Nj 1040 Form Printable 2021

What is the NJ 1040 Form Printable

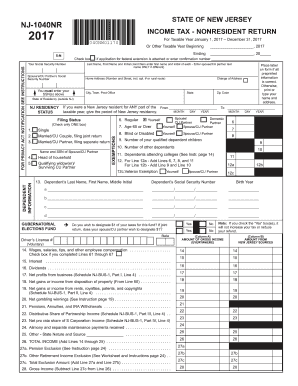

The NJ 1040 form is the official income tax return form used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for filing the New Jersey income tax return, allowing taxpayers to detail their earnings, claim deductions, and determine their tax obligations. The printable version of the NJ 1040 form is designed for those who prefer to complete their tax return on paper rather than electronically. It includes sections for personal information, income sources, deductions, and credits specific to New Jersey tax laws.

Steps to Complete the NJ 1040 Form Printable

Completing the NJ 1040 form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary documents, such as W-2s, 1099s, and any other income statements. Next, fill out your personal information, including your name, address, and Social Security number. Then, report your total income and any applicable deductions. It is crucial to review the instructions for each section carefully to avoid errors. After completing the form, double-check all entries for accuracy before submitting it.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NJ 1040 form is vital for avoiding penalties. Typically, the deadline for submitting your New Jersey income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but this does not extend the time to pay any taxes owed. It is important to mark these dates on your calendar to ensure timely filing.

Required Documents

When preparing to file your NJ 1040 form, certain documents are necessary to complete the process accurately. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the completion of your tax return and help ensure that you do not miss any important information.

Legal Use of the NJ 1040 Form Printable

The NJ 1040 form is legally binding when completed and submitted according to New Jersey state tax laws. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming that the information is correct to the best of their knowledge. Understanding the legal implications of the form can help taxpayers navigate their responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their NJ 1040 form. The form can be filed online through the New Jersey Division of Taxation’s website, which offers a convenient and secure method for submission. Alternatively, taxpayers can mail the completed form to the appropriate address provided in the instructions. In-person submissions may also be available at designated tax offices, although this option may vary based on location. Choosing the right submission method can help ensure that your return is processed efficiently.

Examples of Using the NJ 1040 Form Printable

There are various scenarios in which the NJ 1040 form may be used. For instance, a full-time employee would use the form to report their annual salary and claim any deductions for state taxes withheld. A self-employed individual would report their business income and expenses, calculating their taxable income accordingly. Additionally, nonresidents who earn income in New Jersey must also complete the NJ 1040 form to report their earnings and pay any applicable taxes. Understanding these examples can help clarify how the form applies to different taxpayer situations.

Quick guide on how to complete nj 1040 form printable

Prepare Nj 1040 Form Printable effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruptions. Handle Nj 1040 Form Printable on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The easiest method to modify and eSign Nj 1040 Form Printable without hassle

- Obtain Nj 1040 Form Printable and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invited link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you select. Modify and eSign Nj 1040 Form Printable and guarantee outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 form printable

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 form printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's solution for handling nj income tax documents?

airSlate SignNow provides a streamlined solution for managing nj income tax documents by allowing businesses to easily send, sign, and store these important documents electronically. Our platform is designed to simplify the eSigning process, ensuring compliance with NJ tax regulations while saving time and resources.

-

How does airSlate SignNow ensure the security of nj income tax forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect your nj income tax forms from unauthorized access, ensuring your sensitive financial information remains confidential throughout the signing process.

-

Is airSlate SignNow compliant with nj income tax requirements?

Yes, airSlate SignNow is fully compliant with nj income tax requirements. Our platform meets local regulations regarding digital signatures, making it a reliable choice for documenting nj income tax-related transactions safely and effectively.

-

Can I integrate airSlate SignNow with my tax preparation software?

Absolutely! airSlate SignNow offers seamless integrations with a variety of tax preparation software, enhancing your workflow for managing nj income tax. This ensures that you can easily handle your documents without switching between multiple platforms.

-

What pricing options are available for airSlate SignNow users dealing with nj income tax?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including options for those specifically dealing with nj income tax. You can choose from monthly or yearly subscriptions, ensuring you find a cost-effective solution that fits your budget.

-

Are mobile features available to manage nj income tax signing?

Yes, airSlate SignNow provides robust mobile features that allow you to manage nj income tax signing on-the-go. Whether you're accessing documents from your smartphone or tablet, our app ensures you can conveniently sign and send documents from anywhere.

-

What are the benefits of using airSlate SignNow for nj income tax documents?

Using airSlate SignNow for nj income tax documents brings numerous benefits, including faster processing times, reduced paperwork, and enhanced organization. By digitizing your document management, you can ensure a more efficient and eco-friendly approach to handling your tax responsibilities.

Get more for Nj 1040 Form Printable

- Negative and zero exponents worksheet answers form

- Application for residence permit to settle in sweden form

- Write wh questions for the statements below form

- Bahamas c7 form

- Form 1028 employment verification

- Centerlight prior authorization request form 82755918

- Medicaid waiver form women39s medical center of meridian

- Beschreibung des gebudestandards form

Find out other Nj 1040 Form Printable

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF