Vat Certificate PDF 2008

What is the VAT Certificate PDF?

The VAT Certificate PDF serves as an official document that confirms a business's registration for value-added tax (VAT). This certificate is essential for businesses that engage in taxable activities, as it provides proof of their VAT status. It typically includes details such as the business name, registration number, and the effective date of registration. Understanding the VAT Certificate PDF is crucial for compliance with tax regulations and for ensuring that businesses can reclaim VAT on eligible purchases.

How to Obtain the VAT Certificate PDF

To obtain the VAT Certificate PDF, businesses must first register for VAT with the appropriate tax authority. In the United States, this process often involves completing an application form, which may vary by state. Once the application is submitted and approved, the tax authority will issue the VAT Certificate, which can usually be downloaded as a PDF from their official website or received via email. It is important to keep this document accessible for future reference, especially during audits or tax filings.

Steps to Complete the VAT Certificate PDF

Completing the VAT Certificate PDF involves several key steps. First, ensure that all required information is accurately filled in, including business details and VAT registration number. Next, review the document for any errors or omissions, as inaccuracies can lead to compliance issues. After completing the form, it may need to be signed electronically or printed for manual signing, depending on the submission method. Finally, submit the completed VAT Certificate PDF to the relevant tax authority, either online or by mail, following their specific submission guidelines.

Legal Use of the VAT Certificate PDF

The VAT Certificate PDF is legally binding when it is issued by the tax authority. It serves as proof of a business's VAT registration, which is necessary for conducting transactions that involve VAT. Businesses must use this certificate in accordance with local tax laws, ensuring that it is presented when required, such as during audits or when claiming VAT refunds. Understanding the legal implications of this document helps businesses maintain compliance and avoid potential penalties.

Key Elements of the VAT Certificate PDF

Several key elements are essential to the VAT Certificate PDF. These include the business name and address, the VAT registration number, the date of issue, and any applicable expiration date. Additionally, the certificate may contain information about the types of goods or services for which VAT registration is valid. Ensuring that all these elements are present and accurate is vital for the document's validity and for the business's compliance with tax regulations.

Form Submission Methods

Businesses can submit the VAT Certificate PDF using various methods, depending on the requirements of the tax authority. Common submission methods include online filing through the tax authority's website, mailing a printed copy of the form, or submitting it in person at a designated office. Each method may have specific guidelines, such as required signatures or additional documentation, so it is important to follow the instructions provided by the tax authority to ensure successful submission.

Penalties for Non-Compliance

Failure to comply with VAT regulations, including the proper use of the VAT Certificate PDF, can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses that do not maintain accurate records or fail to present their VAT Certificate when required may face audits and additional scrutiny from tax authorities. Understanding these penalties emphasizes the importance of proper compliance and diligent record-keeping for all VAT-related documentation.

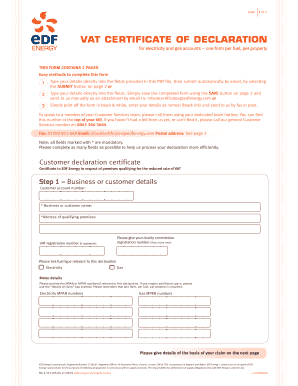

Quick guide on how to complete vat certificate pdf

Prepare Vat Certificate Pdf effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Vat Certificate Pdf on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Vat Certificate Pdf with ease

- Locate Vat Certificate Pdf and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details, then click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from your preferred device. Edit and eSign Vat Certificate Pdf and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat certificate pdf

Create this form in 5 minutes!

How to create an eSignature for the vat certificate pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the edf vat declaration form?

The edf vat declaration form is a document that businesses use to report VAT on their taxable supplies. It simplifies the VAT filing process, ensuring compliance with tax regulations. Understanding how to properly complete the edf vat declaration form is essential for accurate reporting.

-

How can airSlate SignNow help with the edf vat declaration form?

airSlate SignNow streamlines the process of electronically signing and sending the edf vat declaration form. Our platform allows you to create, fill, and eSign your documents securely and efficiently. This not only saves time but also reduces the risk of errors in your VAT submissions.

-

What features does airSlate SignNow offer for handling the edf vat declaration form?

Our platform includes features like document templates, customizable workflows, and secure storage to manage the edf vat declaration form. You can automate reminders for signatures and track the progress of your forms. These capabilities enhance your productivity and ensure compliance.

-

What are the pricing options for using airSlate SignNow for the edf vat declaration form?

airSlate SignNow offers flexible pricing plans that cater to different business needs for managing the edf vat declaration form. Whether you are a small business or a larger enterprise, our plans provide cost-effective solutions. You can choose a plan that best fits your signing needs and budget.

-

Are there integrations available with airSlate SignNow for the edf vat declaration form?

Yes, airSlate SignNow seamlessly integrates with various platforms, enhancing your ability to manage the edf vat declaration form. You can connect with tools like CRM systems, cloud storage services, and accounting software. This integration ensures a smooth workflow and easy access to your documents.

-

What benefits does airSlate SignNow provide for eSigning the edf vat declaration form?

Using airSlate SignNow to eSign the edf vat declaration form offers numerous benefits, including increased efficiency and reduced turnaround time. The platform is user-friendly, allowing for quick signatures from any device. Additionally, it ensures your documents are legally binding and secure.

-

How does airSlate SignNow ensure the security of the edf vat declaration form?

AirSlate SignNow prioritizes security, employing advanced encryption to protect your edf vat declaration form and all other documents. We adhere to strict compliance standards to safeguard sensitive information. Furthermore, our platform provides audit trails to track changes and access to your forms.

Get more for Vat Certificate Pdf

- Firpta affidavit form

- Marriage in saipan form

- Efu surrender form

- Introductory phonology bruce hayes answer key pdf form

- Security guard employment status notification form

- Request letter for siphoning septic tank form

- Asb kiwisaver scheme changing your fund switch f form

- Inz 1002 residence guide form

Find out other Vat Certificate Pdf

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast