Az 5000 Form

What is the Az 5000 Form

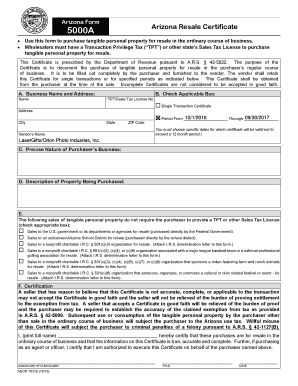

The Az 5000 form is a specific document used in the state of Arizona for various administrative purposes. It may be required for applications, compliance, or reporting, depending on the context. Understanding its purpose is essential for individuals and businesses to ensure they meet legal obligations. The form is often associated with regulatory requirements and may be used by different entities, including government agencies and private organizations.

How to use the Az 5000 Form

Using the Az 5000 form involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial information, or other specific data relevant to the form's purpose. Next, carefully complete each section of the form, ensuring that all information is accurate and up to date. After filling out the form, review it thoroughly for any errors or omissions before submitting it to the appropriate authority.

Steps to complete the Az 5000 Form

Completing the Az 5000 form can be streamlined by following these steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for completion.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for any errors or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Az 5000 Form

The legal use of the Az 5000 form is governed by specific regulations that ensure its validity. For a form to be legally binding, it must be completed in accordance with applicable laws and regulations. This includes providing accurate information and obtaining necessary signatures where required. Additionally, using a reliable electronic signature solution can enhance the legal standing of the form, ensuring compliance with electronic signature laws such as ESIGN and UETA.

Required Documents

When preparing to fill out the Az 5000 form, certain documents may be required to support the information provided. Commonly required documents include:

- Identification documents, such as a driver's license or social security card.

- Financial statements or tax documents, depending on the form's purpose.

- Any additional documentation specified in the form's instructions.

Form Submission Methods

The Az 5000 form can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a designated portal, which may offer a streamlined process.

- Mailing the completed form to the appropriate address, ensuring it is sent via a reliable service.

- In-person submission at designated offices or agencies, allowing for immediate confirmation of receipt.

Quick guide on how to complete az 5000 form

Effortlessly Manage Az 5000 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly solution to traditional paper documents, allowing you to find the necessary forms and securely store them online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage Az 5000 Form on any device with the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to Edit and Electronically Sign Az 5000 Form with Ease

- Find Az 5000 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information using the tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your document, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Az 5000 Form to ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az 5000 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az5000 and how does it benefit my business?

The az5000 is a powerful document management solution offered by airSlate SignNow, enabling users to send and eSign documents seamlessly. By incorporating az5000 into your workflow, you streamline processes, reduce turnaround times, and enhance overall efficiency for your business.

-

How much does the az5000 cost?

Pricing for the az5000 is competitive and designed to fit various business needs. We offer flexible subscription plans to ensure that you only pay for what you need, starting with the basic plan that provides essential features at an affordable rate.

-

What key features does the az5000 provide?

The az5000 includes features such as customizable templates, automated workflow, and real-time tracking of document statuses. Additionally, it supports multiple file formats and advanced security options to protect your sensitive documents, making it a comprehensive solution for any organization.

-

Is it easy to integrate az5000 with other applications?

Yes, the az5000 offers seamless integrations with various popular platforms such as Google Drive, Salesforce, and Microsoft Office. This interoperability ensures that you can enhance your existing workflows without disruption, making document management more streamlined and efficient.

-

How can the az5000 improve my document signing process?

With the az5000, you can signNowly accelerate the document signing process through its user-friendly interface and instant notifications. This not only improves customer satisfaction but also helps maintain a steady flow of operations, as documents can be signed electronically anytime, anywhere.

-

What support options are available for az5000 users?

airSlate SignNow provides comprehensive support for az5000 users, including 24/7 customer service, a detailed knowledge base, and community forums. Whether you have a question about features or need assistance with troubleshooting, our team is ready to help you maximize your use of the az5000.

-

Can I use az5000 for international transactions?

Absolutely! The az5000 is designed to support international transactions, allowing you to send and sign documents across borders with ease. Its robust security features comply with various international regulations, making it suitable for global business operations.

Get more for Az 5000 Form

- State board requirements excelsior college form

- Teamhealth physician services for facilities nationwide form

- Atrium health release of information form

- How to set up a power of attorney fidelityfaqs about beneficiary updates fidelityfaqs about beneficiary updates fidelity form

- Claim form generic hospital confinement use v08 08 19doc

- Prior authorization for anesthesia services form

- Querybrokerdic50txt at master lewismcquerybroker github form

- Faq usbank form

Find out other Az 5000 Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document