Al Rds Tobacco Tax Form 2015

What is the Al Rds Tobacco Tax Form

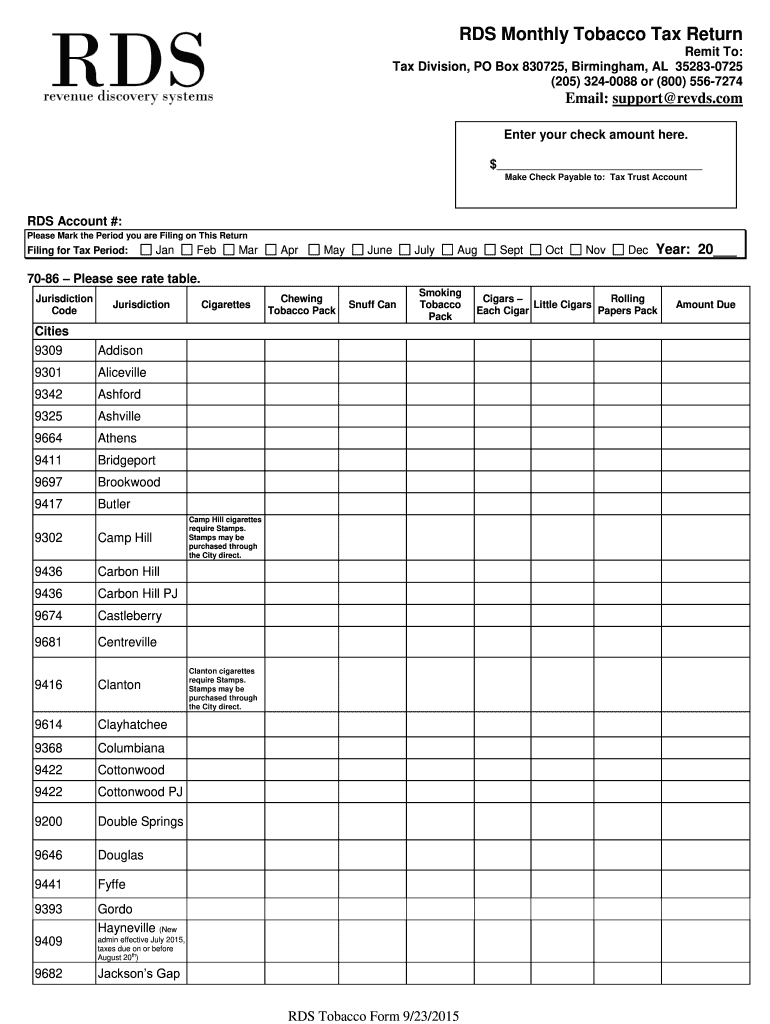

The Al Rds Tobacco Tax Form is a specific document used for reporting and paying tobacco taxes in the United States. This form is essential for businesses involved in the manufacturing, distribution, or sale of tobacco products. It ensures compliance with federal and state regulations regarding tobacco taxation. The form collects necessary information about tobacco sales and usage, helping the government track and manage tobacco-related tax revenues.

How to use the Al Rds Tobacco Tax Form

Using the Al Rds Tobacco Tax Form involves several steps to ensure accurate reporting. First, gather all relevant sales data and inventory records related to tobacco products. Next, fill out the form with the required information, including your business details, sales figures, and any applicable deductions or credits. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the form securely.

Steps to complete the Al Rds Tobacco Tax Form

Completing the Al Rds Tobacco Tax Form requires careful attention to detail. Follow these steps:

- Collect all necessary documentation, including sales records and inventory reports.

- Access the form through the appropriate tax authority's website or your digital document management system.

- Fill in your business information, including name, address, and tax identification number.

- Report all tobacco sales, including quantities and types of products sold.

- Calculate the total tax owed based on the reported sales.

- Review the form for any errors or omissions.

- Sign the form electronically or by hand, as required.

- Submit the completed form to the designated tax authority, either online or via mail.

Legal use of the Al Rds Tobacco Tax Form

The Al Rds Tobacco Tax Form is legally binding and must be completed accurately to comply with federal and state tax laws. Businesses are required to file this form to report their tobacco sales and pay the corresponding taxes. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. It is crucial to stay informed about any changes in tax laws that may affect the completion and submission of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Al Rds Tobacco Tax Form vary depending on the specific tax period and jurisdiction. Generally, businesses must submit their forms on a quarterly or annual basis. It is essential to keep track of these deadlines to avoid late fees and penalties. Mark your calendar with important dates for filing and payment to ensure compliance and maintain good standing with tax authorities.

Form Submission Methods

The Al Rds Tobacco Tax Form can be submitted through various methods, including online, by mail, or in person. Many tax authorities offer electronic filing options, which can expedite processing and reduce paperwork. For those who prefer traditional methods, mailing a printed form is also acceptable. Ensure that you follow the specific submission guidelines provided by the tax authority to avoid delays or complications.

Quick guide on how to complete al rds tobacco tax 2015 form

Your assistance manual on how to prepare your Al Rds Tobacco Tax Form

If you’re unsure about how to complete and submit your Al Rds Tobacco Tax Form, here are some concise guidelines to facilitate tax processing.

Initially, you simply need to create your airSlate SignNow account to revolutionize how you manage documentation online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to accomplish your Al Rds Tobacco Tax Form in just a few minutes:

- Establish your account and start working on PDFs in a matter of minutes.

- Utilize our catalog to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to load your Al Rds Tobacco Tax Form in our editor.

- Complete the mandatory fields with your information (text, figures, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Store changes, print your copy, forward it to your recipient, and save it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in a physical format can increase return errors and postpone refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct al rds tobacco tax 2015 form

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

Create this form in 5 minutes!

How to create an eSignature for the al rds tobacco tax 2015 form

How to create an electronic signature for your Al Rds Tobacco Tax 2015 Form online

How to generate an electronic signature for your Al Rds Tobacco Tax 2015 Form in Chrome

How to generate an eSignature for signing the Al Rds Tobacco Tax 2015 Form in Gmail

How to generate an electronic signature for the Al Rds Tobacco Tax 2015 Form from your smartphone

How to generate an eSignature for the Al Rds Tobacco Tax 2015 Form on iOS

How to generate an electronic signature for the Al Rds Tobacco Tax 2015 Form on Android devices

People also ask

-

What is the Al Rds Tobacco Tax Form and who needs it?

The Al Rds Tobacco Tax Form is a specific document required for reporting tobacco sales and ensuring compliance with tax regulations. Businesses involved in the wholesale or retail sale of tobacco products must complete this form to avoid penalties and maintain regulatory compliance.

-

How can airSlate SignNow help with the Al Rds Tobacco Tax Form?

airSlate SignNow simplifies the process of filling out and submitting the Al Rds Tobacco Tax Form through its intuitive eSignature platform. You can easily send, sign, and store your documents securely, ensuring that your submissions are handled promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Al Rds Tobacco Tax Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, ensuring that you can efficiently manage the Al Rds Tobacco Tax Form without breaking the bank. Each plan provides access to essential features for document management and eSigning, making it a cost-effective solution.

-

What features does airSlate SignNow offer for completing the Al Rds Tobacco Tax Form?

airSlate SignNow provides features such as template creation, real-time collaboration, and secure cloud storage, all designed to enhance the efficiency of completing the Al Rds Tobacco Tax Form. These features streamline the signing process, making it simpler for businesses to manage their tax-related documents.

-

Can I track the status of my Al Rds Tobacco Tax Form submission?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your Al Rds Tobacco Tax Form submissions in real time. You'll receive notifications when the document is viewed, signed, or completed, providing peace of mind and ensuring accountability.

-

Does airSlate SignNow offer integrations with other software for the Al Rds Tobacco Tax Form?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, which can enhance your workflow when dealing with the Al Rds Tobacco Tax Form. Popular integrations include Google Drive, Dropbox, and various CRM systems, enabling you to manage your documents more efficiently.

-

Is airSlate SignNow secure for handling sensitive documents like the Al Rds Tobacco Tax Form?

Yes, airSlate SignNow places a high priority on security, employing advanced encryption and compliance protocols to protect your sensitive documents, including the Al Rds Tobacco Tax Form. You can trust that your data is safe and secure while using our platform for eSigning and document management.

Get more for Al Rds Tobacco Tax Form

Find out other Al Rds Tobacco Tax Form

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document