Exemption Business Tax 2000

What is the Exemption Business Tax

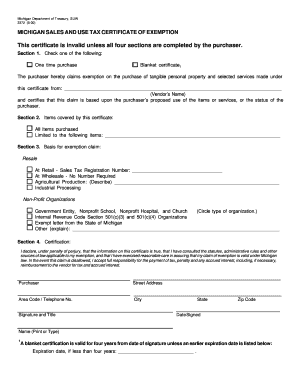

The exemption business tax is a specific tax relief measure that allows eligible businesses to avoid paying sales tax on certain purchases. This form is particularly relevant for businesses that qualify under specific criteria, such as those engaged in manufacturing, research and development, or other exempt activities. Understanding the parameters of this tax exemption can help businesses optimize their expenses and comply with state tax regulations.

How to use the Exemption Business Tax

Using the exemption business tax involves applying for the exemption and ensuring that all purchases made under this status are documented correctly. Businesses must fill out the application tax form accurately, providing necessary details about their operations and the nature of their purchases. Once approved, businesses can present the exemption certificate to suppliers at the time of purchase, ensuring that sales tax is not added to qualifying transactions.

Steps to complete the Exemption Business Tax

Completing the exemption business tax form requires several steps to ensure accuracy and compliance. First, gather all necessary documentation, including your business license and any relevant financial statements. Next, fill out the application tax form, ensuring that all fields are completed with precise information. After submission, monitor the application status and be prepared to provide additional information if requested by tax authorities. Once approved, retain a copy of the exemption certificate for your records.

Key elements of the Exemption Business Tax

Key elements of the exemption business tax include eligibility criteria, the types of purchases that qualify for exemption, and the documentation required for both the application and ongoing compliance. Businesses must demonstrate that their operations fall within the categories outlined by state tax laws. Additionally, maintaining accurate records of exempt purchases is essential to avoid potential penalties during audits.

IRS Guidelines

The IRS provides guidelines that govern the use of exemption business tax forms, ensuring that businesses understand their responsibilities. These guidelines outline the types of businesses that may qualify for exemptions and the documentation required to substantiate claims. Adhering to these guidelines helps businesses stay compliant with federal tax regulations while maximizing their tax benefits.

Eligibility Criteria

Eligibility for the exemption business tax varies by state but generally includes businesses engaged in manufacturing, research and development, and certain types of non-profit organizations. To qualify, businesses must demonstrate that their activities align with the criteria set forth by state tax authorities. This often requires providing detailed information about the nature of the business and the intended use of purchased items.

Form Submission Methods (Online / Mail / In-Person)

Submitting the exemption business tax form can typically be done through various methods, including online, by mail, or in person. Many states offer online submission options that streamline the application process, allowing for quicker processing times. For those who prefer traditional methods, mailing the completed form or delivering it in person to the appropriate tax office are also viable options. Each method has its own set of requirements and processing times, so businesses should choose the one that best fits their needs.

Quick guide on how to complete exemption business tax

Effortlessly Prepare Exemption Business Tax on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Exemption Business Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

Effortlessly Edit and Electronically Sign Exemption Business Tax

- Obtain Exemption Business Tax and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Exemption Business Tax and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exemption business tax

Create this form in 5 minutes!

How to create an eSignature for the exemption business tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of application tax in document signing processes?

Application tax refers to the cost associated with submitting tax-related documents electronically. With airSlate SignNow, you can streamline your document signing process and handle application tax submissions quickly, ensuring compliance and reducing the risk of delays or penalties.

-

How does airSlate SignNow simplify managing application tax documents?

airSlate SignNow simplifies managing application tax documents by providing an intuitive platform for eSigning and document management. You can easily customize templates for application tax forms and track their status in real-time, making the overall process more efficient.

-

What are the pricing options for using airSlate SignNow for application tax?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for handling application tax efficiently. Our plans are cost-effective and designed to provide robust features for seamless document signing and tax submissions, ensuring businesses can choose a suitable option.

-

Are there any special features for application tax submissions?

Yes, airSlate SignNow includes specialized features for application tax submissions such as secure document storage, multi-party signing, and optional audit trails. These features ensure that your application tax forms are signed, stored, and verified correctly, providing peace of mind.

-

Can I integrate airSlate SignNow with other tax software for application tax?

Absolutely! airSlate SignNow integrates seamlessly with various tax software applications, enhancing your ability to manage your application tax needs. This integration streamlines the process of sending and signing tax documents, allowing you to work more efficiently.

-

How does airSlate SignNow ensure the security of application tax documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your application tax documents during transmission and storage, ensuring that sensitive information remains confidential and secure.

-

What advantages does airSlate SignNow provide for small businesses dealing with application tax?

Small businesses benefit greatly from using airSlate SignNow for application tax as it offers a cost-effective solution to streamline their document signing needs. The user-friendly interface allows small business owners to manage application tax submissions without needing extensive training or resources.

Get more for Exemption Business Tax

- Warranty deed from husband and wife to llc virginia form

- Satisfaction judgment court 497428072 form

- Virginia mechanic lien form

- Letter landlord notice 497428075 form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises virginia form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497428077 form

- Virginia tenant notice form

- Letter from tenant to landlord containing notice that doors are broken and demand repair virginia form

Find out other Exemption Business Tax

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form