Homestead Declaration Spouses as Declared Owners Form 2008

What is the Homestead Declaration Spouses As Declared Owners Form

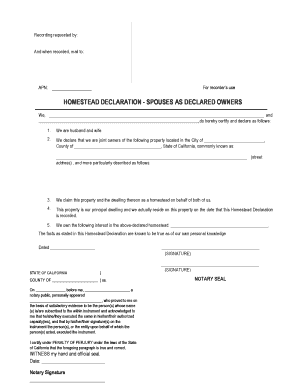

The Homestead Declaration Spouses As Declared Owners Form is a legal document that allows married couples to declare their ownership of a homestead property. This form is essential for couples who wish to protect their home from certain creditors and ensure that their property benefits from homestead exemptions. By filing this form, spouses can establish their rights and responsibilities regarding the property, which may be beneficial in various legal and financial situations.

How to use the Homestead Declaration Spouses As Declared Owners Form

Using the Homestead Declaration Spouses As Declared Owners Form involves several key steps. First, both spouses must complete the form accurately, providing necessary details such as their names, the property address, and the nature of their ownership. Once filled out, the form must be signed by both parties in the presence of a notary public to ensure its validity. After notarization, the completed form should be filed with the appropriate county office, typically the county clerk or assessor’s office, to officially record the declaration.

Steps to complete the Homestead Declaration Spouses As Declared Owners Form

Completing the Homestead Declaration Spouses As Declared Owners Form requires careful attention to detail. Follow these steps:

- Obtain the form from your local county office or online resources.

- Fill in the required information, including both spouses' names and the property address.

- Review the form for accuracy and completeness.

- Sign the form in the presence of a notary public.

- File the notarized form with the county clerk or assessor's office.

Key elements of the Homestead Declaration Spouses As Declared Owners Form

Several key elements must be included in the Homestead Declaration Spouses As Declared Owners Form. These include:

- The full names of both spouses.

- The legal description of the property.

- Statement of ownership indicating that both spouses are declared owners.

- Signatures of both spouses, along with the date of signing.

- Notary public acknowledgment to validate the signatures.

Legal use of the Homestead Declaration Spouses As Declared Owners Form

The legal use of the Homestead Declaration Spouses As Declared Owners Form is significant in protecting a couple's home from certain types of creditors. By filing this form, couples can assert their rights to the property, which may provide exemptions from property taxes and protection against forced sale in some states. It is crucial to ensure that the form is completed correctly and filed in accordance with state laws to maintain its legal standing.

Eligibility Criteria

To be eligible to use the Homestead Declaration Spouses As Declared Owners Form, both individuals must be legally married and jointly own the property in question. Additionally, the property must qualify as a homestead under state law, which typically includes requirements such as the property being the primary residence of the couple. Understanding these criteria is essential for ensuring that the form is applicable and legally binding.

Quick guide on how to complete homestead declaration spouses as declared owners form

Complete Homestead Declaration Spouses As Declared Owners Form effortlessly on any device

Online document management has gained signNow traction among organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly and without delays. Handle Homestead Declaration Spouses As Declared Owners Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Homestead Declaration Spouses As Declared Owners Form with ease

- Locate Homestead Declaration Spouses As Declared Owners Form and click Get Form to begin.

- Make use of the features we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign Homestead Declaration Spouses As Declared Owners Form and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead declaration spouses as declared owners form

Create this form in 5 minutes!

How to create an eSignature for the homestead declaration spouses as declared owners form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Homestead Declaration Spouses As Declared Owners Form?

The Homestead Declaration Spouses As Declared Owners Form is a legal document that enables married couples to declare their property as a homestead. This form helps ensure that the property benefits from specific legal protections, such as exemptions from creditors. It's an essential step for couples looking to secure their home and financial future.

-

How can airSlate SignNow streamline the process of completing the Homestead Declaration Spouses As Declared Owners Form?

AirSlate SignNow simplifies the process of completing the Homestead Declaration Spouses As Declared Owners Form by providing an intuitive eSigning platform. Users can easily fill out, sign, and send documents securely from any device. This efficiency helps couples finalize their homestead declaration without any hassle.

-

Are there any fees associated with using the Homestead Declaration Spouses As Declared Owners Form on airSlate SignNow?

Yes, airSlate SignNow offers a variety of pricing plans based on your needs, all of which are designed to be cost-effective. By choosing a plan, users gain access to unlimited eSignatures, document storage, and advanced features for managing the Homestead Declaration Spouses As Declared Owners Form. You can find detailed pricing information on our website.

-

What features does airSlate SignNow provide for the Homestead Declaration Spouses As Declared Owners Form?

AirSlate SignNow provides essential features including template creation, automated workflows, and real-time tracking of document status for the Homestead Declaration Spouses As Declared Owners Form. Additionally, users can invite multiple signers and customize the document as needed. These features enhance the user experience and ensure timely completion.

-

Can I use airSlate SignNow to store my completed Homestead Declaration Spouses As Declared Owners Form securely?

Absolutely! AirSlate SignNow offers secure cloud storage for all your completed documents, including the Homestead Declaration Spouses As Declared Owners Form. You can easily access, manage, and retrieve your documents at any time, ensuring that your important paperwork is always safe and organized.

-

Is it possible to integrate airSlate SignNow with other software for the Homestead Declaration Spouses As Declared Owners Form?

Yes, airSlate SignNow supports numerous integrations with popular business tools such as Google Drive, Dropbox, and Salesforce. This flexibility allows users to seamlessly work with the Homestead Declaration Spouses As Declared Owners Form across different platforms, enhancing productivity and workflow efficiency.

-

What are the benefits of using airSlate SignNow for my Homestead Declaration Spouses As Declared Owners Form?

Using airSlate SignNow for your Homestead Declaration Spouses As Declared Owners Form offers numerous benefits, including a user-friendly interface, cost-effectiveness, and enhanced security features. Additionally, the ability to eSign documents from any device streamlines the process, making it faster and more convenient for couples to complete their homestead declaration.

Get more for Homestead Declaration Spouses As Declared Owners Form

- Virginia workers compensation form

- Bill of sale of automobile and odometer statement virginia form

- Bill of sale for automobile or vehicle including odometer statement and promissory note virginia form

- Promissory note in connection with sale of vehicle or automobile virginia form

- Virginia bill sale form

- Bill of sale of automobile and odometer statement for as is sale virginia form

- Injuries workers compensation form

- Va workers compensation form

Find out other Homestead Declaration Spouses As Declared Owners Form

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure