Form WI DoR Schedule H EZ Fill Online, Printable 2024-2026

Understanding the Wisconsin Homestead Credit Form

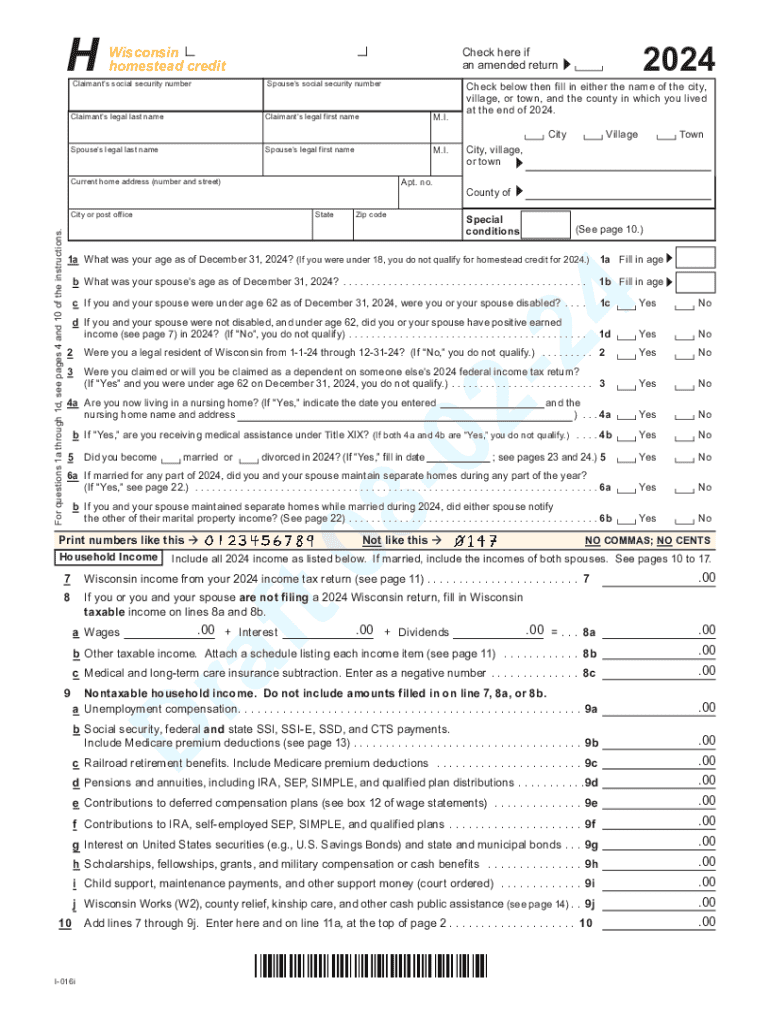

The Wisconsin Homestead Credit Form, also known as the WI DoR Schedule H, is a tax form designed to help eligible homeowners and renters reduce their property tax burden. This form is specifically aimed at individuals who meet certain income and residency criteria, allowing them to receive a credit based on their property taxes or rent paid. The form is essential for those looking to benefit from the homestead tax credit, which can significantly ease financial pressures for low-income residents.

Steps to Complete the Wisconsin Homestead Credit Form

Completing the Wisconsin Homestead Credit Form involves several key steps:

- Gather necessary documents, including proof of income, property tax statements, and any rental agreements.

- Download or access the form online through the Wisconsin Department of Revenue website.

- Fill out the form accurately, providing all required information, such as your name, address, and income details.

- Review the completed form to ensure all information is correct and complete.

- Submit the form by the designated deadline, either online or by mailing it to the appropriate address.

Eligibility Criteria for the Wisconsin Homestead Credit

To qualify for the Wisconsin Homestead Credit, applicants must meet specific eligibility criteria:

- Must be a resident of Wisconsin.

- Must be at least eighteen years old or be a qualified minor.

- Must have a total household income that does not exceed the state’s income limits.

- Must own or rent a home that is your primary residence.

Required Documents for Filing the Wisconsin Homestead Credit Form

When filing the Wisconsin Homestead Credit Form, you will need to provide several documents to support your application:

- Proof of income, such as W-2 forms, 1099 forms, or other income statements.

- Property tax bill or rental agreement to verify housing costs.

- Any additional documentation requested by the Wisconsin Department of Revenue.

Form Submission Methods for the Wisconsin Homestead Credit

The Wisconsin Homestead Credit Form can be submitted through various methods, ensuring convenience for applicants:

- Online Submission: Complete and submit the form electronically through the Wisconsin Department of Revenue website.

- Mail: Print the completed form and send it to the designated address provided on the form.

- In-Person: Visit a local Department of Revenue office to submit the form directly.

Filing Deadlines for the Wisconsin Homestead Credit Form

It is crucial to be aware of the filing deadlines for the Wisconsin Homestead Credit Form to ensure eligibility:

- The deadline for filing the form is typically April 15 of the year following the tax year for which the credit is claimed.

- Extensions may be available under certain circumstances, but it is important to check with the Wisconsin Department of Revenue for specific guidelines.

Create this form in 5 minutes or less

Find and fill out the correct form wi dor schedule h ez fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form wi dor schedule h ez fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WI homestead credit form?

The WI homestead credit form is a document used by Wisconsin residents to apply for property tax relief. This form helps eligible homeowners reduce their property tax burden based on income and property value. Completing the WI homestead credit form accurately is essential to ensure you receive the benefits you qualify for.

-

How can airSlate SignNow help with the WI homestead credit form?

airSlate SignNow simplifies the process of completing and submitting the WI homestead credit form. With our easy-to-use platform, you can fill out the form electronically, ensuring accuracy and saving time. Additionally, you can eSign the document securely, making the submission process seamless.

-

Is there a cost associated with using airSlate SignNow for the WI homestead credit form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our cost-effective solution ensures that you can manage your documents, including the WI homestead credit form, without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the WI homestead credit form?

airSlate SignNow provides features such as document templates, eSigning, and secure cloud storage, all of which are beneficial for managing the WI homestead credit form. You can easily create, edit, and store your forms in one place, ensuring you have everything you need at your fingertips. Our platform also allows for collaboration with others if needed.

-

Can I integrate airSlate SignNow with other applications for the WI homestead credit form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage your documents, including the WI homestead credit form, alongside your existing tools. Whether you use CRM systems or cloud storage services, our platform can connect seamlessly to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the WI homestead credit form?

Using airSlate SignNow for the WI homestead credit form provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to complete and submit your forms electronically, minimizing the risk of errors. Additionally, you can track the status of your submissions in real-time.

-

How secure is airSlate SignNow when handling the WI homestead credit form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data when handling the WI homestead credit form. You can trust that your personal information and documents are safe with us throughout the entire process.

Get more for Form WI DoR Schedule H EZ Fill Online, Printable

- English for marketing pdf form

- Print 1095 a from marketplace form

- Brazos county homestead exemption form

- Dhs release of information form

- Annual tb screening questionnaire form

- Application for temporary disconnection of electricity connection form

- Iep at a glance template form

- Mandibular function impairment questionnaire form

Find out other Form WI DoR Schedule H EZ Fill Online, Printable

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now