DEPARTMENT of REVENUE SERVICES STATE of CONNECTICUT FORM 2021

What is the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

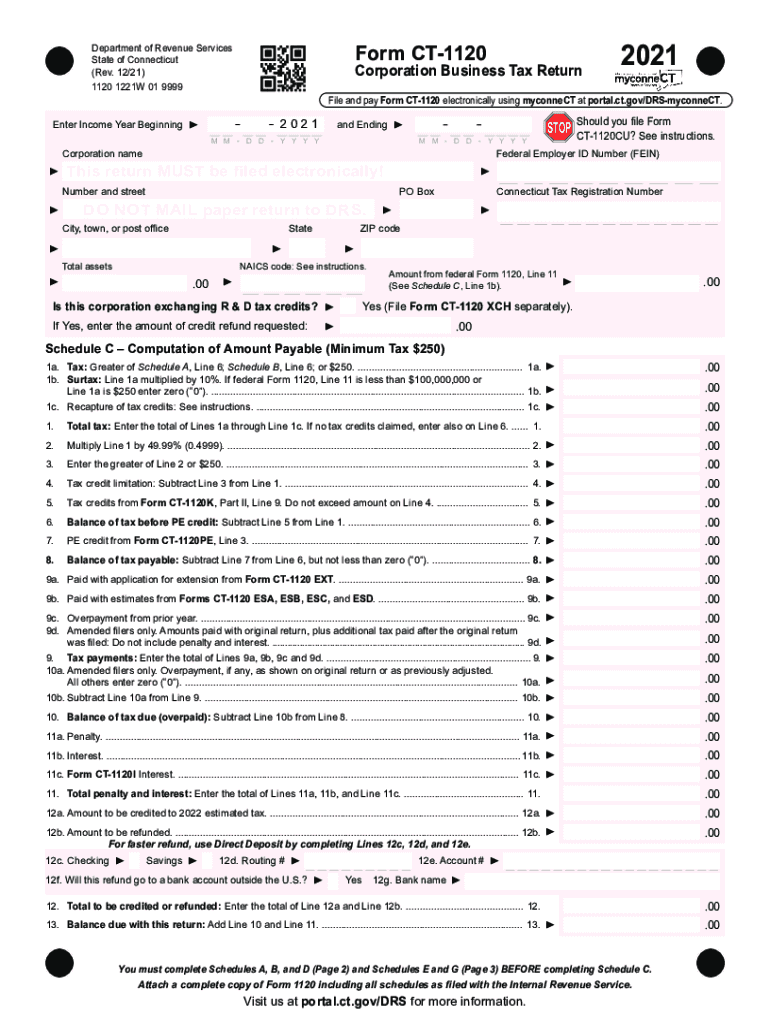

The DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM is a crucial document used by individuals and businesses to report financial information and comply with state tax regulations. This form is essential for ensuring accurate tax reporting and fulfilling legal obligations within the state of Connecticut. It may encompass various tax-related filings, including income tax, sales tax, and other revenue-related submissions mandated by the state government.

How to use the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

Using the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the official state website. Next, carefully read the instructions accompanying the form to understand the required information. Fill out the form completely, providing accurate details about your financial situation. Once completed, review the form for any errors before submission to avoid delays or penalties.

Steps to complete the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

Completing the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM requires a systematic approach. Begin by gathering all necessary documents, such as income statements, receipts, and previous tax returns. Follow these steps:

- Download the form from the official Connecticut Department of Revenue Services website.

- Read the instructions carefully to understand the information required.

- Fill in your personal and financial information accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

After completing the form, you can submit it according to the guidelines provided.

Legal use of the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

The legal use of the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM is governed by state tax laws and regulations. To ensure the form is legally binding, it must be filled out accurately and submitted on time. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the form retains its legal validity when submitted electronically.

Form Submission Methods

There are several methods available for submitting the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. You can choose from the following options:

- Online Submission: Many forms can be submitted electronically through the Connecticut Department of Revenue Services website.

- Mail: You can print the completed form and send it to the designated address provided in the instructions.

- In-Person: Some forms may also be submitted in person at local Department of Revenue Services offices.

Each submission method has specific guidelines and deadlines, so it is important to follow the instructions carefully to ensure timely processing.

Required Documents

When completing the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM, certain documents are typically required to support your submission. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Identification documents, if necessary.

Ensuring you have all required documents ready will facilitate a smoother completion and submission process.

Quick guide on how to complete department of revenue services state of connecticut form

Complete DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the resources required to create, alter, and eSign your documents swiftly without delays. Manage DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM effortlessly

- Find DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just moments and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services state of connecticut form

Create this form in 5 minutes!

People also ask

-

What is the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

The DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM is an official document required by the state for various tax-related purposes. It can be used for reporting income, claiming deductions, or other state revenue initiatives. Understanding how to properly fill this form is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help me with the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

AirSlate SignNow streamlines the process of preparing and submitting the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. Our platform allows you to eSign documents securely and share them with relevant parties quickly. This efficiency reduces errors and speeds up the submission process.

-

Is there a cost to use airSlate SignNow for the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

AirSlate SignNow offers a variety of affordable plans to suit your needs, including options for businesses that frequently work with the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. We provide a cost-effective solution without compromising on features, ensuring that you can manage documents efficiently.

-

What features does airSlate SignNow offer for managing the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

Our platform includes features such as customizable templates, real-time tracking, and secure eSigning specifically for documents like the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. These tools help you manage every aspect of document workflow, ensuring seamless collaboration and compliance.

-

Can I integrate airSlate SignNow with other software while using the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

Yes, airSlate SignNow offers integrations with popular business applications, enhancing your ability to work with the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. This interoperability allows you to connect with tools like CRMs, accounting software, and more, streamlining your overall workflow.

-

How secure is airSlate SignNow for handling the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM. We implement advanced encryption technologies and comply with stringent regulations to ensure your data remains safe and confidential.

-

What benefits can I expect from using airSlate SignNow for the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM?

By using airSlate SignNow for the DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM, you can expect faster processing times, reduced paperwork, and a seamless eSigning experience. This not only improves efficiency but also enhances compliance and accuracy in your document submissions.

Get more for DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

- Commercial contractor package north carolina form

- Excavation contractor package north carolina form

- Renovation contractor package north carolina form

- Concrete mason contractor package north carolina form

- Demolition contractor package north carolina form

- Security contractor package north carolina form

- Insulation contractor package north carolina form

- Paving contractor package north carolina form

Find out other DEPARTMENT OF REVENUE SERVICES STATE OF CONNECTICUT FORM

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement