Everhome Mortgage Form

What is the Everhome Mortgage Form

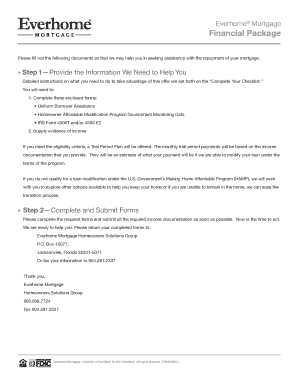

The Everhome Mortgage Form is a critical document used by borrowers in the United States to manage their mortgage payments with Everhome Mortgage Company. This form outlines the terms of the mortgage agreement, including payment schedules, interest rates, and other essential details. Understanding this form is vital for homeowners to ensure they meet their financial obligations and maintain their mortgage in good standing.

How to use the Everhome Mortgage Form

Utilizing the Everhome Mortgage Form involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from the Everhome website or customer service. Once you have the form, fill it out carefully, providing accurate information regarding your mortgage account, payment details, and any other required data. After completing the form, it can be submitted electronically through a secure platform, ensuring that your information is protected during transmission.

Steps to complete the Everhome Mortgage Form

Completing the Everhome Mortgage Form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as your mortgage account number and payment details.

- Access the form through the Everhome website or customer service.

- Fill in your personal information, including your name, address, and contact details.

- Provide your mortgage account information and specify the payment amount.

- Review the form for accuracy before submission.

- Submit the completed form electronically or as instructed.

Legal use of the Everhome Mortgage Form

The Everhome Mortgage Form must be executed in compliance with applicable laws to be considered legally binding. This includes adhering to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which govern the validity of electronic signatures and documents. Ensuring compliance protects both the borrower and the lender in case of disputes or legal challenges.

Required Documents

To complete the Everhome Mortgage Form, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport.

- Current mortgage statement or account number.

- Financial information, including income verification and credit history.

Having these documents ready can streamline the process of filling out the form and ensure all necessary information is provided.

Form Submission Methods

The Everhome Mortgage Form can be submitted through various methods, catering to the preferences of borrowers. Common submission options include:

- Online submission through a secure portal on the Everhome website.

- Mailing a printed copy of the form to the designated address.

- In-person submission at a local Everhome office, if available.

Choosing the right submission method can enhance the efficiency of processing your mortgage payment information.

Quick guide on how to complete everhome mortgage form

Prepare Everhome Mortgage Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, since you can easily locate the appropriate form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents rapidly and without any issues. Manage Everhome Mortgage Form across any platform using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign Everhome Mortgage Form with ease

- Locate Everhome Mortgage Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Everhome Mortgage Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the everhome mortgage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Everhome mortgage payment?

Everhome mortgage payment refers to the monthly payment amount you are required to make towards your Everhome mortgage loan. This payment typically includes the principal and interest on your loan, as well as property taxes and homeowners insurance. Understanding your Everhome mortgage payment is crucial for effective budgeting and financial planning.

-

How can I make my Everhome mortgage payment?

You can make your Everhome mortgage payment through several convenient methods. Options typically include online payment portals, mobile banking apps, and automated phone services. Additionally, many customers opt for direct debit to ensure timely payments and to avoid missed deadlines.

-

What features does airSlate SignNow offer for facilitating Everhome mortgage payment documents?

AirSlate SignNow provides essential features for managing Everhome mortgage payment documents efficiently. With electronic signatures, you can get approvals quickly and securely, eliminating the need for paper-based processes. Furthermore, you can create templates and automate workflows to streamline document management related to your Everhome mortgage payment.

-

Are there any integrations available with airSlate SignNow for managing Everhome mortgage payments?

Yes, airSlate SignNow supports integrations with various platforms that can enhance the management of your Everhome mortgage payments. By connecting with CRMs, accounting software, and other applications, you can automate notifications and keep all your financial documents in sync, ensuring smoother transactions.

-

What are the benefits of using airSlate SignNow for Everhome mortgage payment processes?

Using airSlate SignNow to handle your Everhome mortgage payment processes offers several benefits, including increased efficiency and reduced paperwork. The user-friendly interface allows for quick document signing and sharing, helping you close deals faster. Moreover, enhanced security features protect sensitive financial information throughout the transaction.

-

Is airSlate SignNow cost-effective for managing Everhome mortgage payments?

Yes, airSlate SignNow is a cost-effective solution for managing your Everhome mortgage payments. It reduces traditional paperwork costs and saves time with its efficient electronic signature process. The pricing plans are designed to fit various budgets, making it accessible for individuals and businesses alike.

-

Can I track my Everhome mortgage payment with airSlate SignNow?

Absolutely! AirSlate SignNow provides tracking features that allow you to monitor the status of your Everhome mortgage payment documents in real-time. You can stay informed about who has viewed, signed, or completed your documents, ensuring that you never miss a crucial deadline.

Get more for Everhome Mortgage Form

Find out other Everhome Mortgage Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors