Form Refund

What is the Form Refund

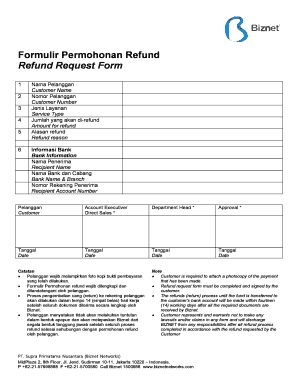

The form refund is a document used to request the return of funds previously paid, often related to taxes, fees, or other financial transactions. This form is essential for individuals and businesses seeking to recover overpayments or incorrect charges. Understanding the purpose and details of the form refund can help ensure that the process is completed accurately and efficiently.

How to use the Form Refund

Utilizing the form refund involves several steps to ensure that it is filled out correctly. Begin by gathering all necessary information, including personal identification details and any relevant transaction records. Complete the form by providing accurate information about the payment you are disputing. After filling out the form, review it carefully to ensure all details are correct before submission.

Steps to complete the Form Refund

Completing the form refund requires careful attention to detail. Follow these steps:

- Collect your personal information, including your name, address, and social security number.

- Gather documentation that supports your request, such as receipts or bank statements.

- Fill out the form with accurate details regarding the transaction in question.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified submission method.

Legal use of the Form Refund

The form refund must be used in accordance with applicable laws and regulations. In the United States, it is essential to comply with federal and state guidelines to ensure that your request is valid. This includes adhering to deadlines and providing sufficient documentation to support your claim. Proper legal use helps to protect your rights and ensures that your request is processed without unnecessary delays.

Required Documents

When submitting the form refund, specific documents are typically required to substantiate your claim. These may include:

- Proof of payment, such as receipts or bank statements.

- Identification documents, like a driver's license or social security card.

- Any correspondence related to the transaction, including emails or letters.

Having these documents ready can facilitate a smoother process and increase the likelihood of a successful refund.

Filing Deadlines / Important Dates

Each form refund may have specific filing deadlines that must be adhered to for the request to be considered valid. It is crucial to be aware of these dates to ensure timely submission. Missing a deadline can result in the denial of your claim, so keeping track of important dates related to your form refund is essential for a successful outcome.

Quick guide on how to complete form refund

Prepare Form Refund effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Form Refund on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form Refund effortlessly

- Locate Form Refund and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Refund to guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for requesting a form refund with airSlate SignNow?

To request a form refund with airSlate SignNow, you need to log into your account and navigate to the billing section. From there, select the transaction for which you want a refund and follow the on-screen instructions. Make sure to provide any necessary documentation that supports your refund request related to the form.

-

Are there any fees associated with processing a form refund?

airSlate SignNow does not charge any fees for processing a form refund, provided that the request is made within the stipulated time frame. However, if the refund is requested after a signNow delay or policy violation, additional considerations may apply. It's always best to review our refund policy detailed on our website.

-

How long does it take to receive a form refund?

Once your form refund request is approved, you can expect the funds to be credited back to your original payment method within 5-7 business days. We strive to process refunds promptly, but factors like bank processing times may influence how quickly you see the funds. Check your account for updates on your refund status.

-

Can I receive a form refund for a subscription plan I no longer use?

You can request a form refund for a subscription plan you're no longer using, as long as the subscription falls within our refund policy guidelines. It's important to cancel your subscription before the next billing cycle and apply for a refund within the specified period. For detailed steps, refer to our cancellation and refund policy.

-

What features does airSlate SignNow offer for managing form refunds?

airSlate SignNow provides seamless document management features, allowing you to efficiently track form refunds and related transactions. You can view transaction histories, get notifications about refund statuses, and access support directly from your dashboard for any related queries. These features enhance your overall user experience.

-

Does airSlate SignNow integrate with other platforms to help manage refunds?

Yes, airSlate SignNow integrates with various platforms that can assist in managing form refunds, including CRM systems, accounting software, and payment gateways. This integration allows for a streamlined process when tracking and managing your transactions, including refunds. Check our integrations page for specific compatible platforms.

-

What can I do if my form refund request is denied?

If your form refund request is denied, you have the option to appeal the decision by providing additional information or clarification regarding your case. signNow out to our customer support team to discuss the issue further, as they can often assist in resolving your concerns. We aim to ensure that all customer queries are addressed satisfactorily.

Get more for Form Refund

- Notice name change 497313383 form

- Missouri note form

- Promissory note template missouri form

- Mo secured form

- Missouri note 497313387 form

- Notice of option for recording missouri form

- Life documents planning package including will power of attorney and living will missouri form

- General durable power of attorney for property and finances or financial effective upon disability missouri form

Find out other Form Refund

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer