate the amount owed.

- Identification documents, such as a Social Security number or Employer Identification Number.

- Any previous correspondence from the tax authority related to the payment.

Form Submission Methods (Online / Mail / In-Person)

The Il 501 can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through the tax authority's website, which may offer a quicker processing time.

- Mailing the completed form and payment to the designated address provided by the tax authority.

- In-person submission at local tax offices, which may be beneficial for those needing assistance.

Quick guide on how to complete il 501

Complete Il 501 with ease on any gadget

Web-based document administration has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the features needed to generate, modify, and electronically sign your papers swiftly and without hindrance. Manage Il 501 on any device using airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

How to modify and electronically sign Il 501 effortlessly

- Obtain Il 501 and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal value as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form: through email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Il 501 and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 501

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 501 in the context of airSlate SignNow?

Il 501 refers to a specific form integration available with airSlate SignNow, allowing users to efficiently manage and eSign essential documents. This feature is designed to streamline the signing process and enhance workflow productivity for businesses.

-

How does airSlate SignNow handle pricing for il 501?

AirSlate SignNow offers flexible pricing options for users looking to integrate il 501. Depending on your business needs, you can choose from various subscription plans that include access to all features related to il 501 at competitive rates, ensuring cost-effectiveness.

-

What are the key benefits of using il 501 with airSlate SignNow?

Using il 501 with airSlate SignNow allows businesses to automate document workflows, reduce turnaround times, and improve compliance. With the intuitive interface and efficient eSigning options, employees can focus on core tasks while managing documents effortlessly.

-

Are there any integrations available with il 501 in airSlate SignNow?

Yes, airSlate SignNow offers various integrations with il 501, including collaboration tools and cloud storage solutions. This compatibility enhances your document management processes, allowing seamless access and sharing of signed documents across platforms.

-

How secure is the signing process for il 501 in airSlate SignNow?

The signing process for il 501 in airSlate SignNow is highly secure, utilizing industry-standard encryption and authentication measures. This ensures that all documents signed using il 501 are protected, ensuring compliance with data protection regulations.

-

Can I customize my il 501 documents in airSlate SignNow?

Absolutely! AirSlate SignNow lets you customize your il 501 documents with various templates and branding options. This feature allows you to create a professional appearance while tailoring the documents to your specific business needs.

-

How user-friendly is the airSlate SignNow platform for managing il 501?

AirSlate SignNow is designed to be user-friendly, making it easy to manage il 501. With a straightforward setup and navigation, even users with limited technical skills can efficiently handle document eSigning and management tasks.

Get more for Il 501

- Michigan trust form

- Mi trust form

- Living trust property record michigan form

- Financial account transfer to living trust michigan form

- Assignment to living trust michigan form

- Notice of assignment to living trust michigan form

- Mi trust 497311595 form

- Letter to lienholder to notify of trust michigan form

Find out other Il 501

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile