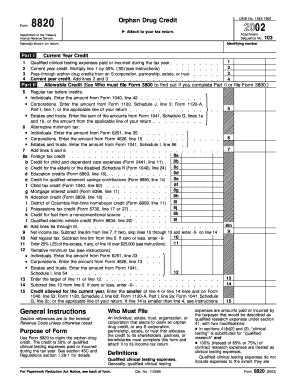

Form 8820 2002

What is the Form 8820

The Form 8820, also known as the IRS 8820 form, is utilized by taxpayers to claim a credit for the federal tax on certain fuels. This form is particularly relevant for individuals and businesses that use specific types of fuel in their operations. The IRS 8820 form allows eligible taxpayers to report their fuel usage and claim credits accordingly, which can lead to significant tax savings. Understanding the purpose and requirements of the form is essential for accurate filing and compliance with IRS regulations.

How to use the Form 8820

Using the Form 8820 involves several steps to ensure that the information provided is accurate and complete. Taxpayers should first gather all necessary documentation regarding their fuel usage, including receipts and invoices. Next, they will need to fill out the form by providing details such as the type of fuel used, the quantity, and the purpose of use. After completing the form, it must be submitted to the IRS along with any required supporting documents. It is crucial to review the form for accuracy before submission to avoid potential delays or penalties.

Steps to complete the Form 8820

Completing the Form 8820 involves a systematic approach to ensure all required information is accurately reported. Here are the key steps:

- Gather necessary documents, including fuel purchase receipts and usage records.

- Provide personal or business information at the top of the form, including your name, address, and taxpayer identification number.

- Detail the type and quantity of fuel used in the appropriate sections of the form.

- Calculate the credit amount based on the fuel usage and applicable IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Legal use of the Form 8820

The legal use of the Form 8820 is governed by IRS regulations, which stipulate that taxpayers must accurately report their fuel usage to claim credits. To ensure compliance, it is important to maintain thorough records of fuel purchases and usage. The form must be filled out truthfully, as any discrepancies or false information can result in penalties. Additionally, taxpayers should be aware of the specific eligibility criteria and guidelines set forth by the IRS to avoid issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8820 are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by the due date of the tax return for the year in which the fuel was used. Taxpayers should also be aware of any extensions that may apply to their specific situation. Keeping track of these important dates helps ensure that all necessary forms are filed timely, allowing for the proper processing of any claimed credits.

Form Submission Methods (Online / Mail / In-Person)

The Form 8820 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Taxpayers can file electronically through approved e-filing software that supports IRS forms.

- Mail: The completed form can be printed and mailed to the appropriate IRS address specified in the form instructions.

- In-Person: While less common, some taxpayers may choose to deliver their forms directly to a local IRS office.

Choosing the right submission method can help ensure that the form is processed efficiently and securely.

Quick guide on how to complete form 8820

Complete Form 8820 effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Handle Form 8820 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The simplest method to modify and eSign Form 8820 effortlessly

- Obtain Form 8820 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 8820 and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8820

Create this form in 5 minutes!

How to create an eSignature for the form 8820

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8820 and how can airSlate SignNow help with it?

Form 8820 is used to report the income and expenses related to a rental real estate activity. With airSlate SignNow, you can easily eSign and manage Form 8820 electronically, making the process streamlined and efficient for business owners.

-

How can I ensure my Form 8820 is secure when using airSlate SignNow?

AirSlate SignNow uses industry-leading security measures, including encryption and secure storage, to protect your Form 8820. This ensures that your documents remain confidential and secure while being signed and stored.

-

What features does airSlate SignNow offer for managing Form 8820?

AirSlate SignNow provides features like customizable templates, audit trails, and real-time tracking for Form 8820. These tools help streamline the eSigning process and ensure all necessary steps are completed accurately.

-

Is there a free trial available for using airSlate SignNow with Form 8820?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including those for managing Form 8820. This enables you to evaluate if it meets your specific needs before committing to a subscription.

-

Are there any integration options for airSlate SignNow with other platforms related to Form 8820?

AirSlate SignNow offers integrations with various platforms such as Google Drive and Dropbox, which can help manage files related to Form 8820 more efficiently. Integrating these tools enhances your workflow and document management.

-

What are the pricing options for using airSlate SignNow for Form 8820?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes and requirements. You can choose a plan that fits your needs best while ensuring efficient management of Form 8820.

-

Can I track who has signed my Form 8820 using airSlate SignNow?

Yes, airSlate SignNow provides a feature that allows you to track the signing status of your Form 8820. This ensures that you are always informed about each signer's progress.

Get more for Form 8820

Find out other Form 8820

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure