Chessiecreditunion Form

What is the Chessie Federal Credit Union?

The Chessie Federal Credit Union, often referred to as ChessieFCU, is a member-focused financial institution serving individuals and families primarily in the United States. It offers a range of financial products and services, including savings accounts, loans, and digital banking options. As a credit union, it operates on a not-for-profit basis, aiming to provide favorable rates and lower fees to its members compared to traditional banks.

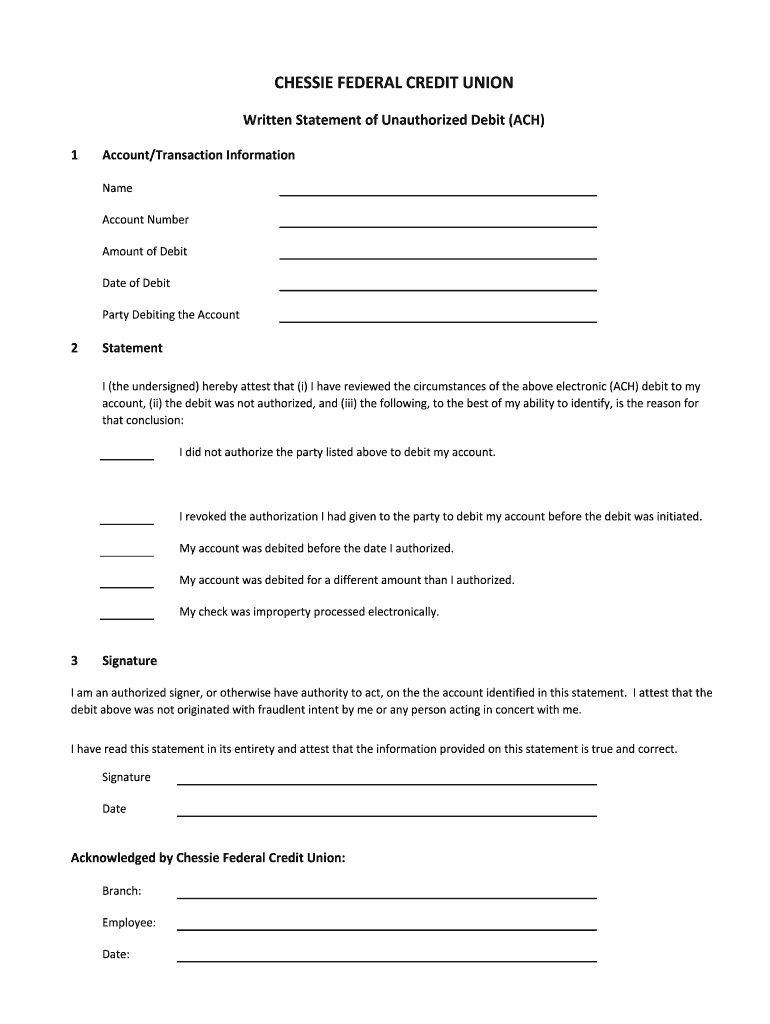

Steps to Complete the Chessie Unauthorized ACH Form

Completing the Chessie unauthorized ACH form involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary personal information, including your account number and identification details. Next, access the form through the Chessie Federal Credit Union's online banking portal. Fill in the required fields, ensuring that all information is correct. After completing the form, review it for any errors before submitting it electronically. Finally, retain a copy of the submitted form for your records.

Legal Use of the Chessie Unauthorized ACH

Using the Chessie unauthorized ACH form legally requires adherence to specific regulations governing electronic transactions. The form must comply with the Electronic Fund Transfer Act (EFTA) and other relevant federal and state laws. It is essential to ensure that you have the proper authorization to initiate ACH transfers, as unauthorized transactions can lead to penalties and disputes. Always verify that you understand the terms and conditions associated with ACH transactions through Chessie Federal Credit Union.

Key Elements of the Chessie Unauthorized ACH Form

The Chessie unauthorized ACH form includes several key elements that must be accurately completed to ensure proper processing. These elements typically include your name, account number, the type of transaction being authorized, and any specific instructions regarding the transfer. Additionally, the form may require your signature to confirm your consent for the transaction. Understanding these components is crucial for a smooth transaction process.

Examples of Using the Chessie Unauthorized ACH

There are various scenarios where the Chessie unauthorized ACH form may be utilized. For instance, a member may need to set up automatic payments for recurring bills, such as utilities or loan repayments. Another example includes authorizing a one-time transfer to another bank account. Each use case highlights the flexibility of ACH transactions in managing personal finances efficiently and securely.

Form Submission Methods

The Chessie unauthorized ACH form can be submitted through multiple methods to accommodate members' preferences. The primary method is online submission via the Chessie Federal Credit Union's secure online banking platform. Members can also choose to print the form and submit it by mail or deliver it in person to a local branch. Each submission method ensures that the form is processed in a timely manner, providing members with various options based on their convenience.

Quick guide on how to complete chessie federal credit union chessiefcu

The simplest method to locate and authorize Chessiecreditunion

Across the entirety of your organization, ineffective procedures involving paper approvals can take up considerable working hours. Signing documents such as Chessiecreditunion is a routine aspect of operations across all sectors, which is why the efficacy of each agreement’s timeline signNowly impacts the overall performance of the business. With airSlate SignNow, signing your Chessiecreditunion is as straightforward and rapid as possible. You’ll discover on this platform the latest version of nearly any document. Even better, you can sign it immediately without needing to install external software on your computer or printing out physical copies.

Steps to obtain and sign your Chessiecreditunion

- Browse our library by category or utilize the search box to find the document you require.

- View the document preview by clicking on Learn more to ensure it’s the correct one.

- Select Get form to start editing right away.

- Fill out your document and include any necessary details using the toolbar.

- Once completed, click the Sign tool to authorize your Chessiecreditunion.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Hit Done to finish editing and move on to sharing options as required.

With airSlate SignNow, you possess everything needed to effectively handle your documents. You can locate, complete, modify, and even send your Chessiecreditunion within a single tab effortlessly. Enhance your procedures by employing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Where do you find forms for a federal inmate to fill out for a presidential pardon?

The forms are available on the DOJ website. Pardon Information and InstructionsBe aware that this is not an easy process and you will have to explain why you believe a person is entitled to receive the pardon.Also be aware that the pardon relates to foreviveness for the crimes comitted. If the person denies that they committed the crime that they have been convicted of, they cannot seek a pardon. By receiving a pardon, it will include an acknowledgment of guilt, but that it has been forgiven.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How would it play out if part of a state tried to secede to form another state of the Union?

Article 4, Section 3 of the Constitution states:New States may be admitted by the Congress into this Union; but no new State shall be formed or erected within the Jurisdiction of any other State; nor any State be formed by the Junction of two or more States, or Parts of States, without the Consent of the Legislatures of the States concerned as well as of the Congress.This is really not feasible without direct assent from the state being separated from. Both Maine and Kentucky split based on the assent of Massachusetts and Virginia under the Constitution.West Virginia was a wartime ploy, an act that held up due to the acceptance as fact that enough representatives of the state of Virginia showed up at the Wheeling Conventions to justify a state legislature. Lincoln and Congress accepted it, and in 1863, West Virginia was accepted as a state separate from Virginia. In peacetime, this arrangement would never have worked.To get the obstinate California legislature to go along with the notion of several of their prosperous counties just leave is just impossible.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How is a CD account (an account you set up at a federal credit union) different from a savings or checking out at a bank, and does money put into a CD account get reported to Social Security?

By CD account I assume you mean Certificate of Deposit. Federal credit unions are not the only places that offer them. State and federal banks do, also.Certificate Of Deposit - CDA CD is a “savings security” with a fixed maturity date. In other words, one “buys” a CD with a maturity date of - 1 year, 2 years, or more. The agreement that one is making with a bank in obtaining a CD is that the money will remain in the CD until the maturity date, and if the money is taken out before the maturity date there will be a penalty - perhaps one month’s interest, for example, on a one-year CD. The total amount of the CD, including any interest earned, must be withdrawn - cancelling the CD. In return for allowing the bank or credit union to “hold onto” all of that money for 1, 2, or more years, the bank/credit union will pay you perhaps 2% interest on that money - available when the CD matures.A savings account is an interest-paying account at a bank (or credit union) with little or no penalties for withdrawal of any part of the balance in the account. So, if you have $2,000 in a savings account you can withdraw $100, or even the entire $2,000, plus interest. But if you leave just a few dollars in the savings account, it remains open. Back in to good ol’ days, savings accounts paid about 5% in annual interest (and in the hyperinflation days of J Carter’s administration it was sometimes three times or more than that amount). Nowadays, interest on a savings account can be zero, and sometimes as high as 7 hundredths of a percent (.0007) on the principal. You’re almost (and sometimes are) paying the bank for the privilege of keeping your money there. Still, it’s safer than sticking it under your mattress.Any interest that is earned on your deposited money is reported to the IRS (Internal Revenue Service). Social Security Admin. would obtain such information from the IRS. (well, the IRS would know how much you received from SSI and any bank). Your total income, when you are receiving Social Security payments, will never be less than what you presently receive exclusively from Social Security. In other words, if you receive $15,000 per year in SSI payments, no matter how much more you receive in investment income or salary payments, your annual income - even if you have to “repay” some of the SSI payments - will never be less than the SSI payment alone.I want to emphasize that last sentence, because I’ve met young-ish widows and retired people who are afraid to earn more than a pittance at a part-time job because they are afraid that they will “lose” income if they make more than the “maximum you can earn” provision of Social Security. The US government isn’t particularly generous to its poorest citizens, but it doesn’t penalize its retirees and widows by reducing the bare minimum income provided by Social Security.

Create this form in 5 minutes!

How to create an eSignature for the chessie federal credit union chessiefcu

How to make an electronic signature for the Chessie Federal Credit Union Chessiefcu in the online mode

How to make an eSignature for your Chessie Federal Credit Union Chessiefcu in Chrome

How to generate an electronic signature for putting it on the Chessie Federal Credit Union Chessiefcu in Gmail

How to make an eSignature for the Chessie Federal Credit Union Chessiefcu right from your mobile device

How to make an eSignature for the Chessie Federal Credit Union Chessiefcu on iOS

How to make an eSignature for the Chessie Federal Credit Union Chessiefcu on Android OS

People also ask

-

What is chessiefcu and how does it relate to airSlate SignNow?

Chessiefcu is a financial institution that, like many businesses, can benefit from using airSlate SignNow for secure document signing. By integrating chessiefcu with airSlate SignNow, you can streamline the process of sending and signing important financial documents, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer to chessiefcu users?

AirSlate SignNow offers a variety of features tailored for chessiefcu users, including customizable templates, secure eSigning, and document tracking. These features help enhance workflows and improve the overall user experience when managing financial documents.

-

How much does airSlate SignNow cost for chessiefcu customers?

The pricing for airSlate SignNow varies based on the plan selected and the number of users. Chessiefcu customers can choose from different tiers, which offer various features tailored to meet the needs of their operations, ensuring cost-effectiveness.

-

Is airSlate SignNow secure for chessiefcu transactions?

Yes, airSlate SignNow is designed with advanced security measures to protect sensitive information, making it suitable for chessiefcu transactions. All documents are encrypted, and access is restricted to authorized users, ensuring compliance with regulatory standards.

-

Can chessiefcu integrate airSlate SignNow with other software?

Absolutely! AirSlate SignNow offers seamless integrations with various software platforms, making it easy for chessiefcu to incorporate eSigning into existing systems. This enhances productivity and allows for a smoother workflow across departments.

-

What are the benefits of using airSlate SignNow for chessiefcu?

Using airSlate SignNow provides chessiefcu with numerous benefits, including faster turnaround times for document signing and improved accuracy through digital processes. This leads to better customer satisfaction and operational efficiency.

-

How can chessiefcu customers get support for airSlate SignNow?

Chessiefcu customers can access dedicated support for airSlate SignNow through various channels, including email, phone, and live chat. Comprehensive resources, such as tutorials and FAQs, are also available to assist users in navigating the platform.

Get more for Chessiecreditunion

Find out other Chessiecreditunion

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free