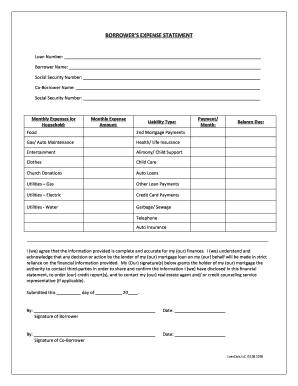

BORROWERS EXPENSE STATEMENT Form

What is the borrowers expense statement?

The borrowers expense statement is a crucial document used primarily in the lending process. It outlines the financial obligations and expenses of a borrower, providing lenders with a comprehensive view of the borrower's financial situation. This statement typically includes details such as income, debts, and other financial commitments, allowing lenders to assess the borrower's ability to repay a loan. Understanding this document is essential for both borrowers and lenders to facilitate a transparent and efficient lending process.

How to use the borrowers expense statement

Using the borrowers expense statement involves several steps. First, borrowers need to gather all relevant financial information, including income sources, monthly expenses, and existing debts. This information should be organized clearly to present a complete picture of financial health. Once compiled, the statement can be filled out accurately, ensuring all entries reflect the borrower's current financial status. Lenders will use this document to evaluate loan applications and determine eligibility for financing options.

Steps to complete the borrowers expense statement

Completing the borrowers expense statement requires careful attention to detail. Here are the essential steps:

- Gather financial documents: Collect pay stubs, bank statements, and other relevant financial records.

- List income sources: Clearly outline all income streams, including salary, bonuses, and any additional earnings.

- Detail expenses: Include all monthly expenses such as rent, utilities, and loan payments.

- Summarize debts: Provide information on any outstanding debts, including credit cards and personal loans.

- Review for accuracy: Double-check all entries for accuracy and completeness before submission.

Legal use of the borrowers expense statement

The borrowers expense statement holds legal significance in the lending process. It serves as a formal declaration of a borrower's financial status, which lenders rely on to make informed decisions. To ensure its legal validity, the statement must be completed truthfully and accurately. Misrepresentation of financial information can lead to legal consequences, including loan denial or potential fraud charges. Therefore, it is essential for borrowers to understand the implications of the information provided in this document.

Key elements of the borrowers expense statement

Several key elements are essential to include in the borrowers expense statement to ensure it meets lender requirements:

- Personal Information: Name, address, and contact details of the borrower.

- Income Details: Comprehensive listing of all income sources and amounts.

- Monthly Expenses: Detailed breakdown of regular expenses, including housing and utilities.

- Debt Obligations: Summary of all current debts and monthly payment amounts.

- Net Worth: An overview of assets versus liabilities to gauge overall financial health.

Examples of using the borrowers expense statement

The borrowers expense statement can be utilized in various scenarios. For instance, when applying for a mortgage, lenders will request this document to evaluate the borrower's financial capacity. Additionally, it may be used when seeking personal loans or refinancing existing debts. In each case, the statement provides a clear overview of the borrower's financial obligations, enabling lenders to make informed decisions regarding loan approvals and terms.

Quick guide on how to complete borrowers expense statement

Effortlessly Prepare BORROWERS EXPENSE STATEMENT on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage BORROWERS EXPENSE STATEMENT on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to Edit and Electronically Sign BORROWERS EXPENSE STATEMENT with Ease

- Obtain BORROWERS EXPENSE STATEMENT and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to submit your form—via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign BORROWERS EXPENSE STATEMENT to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrowers expense statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a borrowers statement?

A borrowers statement is a document that outlines a borrower’s financial information, including income, debts, and assets. It is essential for lenders to assess borrowing eligibility. airSlate SignNow simplifies the creation and signing of borrowers statements, making it easy to manage your loan applications.

-

How does airSlate SignNow help with managing borrowers statements?

airSlate SignNow allows users to create, send, and eSign borrowers statements efficiently. The platform offers customizable templates and an intuitive interface to ensure that all necessary information is included. By streamlining this process, users can save time and reduce errors in their financial documentation.

-

Is there a cost to get a borrowers statement through airSlate SignNow?

The cost of using airSlate SignNow for borrowers statements varies based on the subscription plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. Regardless of the plan, you’ll benefit from our cost-effective solution that simplifies document management.

-

What features does airSlate SignNow provide for borrowers statements?

airSlate SignNow provides an array of features for managing borrowers statements, including eSigning, secure document storage, and real-time tracking of document progress. These features ensure that your borrowers statements are processed quickly and securely. Additionally, users can easily integrate with popular applications for enhanced efficiency.

-

Can I customize my borrowers statement template in airSlate SignNow?

Yes, you can customize your borrowers statement template in airSlate SignNow to meet your specific needs. The platform allows you to edit text, add fields for signatures, and include your branding. Customization helps ensure that your documents reflect your business’s professionalism and comply with industry standards.

-

How do I ensure my borrowers statements are secure with airSlate SignNow?

airSlate SignNow takes document security seriously, utilizing encryption and secure cloud storage for all borrowers statements. Our platform is compliant with industry standards to protect sensitive information. Additionally, users can set access controls to ensure only authorized individuals can view or edit documents.

-

What integrations are available for managing borrowers statements?

airSlate SignNow offers seamless integrations with many popular software applications, such as CRM systems, project management tools, and cloud storage services. These integrations optimize the workflow for converting borrowers statements. You can combine tools to enhance your business efficiency and document management.

Get more for BORROWERS EXPENSE STATEMENT

- Hba form

- Djb new connection status form

- Riverside rehnonline com form

- Fdlic death claim form

- N9a response pack form

- Community based residential facility cbrf residents rights dhs wisconsin form

- Tmj health questionnaire dr joseph sarkissian d d s form

- Protected b when completed page of treaty annuit form

Find out other BORROWERS EXPENSE STATEMENT

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template