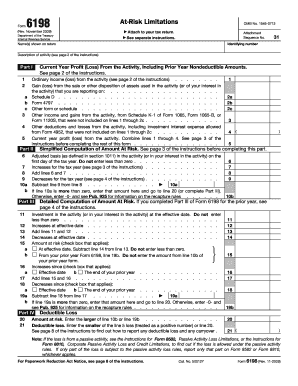

Form 6198 Example 2009

What is Form 6198?

Form 6198, officially known as the IRS Form 6198, is used to report the income and expenses of a business that operates at a loss. This form is particularly relevant for taxpayers who are involved in activities classified as hobbies or those that do not meet the IRS's criteria for a profit motive. Understanding Form 6198 is essential for accurately reporting income and ensuring compliance with tax regulations.

Steps to Complete Form 6198

Completing Form 6198 involves several key steps:

- Gather necessary documentation, including records of income and expenses related to the business activity.

- Begin filling out the form by entering your personal information, such as your name and Social Security number.

- Report the income generated from the business activity in the appropriate section of the form.

- Detail the expenses incurred, ensuring to categorize them correctly according to IRS guidelines.

- Calculate the net income or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal Use of Form 6198

Form 6198 serves a legal purpose in the context of tax reporting. It is essential to ensure that the form is filled out accurately to avoid potential penalties from the IRS. The form must be submitted with your tax return if you are claiming a loss from a business activity. Adhering to IRS guidelines while completing the form helps maintain compliance and protects against audits or disputes.

IRS Guidelines for Form 6198

The IRS provides specific guidelines for completing Form 6198. Taxpayers must ensure they understand the definitions of business activities versus hobbies, as this distinction affects eligibility for deducting losses. The IRS also outlines the types of expenses that can be claimed, which must be ordinary and necessary for the business. Familiarizing yourself with these guidelines is crucial for accurate reporting.

Examples of Using Form 6198

Form 6198 can be applied in various scenarios. For instance, if a taxpayer operates a small business that incurs more expenses than income, they can use this form to report the loss. Additionally, individuals engaged in hobbies that generate some income may also utilize Form 6198 to report their financial activities correctly. Each example highlights the importance of accurately categorizing income and expenses.

Filing Deadlines for Form 6198

Timely submission of Form 6198 is critical. The form must be filed by the tax return deadline, which is typically April 15 for individuals. If you require an extension for your tax return, it is essential to also extend the filing of Form 6198. Staying aware of these deadlines helps avoid late fees and ensures compliance with IRS regulations.

Quick guide on how to complete form 6198 example

Easily Prepare Form 6198 Example on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 6198 Example on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Edit and Electronically Sign Form 6198 Example

- Obtain Form 6198 Example and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow specially provides for that purpose.

- Create your electronic signature with the Sign tool, which takes only moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Form 6198 Example and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6198 example

Create this form in 5 minutes!

How to create an eSignature for the form 6198 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 6198 instructions and why are they important?

Form 6198 instructions provide critical guidance on how to accurately report and calculate the deduction for expenses related to rental real estate. Following these instructions ensures compliance with tax laws and maximizes your potential deductions, making them essential for property owners and real estate professionals.

-

How can airSlate SignNow assist with the completion of form 6198?

airSlate SignNow streamlines the process of completing form 6198 by providing an easy-to-use platform for filling out and eSigning documents. You can collaborate with team members in real-time, ensuring that all information is accurate and compliant with the necessary form 6198 instructions.

-

Is there a cost associated with using airSlate SignNow for form 6198?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to features that facilitate the efficient handling of documents, including support for completing complex forms like the form 6198 instructions.

-

What features does airSlate SignNow offer that are relevant to form 6198 instructions?

airSlate SignNow offers features such as customizable templates, document tracking, and automated workflows, all of which simplify the preparation of form 6198 instructions. These tools help ensure that you can easily follow the necessary steps for accurate completion and submission.

-

Can airSlate SignNow integrate with other software to manage form 6198?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, enabling users to manage form 6198 alongside their other financial documentation. This integration ensures a cohesive workflow that adheres to the form 6198 instructions without redundancies.

-

What are the benefits of using airSlate SignNow for eSigning form 6198?

Using airSlate SignNow for eSigning form 6198 provides a fast and secure way to finalize documents. As an authority on form 6198 instructions, Signature ensures that all parties can sign from anywhere, streamlining the approval process and reducing paperwork delays.

-

How does airSlate SignNow ensure compliance with form 6198 instructions?

airSlate SignNow incorporates features that help users remain compliant with all necessary regulations while completing form 6198. Our platform is continuously updated with the latest legal requirements and best practices, ensuring accurate documentation every time.

Get more for Form 6198 Example

- Subpoena form ds 2000p 2007

- Calif dmv printable forms application for duplicate or paperless title 2012

- Government requestor account instructionsapplications 2011 form

- Inf 1133 commercial requester account instructionsapplication intellicorp form

- Inv 172a rev dmv ca form

- Bmv wooster power of attorney form 2004

- Form 362 chp 1999

- Department of california highway patrol application for terminal inspection 2007 form

Find out other Form 6198 Example

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later