Department of Revenue Services State of Connecticut 450 2021

What is the Department Of Revenue Services State Of Connecticut 450

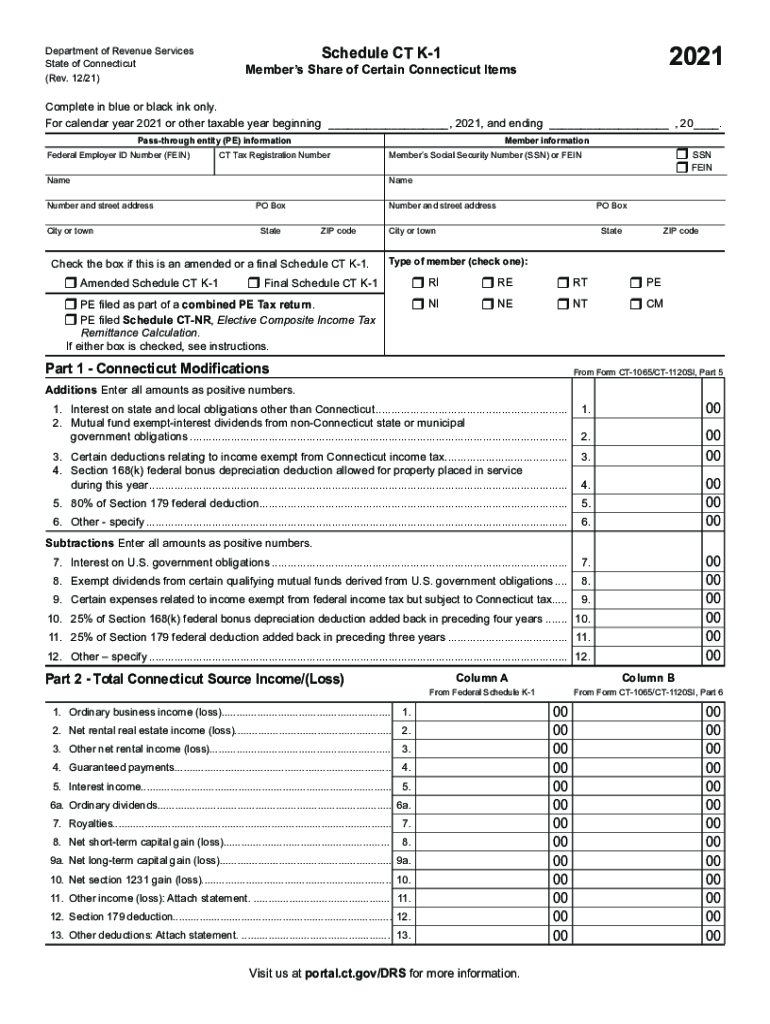

The Department Of Revenue Services State Of Connecticut 450 form is a crucial document used for various tax-related purposes within the state. This form is primarily associated with the reporting of income and deductions for individuals and businesses. Understanding its purpose is essential for compliance with state tax regulations.

How to use the Department Of Revenue Services State Of Connecticut 450

Using the Department Of Revenue Services State Of Connecticut 450 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form carefully, ensuring all sections are completed accurately. Finally, review the form for any errors before submission to avoid delays or penalties.

Steps to complete the Department Of Revenue Services State Of Connecticut 450

Completing the Department Of Revenue Services State Of Connecticut 450 form requires attention to detail. Follow these steps:

- Gather required documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Detail any deductions or credits you are eligible for.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Department Of Revenue Services State Of Connecticut 450

The legal use of the Department Of Revenue Services State Of Connecticut 450 form is governed by state tax laws. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal consequences, including fines or audits. Utilizing electronic signatures through a trusted platform can enhance the legal validity of the form.

State-specific rules for the Department Of Revenue Services State Of Connecticut 450

Each state has specific rules regarding the completion and submission of tax forms. For the Department Of Revenue Services State Of Connecticut 450, it is important to be aware of deadlines, filing requirements, and any state-specific deductions that may apply. Staying informed about these regulations ensures compliance and helps avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Department Of Revenue Services State Of Connecticut 450 form can be submitted through various methods. Taxpayers may choose to file online, which is often the quickest option. Alternatively, the form can be mailed to the appropriate state office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete department of revenue services state of connecticut 450

Compile Department Of Revenue Services State Of Connecticut 450 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, adjust, and electronically sign your documents swiftly without delays. Manage Department Of Revenue Services State Of Connecticut 450 on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Department Of Revenue Services State Of Connecticut 450 with ease

- Locate Department Of Revenue Services State Of Connecticut 450 and select Get Form to initiate the process.

- Employ the tools we provide to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to secure your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and electronically sign Department Of Revenue Services State Of Connecticut 450 to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services state of connecticut 450

Create this form in 5 minutes!

People also ask

-

What is the Department Of Revenue Services State Of Connecticut 450 form?

The Department Of Revenue Services State Of Connecticut 450 form is used for tax purposes in Connecticut. This form is essential for businesses to comply with state tax regulations. By using the airSlate SignNow solution, you can easily eSign and manage this form effectively.

-

How does airSlate SignNow assist with the Department Of Revenue Services State Of Connecticut 450 form?

airSlate SignNow provides a streamlined process for completing and submitting your Department Of Revenue Services State Of Connecticut 450 form. Our platform allows users to easily fill out, sign, and send the form securely. This simplifies your workflow and ensures timely submission.

-

What are the pricing options for airSlate SignNow services related to the Department Of Revenue Services State Of Connecticut 450?

airSlate SignNow offers flexible pricing plans tailored to the needs of different businesses. Our cost-effective solutions ensure you get the best value while managing documents like the Department Of Revenue Services State Of Connecticut 450 form. Visit our pricing page for detailed information on plans.

-

Can I integrate airSlate SignNow with other applications while managing the Department Of Revenue Services State Of Connecticut 450?

Yes, airSlate SignNow seamlessly integrates with numerous applications and tools. This allows you to manage your Department Of Revenue Services State Of Connecticut 450 form alongside your existing business processes. The integration capabilities enhance efficiency and save time.

-

What features does airSlate SignNow offer for eSigning the Department Of Revenue Services State Of Connecticut 450?

airSlate SignNow offers a range of features for eSigning documents, including templates, in-app signing, and real-time tracking. These features make it easy to prepare the Department Of Revenue Services State Of Connecticut 450 form for signatures. Ensuring a secure and efficient signing process is our priority.

-

Is airSlate SignNow secure for handling the Department Of Revenue Services State Of Connecticut 450 form?

Absolutely! airSlate SignNow prioritizes security with robust encryption and compliance protocols. When handling the Department Of Revenue Services State Of Connecticut 450 form, you can trust that your data is secure and confidential. We take every measure to protect your information.

-

What are the benefits of using airSlate SignNow for the Department Of Revenue Services State Of Connecticut 450?

Using airSlate SignNow for the Department Of Revenue Services State Of Connecticut 450 offers numerous benefits, including time savings and reduced paper usage. Our platform increases productivity through efficient document management. You'll experience a faster, more reliable way to submit your tax forms.

Get more for Department Of Revenue Services State Of Connecticut 450

Find out other Department Of Revenue Services State Of Connecticut 450

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement