Ct W4na Form

What is the Ct W4na

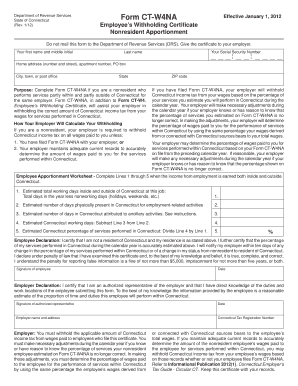

The Ct W4na form is a state-specific tax document used in Connecticut. It is primarily utilized by employees to inform their employers about the amount of state income tax to withhold from their paychecks. This form is crucial for ensuring that the correct tax amount is deducted, helping individuals avoid underpayment or overpayment of state taxes. The Ct W4na is similar to the federal W-4 form but tailored to meet Connecticut's tax regulations and requirements.

How to use the Ct W4na

Using the Ct W4na form involves several straightforward steps. First, individuals need to download the form from the official state website or obtain it from their employer. After filling out personal information, including name, address, and Social Security number, users must indicate their filing status and any additional withholding allowances. It is essential to review the completed form for accuracy before submitting it to the employer, ensuring that the information reflects current circumstances.

Steps to complete the Ct W4na

Completing the Ct W4na form requires careful attention to detail. Here are the steps to follow:

- Download the Ct W4na form from the Connecticut Department of Revenue Services website.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status, which may include options like single, married, or head of household.

- Determine the number of allowances you are claiming based on your personal and financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Ct W4na

The Ct W4na form is legally recognized in Connecticut as a valid document for tax withholding purposes. It complies with state tax laws and regulations, ensuring that employers withhold the appropriate amount of state income tax from employees' wages. Proper completion and submission of the Ct W4na are essential for maintaining compliance with state tax obligations and avoiding potential penalties for under-withholding.

Key elements of the Ct W4na

Several key elements define the Ct W4na form, making it essential for employees in Connecticut:

- Personal Information: Includes name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Withholding Allowances: Employees can claim allowances based on personal circumstances, which affects tax withholding amounts.

- Signature: The employee must sign and date the form, affirming the accuracy of the provided information.

Form Submission Methods

Employees can submit the Ct W4na form through various methods, ensuring flexibility in how they provide their information to employers. The primary submission methods include:

- In-Person: Deliver the completed form directly to the employer's human resources or payroll department.

- Mail: Send the form via postal service to the employer's designated address.

- Electronic Submission: Some employers may allow digital submission through secure online portals.

Quick guide on how to complete ct w4na

Complete Ct W4na effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your files swiftly without any hold-ups. Manage Ct W4na on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Ct W4na without breaking a sweat

- Obtain Ct W4na and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize crucial sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your chosen device. Modify and eSign Ct W4na and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w4na

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct w4na?

CT W4NA refers to a specific tax form used for employee withholding in Connecticut. It ensures that your income tax is accurately calculated and deducted from your paycheck. Using tools like airSlate SignNow can simplify the process of submitting and managing your CT W4NA form.

-

How can airSlate SignNow help with CT W4NA submissions?

AirSlate SignNow provides an intuitive online platform that allows you to complete and eSign your CT W4NA forms efficiently. Our solution eliminates the hassle of paper documents and speeds up the submission process to the IRS. With airSlate SignNow, you can easily track the status of your CT W4NA submissions.

-

What features does airSlate SignNow offer for managing CT W4NA forms?

Our platform offers a range of features including eSignature capabilities, document templates, and real-time collaboration tools. These features streamline the completion of your CT W4NA forms and enhance overall efficiency. With airSlate SignNow, filling out the CT W4NA form becomes a straightforward task.

-

Is airSlate SignNow a cost-effective solution for handling CT W4NA?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your CT W4NA forms and other document needs. Our pricing plans provide exceptional value, enabling businesses of all sizes to benefit from our powerful features and streamlined workflows. This makes managing CT W4NA forms more affordable than traditional methods.

-

Can I integrate airSlate SignNow with other tools for processing CT W4NA?

Absolutely! AirSlate SignNow offers seamless integrations with various applications and platforms like Google Drive, Salesforce, and Dropbox. These integrations enhance your workflow and enable you to process your CT W4NA digitally alongside your existing tools, improving overall productivity.

-

What are the benefits of using airSlate SignNow for CT W4NA documents?

Using airSlate SignNow for your CT W4NA documents offers numerous benefits, such as increased efficiency, reduced paperwork, and improved accuracy. By digitizing your document processes, you can minimize human error and enhance compliance with state requirements. Additionally, our platform ensures secure storage and easy access to your CT W4NA forms.

-

Is it safe to use airSlate SignNow for my sensitive CT W4NA information?

Yes, safety is a top priority at airSlate SignNow. We employ advanced encryption standards and secure data storage solutions to protect your sensitive CT W4NA information. By choosing airSlate SignNow, you can be confident that your data is secure and compliant with industry regulations.

Get more for Ct W4na

- Fs 6300 20 form

- Westmead home safety assessment pdf form

- Journal writing rubric form

- Dental office morning huddle template form

- Karvy account closing form

- How long does it take to process form 15111 fill out ampamp sign

- Understanding the medco form for ohio workers comp

- If yes list all past surgical procedures form

Find out other Ct W4na

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT