Get the Avenu Monthly GasolineMotor Fuels Tax Return Fill 2022

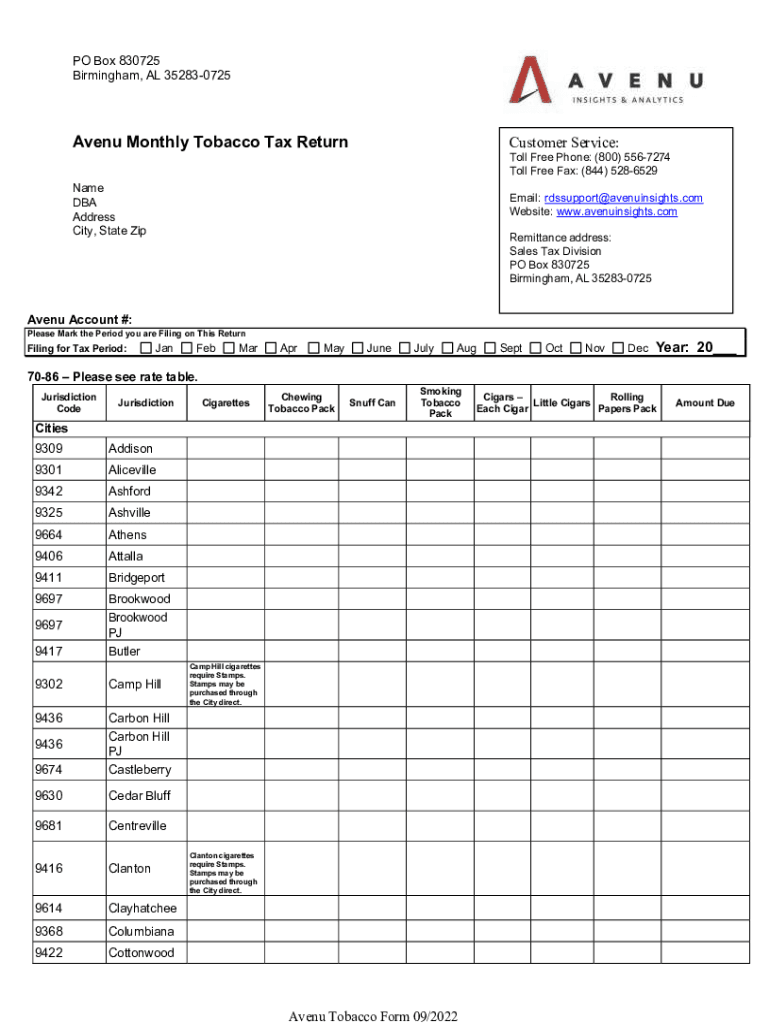

What is the RDS tobacco tax form?

The RDS tobacco tax form is a crucial document for businesses involved in the tobacco industry, particularly in Alabama. This form is used to report and pay state tobacco taxes, ensuring compliance with local regulations. It is essential for manufacturers, wholesalers, and retailers who distribute tobacco products within the state. By accurately completing this form, businesses can avoid penalties and maintain good standing with state authorities.

Steps to complete the RDS tobacco tax form

Completing the RDS tobacco tax form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including business details, tobacco product types, and sales data.

- Fill out the form with accurate figures, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a secure eSignature solution to validate your submission.

- Submit the form by the specified deadline, either online or via mail.

Legal use of the RDS tobacco tax form

The legal use of the RDS tobacco tax form is governed by state laws and regulations. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are legally binding under the ESIGN and UETA acts, provided that the eSignature solution used meets compliance standards. This ensures that the form holds up in legal contexts and is recognized by state authorities.

Filing deadlines for the RDS tobacco tax form

It is important to be aware of filing deadlines for the RDS tobacco tax form to avoid penalties. Typically, the form must be filed monthly, with specific due dates set by the Alabama Department of Revenue. Businesses should mark their calendars and prepare submissions ahead of time to ensure timely compliance.

Required documents for the RDS tobacco tax form

When completing the RDS tobacco tax form, certain documents may be required to substantiate the information provided. These may include:

- Sales records detailing tobacco product sales.

- Invoices from suppliers and distributors.

- Previous tax returns for reference.

Having these documents ready can streamline the completion process and help ensure accuracy.

Form submission methods

The RDS tobacco tax form can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission via the Alabama Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, if preferred.

Choosing the right method can depend on the business's resources and preferences.

Quick guide on how to complete get the free avenu monthly gasolinemotor fuels tax return fill

Complete Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly replacement for traditional printed and signed documents, as you can locate the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill on any platform using airSlate SignNow's Android or iOS applications and streamline your document processes today.

Steps to modify and eSign Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill with ease

- Obtain Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you would like to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free avenu monthly gasolinemotor fuels tax return fill

Create this form in 5 minutes!

People also ask

-

What is the rds tobacco tax form and why is it important?

The rds tobacco tax form is a crucial document used by businesses to report and pay tobacco taxes. Accurate submission of this form ensures compliance with state regulations, helping to avoid penalties and fines. Understanding its purpose can streamline your tobacco business operations.

-

How can airSlate SignNow help with the rds tobacco tax form?

AirSlate SignNow offers a user-friendly platform for creating, sending, and eSigning the rds tobacco tax form efficiently. Our solution simplifies document management, ensuring quick and secure transactions, which can enhance your business workflows. You'll save time and reduce errors while staying compliant.

-

Is there a cost to use airSlate SignNow for submitting the rds tobacco tax form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are competitive and provide excellent value, ensuring you can prepare and manage the rds tobacco tax form without breaking the bank. You can choose a plan that best fits your needs and budget.

-

Can I integrate airSlate SignNow with other software for the rds tobacco tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline the process of completing the rds tobacco tax form. Whether you use accounting software or document management systems, our integrations enhance efficiency and productivity.

-

What features does airSlate SignNow offer for managing the rds tobacco tax form?

AirSlate SignNow provides several features specifically designed to manage the rds tobacco tax form, including customizable templates, secure eSigning, and automated reminders. These features ensure that you stay organized and compliant with submission deadlines, making the entire process hassle-free.

-

How secure is airSlate SignNow when handling the rds tobacco tax form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and robust authentication methods to ensure that your rds tobacco tax form and other sensitive documents are well-protected. Our platform complies with industry standards, giving you peace of mind.

-

Is there customer support available for using airSlate SignNow for the rds tobacco tax form?

Yes, airSlate SignNow offers extensive customer support to assist you with any inquiries related to the rds tobacco tax form. Our knowledgeable support team is available through various channels to ensure you have all the help you need to navigate the platform effortlessly.

Get more for Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill

- Newly divorced individuals package north carolina form

- Authorization health for form

- North carolina statutory form

- Contractors forms package north carolina

- Nc vehicle form

- Revocation power attorney 497317201 form

- Wedding planning or consultant package north carolina form

- Hunting forms package north carolina

Find out other Get The Avenu Monthly GasolineMotor Fuels Tax Return Fill

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template