Hawaii Department of Taxation Filing Amended Returns Form

What is the Hawaii Department of Taxation Filing Amended Returns Form

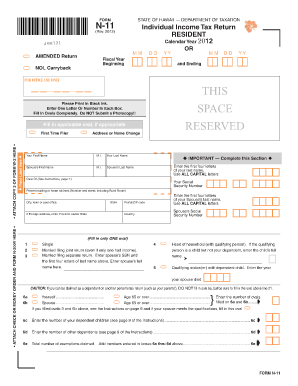

The Hawaii Department of Taxation Filing Amended Returns Form is a crucial document for taxpayers who need to correct errors or make changes to their previously submitted tax returns. This form allows individuals and businesses to adjust their income, deductions, or credits, ensuring that their tax filings are accurate and compliant with state regulations. It is important to note that filing an amended return can affect the tax liability, and taxpayers should carefully review their original return before making amendments.

How to obtain the Hawaii Department of Taxation Filing Amended Returns Form

Taxpayers can obtain the Hawaii Department of Taxation Filing Amended Returns Form through several methods. The form is available on the official Hawaii Department of Taxation website, where it can be downloaded and printed. Additionally, taxpayers may request a physical copy by contacting the department directly. It is advisable to ensure that the most current version of the form is used to avoid complications during the filing process.

Steps to complete the Hawaii Department of Taxation Filing Amended Returns Form

Completing the Hawaii Department of Taxation Filing Amended Returns Form involves several key steps:

- Gather all relevant documents, including the original tax return and any supporting documentation for the changes.

- Clearly indicate the changes being made on the form, providing detailed explanations where necessary.

- Calculate any adjustments to the tax liability, ensuring accuracy in figures.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate the submission.

Legal use of the Hawaii Department of Taxation Filing Amended Returns Form

The legal use of the Hawaii Department of Taxation Filing Amended Returns Form is governed by state tax laws. To ensure that the amended return is considered valid, it must be submitted within the appropriate timeframe, typically within three years of the original filing date. Additionally, the form must be signed by the taxpayer or an authorized representative to be legally binding. Adhering to these requirements helps prevent issues with tax compliance and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Department of Taxation Filing Amended Returns Form are critical for compliance. Generally, taxpayers must file their amended returns within three years from the original due date of the return. It is essential to stay informed about any specific deadlines that may apply, especially for taxpayers who are seeking refunds or who have made significant changes to their tax situation. Missing these deadlines can result in the inability to amend the return or claim any potential refunds.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Hawaii Department of Taxation Filing Amended Returns Form. The form can be submitted online through the Hawaii Department of Taxation's e-filing system, which offers a convenient and efficient way to file. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the department. In-person submissions are also possible at designated tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits the taxpayer's needs.

Quick guide on how to complete hawaii department of taxation filing amended returns form

Effortlessly Complete Hawaii Department Of Taxation Filing Amended Returns Form on Any Device

Digital document management has gained traction among companies and individuals. It serves as a superior eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and store them securely online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any holdups. Manage Hawaii Department Of Taxation Filing Amended Returns Form across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

How to Edit and eSign Hawaii Department Of Taxation Filing Amended Returns Form with Ease

- Obtain Hawaii Department Of Taxation Filing Amended Returns Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks on your preferred device. Edit and eSign Hawaii Department Of Taxation Filing Amended Returns Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii department of taxation filing amended returns form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hawaii amended tax return?

A Hawaii amended tax return is a document filed by individuals or businesses to correct errors on a previously submitted tax return. This process allows taxpayers to update their information, claim additional deductions, or address any mistakes related to their Hawaii tax filings. Utilizing software like airSlate SignNow can simplify the eSignature process for submitting these amendments.

-

How do I file a Hawaii amended tax return?

To file a Hawaii amended tax return, you need to complete Form N-101A, then submit it along with any pertinent documentation to the Hawaii Department of Taxation. AirSlate SignNow can facilitate the eSigning of these documents, making it easier to send them electronically. It's important to ensure all details are accurate before submission to avoid delays.

-

What are the benefits of using airSlate SignNow for Hawaii amended tax returns?

Using airSlate SignNow for Hawaii amended tax returns streamlines the process by allowing users to securely eSign and send documents online. This saves time and reduces the potential for errors in the submission process. Additionally, airSlate SignNow's user-friendly platform makes managing amendments straightforward and efficient.

-

Are there any fees associated with filing a Hawaii amended tax return?

While there is no specific fee for filing a Hawaii amended tax return itself, you may incur costs related to the services you use for preparation, or if you choose to file through tax software like airSlate SignNow. It's recommended to consult with a tax professional for detailed advice on fees. Utilizing an efficient eSigning service can also save you time and potentially money in the long run.

-

Can I track my Hawaii amended tax return status?

Yes, once you have filed your Hawaii amended tax return, you can track its status through the Hawaii Department of Taxation’s website. Keeping records of your submission through airSlate SignNow creates a reliable reference for tracking. Monitoring your return's status ensures you are informed about any updates or issues that may arise.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow provides a range of features beneficial for tax-related documents, such as secure eSigning, document management, templates, and cloud storage. These functionalities ensure that users can create, sign, and send their Hawaii amended tax returns efficiently. The platform’s integration capabilities also allow seamless collaboration with tax professionals.

-

Is airSlate SignNow suitable for businesses filing Hawaii amended tax returns?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses, making it an excellent choice for filing Hawaii amended tax returns. The platform enables teams to collaborate on document preparation and ensures compliance through secure eSigning. Businesses can also track their amendments effectively using the software.

Get more for Hawaii Department Of Taxation Filing Amended Returns Form

Find out other Hawaii Department Of Taxation Filing Amended Returns Form

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple