W 2T and 1099T Transmittal for Paper W 2 and 1099 Forms Otr Cfo Dc

Understanding the DC Form WT

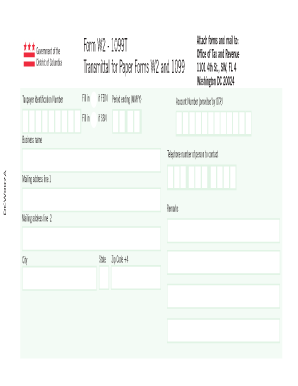

The DC Form WT, also known as the W-2T and 1099T transmittal for paper W-2 and 1099 forms, serves as a crucial document for businesses and individuals in the United States. This form is primarily used for reporting wage and tax information to the IRS. It consolidates data from W-2 and 1099 forms, ensuring that all necessary information is submitted accurately and efficiently. Understanding the purpose and requirements of this form is essential for compliance with federal tax laws.

Steps to Complete the DC Form WT

Completing the DC Form WT involves several key steps that ensure accuracy and compliance. Begin by gathering all necessary information from your W-2 and 1099 forms. This includes employee details, income amounts, and tax withholdings. Next, accurately fill out the form, ensuring that all entries match the information on the original documents. After completing the form, review it for any errors or omissions. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail, depending on your preference.

Legal Use of the DC Form WT

The DC Form WT is legally binding when filled out and submitted according to IRS guidelines. It is essential that the information provided is accurate and complete to avoid penalties. The form must be signed by an authorized individual, affirming that the information is true and correct. Compliance with federal regulations, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensures that electronic submissions are valid and enforceable.

Filing Deadlines for the DC Form WT

Filing deadlines for the DC Form WT are critical to avoid penalties. Typically, the form must be submitted to the IRS by the end of January for paper submissions. If filing electronically, the deadline may extend to early March. It is important to verify specific deadlines each tax year, as they can vary. Keeping track of these dates helps ensure timely compliance and reduces the risk of incurring fines.

Required Documents for the DC Form WT

To complete the DC Form WT, certain documents are necessary. You will need copies of all W-2 and 1099 forms that report income and tax withholdings. Additionally, having your Employer Identification Number (EIN) and any relevant state tax identification numbers will facilitate accurate completion. Collecting these documents beforehand streamlines the process and helps ensure that all required information is included.

Examples of Using the DC Form WT

Businesses often use the DC Form WT in various scenarios. For example, an employer may need to submit this form when reporting wages for multiple employees at the end of the tax year. Freelancers and contractors may also utilize the form to report income received from different clients. Understanding these use cases helps clarify the importance of accurate reporting and compliance with tax obligations.

Quick guide on how to complete w 2t and 1099t transmittal for paper w 2 and 1099 forms otr cfo dc

Complete W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc effortlessly on any device

Digital document management has become widespread among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your files swiftly without delays. Handle W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc with ease

- Locate W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc and click on Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 2t and 1099t transmittal for paper w 2 and 1099 forms otr cfo dc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc form wt and how can I use it with airSlate SignNow?

The dc form wt is a specific document format that can be easily integrated into airSlate SignNow for electronic signatures. With our platform, you can upload your dc form wt, customize it for your needs, and send it for eSigning in just a few clicks.

-

Are there any pricing plans for using dc form wt with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that allow you to use dc form wt efficiently. Depending on your business size and requirements, you can choose from our flexible subscription options that include features specifically designed for managing dc form wt.

-

What features does airSlate SignNow offer for managing dc form wt?

airSlate SignNow provides a range of features for managing dc form wt, including customizable templates, automated workflows, and real-time tracking of document status. These features streamline the eSigning process, ensuring that your dc form wt is completed promptly and securely.

-

How do I integrate dc form wt into my existing workflows with airSlate SignNow?

Integrating dc form wt into your workflows with airSlate SignNow is straightforward. You can easily upload your dc form wt to our platform, set up automated workflows, and connect with your existing tools and software for a seamless experience.

-

What are the benefits of using airSlate SignNow for dc form wt?

Using airSlate SignNow for your dc form wt offers numerous benefits, including enhanced security, reduced turnaround time, and improved document accuracy. Our platform ensures that your dc form wt is signed quickly, while providing a user-friendly experience for all parties involved.

-

Is there a mobile app for managing dc form wt with airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows users to manage dc form wt on the go. Whether you are sending or signing documents, our mobile app ensures you can handle your dc form wt conveniently from your smartphone or tablet.

-

Can multiple users collaborate on dc form wt using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on dc form wt effortlessly. Our platform enables easy sharing and real-time updates, ensuring that all stakeholders can participate in the signing process and stay informed.

Get more for W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc

- Pacra form

- Borang pa 2 13 form

- Pmkvy certificate download pdf form

- Cps application form 2021 pdf

- Bpl certificate format

- Medtronic plc mdt product pipeline analysis 2015 update market research report form

- Worksheet on safety rules for class 3 form

- How to contact us pennsylvania gaming control board form

Find out other W 2T And 1099T Transmittal For Paper W 2 And 1099 Forms Otr Cfo Dc

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free