410V1VATCertgas&elect 2006

What is the 410V1VATCertgas&elect

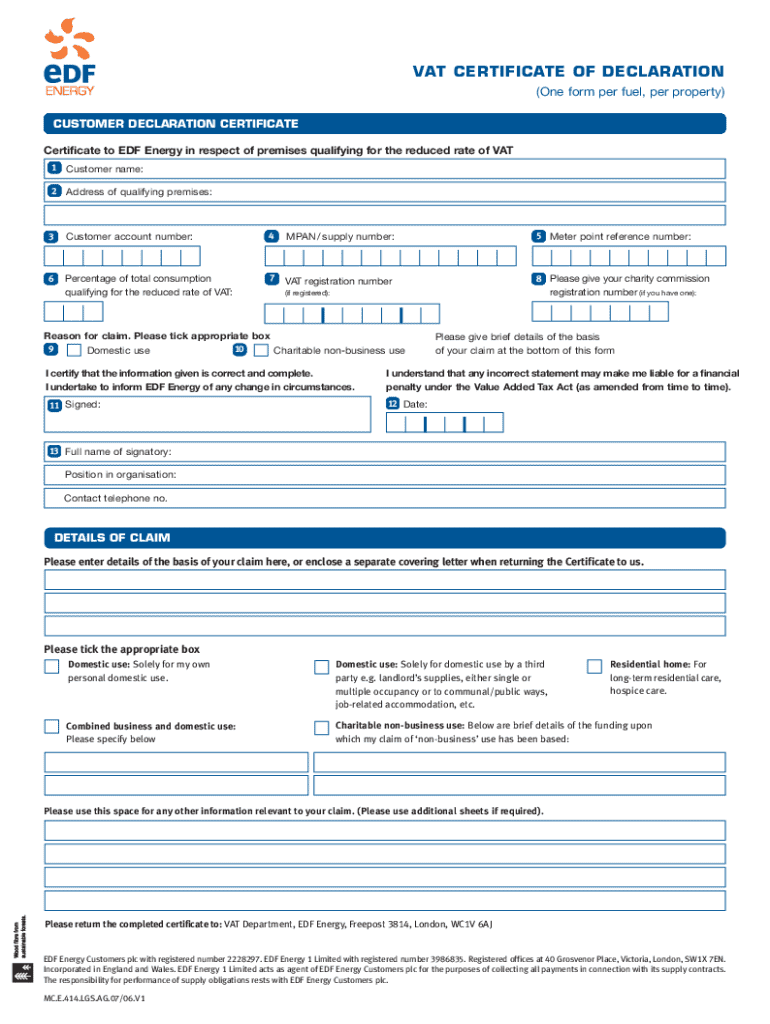

The 410V1VATCertgas&elect is a specific form used in the United States for certifying the exemption of certain gas and electric services from state sales tax. This form is particularly relevant for businesses and individuals who qualify for tax exemptions based on their usage of these utilities. Understanding the purpose and function of this form is essential for ensuring compliance with state tax regulations.

How to use the 410V1VATCertgas&elect

To effectively use the 410V1VATCertgas&elect, individuals or businesses must first determine their eligibility for tax exemption. Once eligibility is confirmed, the form should be completed with accurate information regarding the entity and the specific services for which the exemption is sought. After filling out the form, it needs to be submitted to the appropriate utility provider to ensure that sales tax is not charged on the eligible services.

Steps to complete the 410V1VATCertgas&elect

Completing the 410V1VATCertgas&elect involves several steps:

- Gather necessary information, including business details and utility account numbers.

- Ensure you meet the eligibility criteria for tax exemption.

- Fill out the form accurately, providing all required details.

- Review the form for any errors or omissions.

- Submit the completed form to your utility provider.

Legal use of the 410V1VATCertgas&elect

The legal use of the 410V1VATCertgas&elect is critical for maintaining compliance with state tax laws. This form serves as a declaration of eligibility for tax exemption, and misuse or inaccuracies can lead to penalties. It is important to ensure that the information provided is truthful and that the exemption is valid under state regulations.

Required Documents

When filling out the 410V1VATCertgas&elect, certain documents may be required to support your application. These documents typically include:

- Proof of business registration or incorporation.

- Utility account statements.

- Any previous tax exemption certificates, if applicable.

Who Issues the Form

The 410V1VATCertgas&elect is typically issued by state tax authorities or specific utility companies that require certification for tax exemption. It is important to check with your local utility provider or state tax office for the correct form and any specific instructions related to its use.

Create this form in 5 minutes or less

Find and fill out the correct 410v1vatcertgaselect

Create this form in 5 minutes!

How to create an eSignature for the 410v1vatcertgaselect

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 410V1VATCertgas&elect and how does it work?

The 410V1VATCertgas&elect is a specialized document used for VAT certification in gas and electricity sectors. It streamlines the process of verifying VAT exemptions, making it easier for businesses to manage their tax obligations. By utilizing airSlate SignNow, you can efficiently send and eSign this document, ensuring compliance and accuracy.

-

How much does it cost to use the 410V1VATCertgas&elect feature?

Pricing for using the 410V1VATCertgas&elect feature varies based on your subscription plan with airSlate SignNow. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your needs. Contact our sales team for a detailed quote tailored to your requirements.

-

What are the key features of the 410V1VATCertgas&elect?

The 410V1VATCertgas&elect includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features enhance efficiency and ensure that your VAT certification process is seamless. With airSlate SignNow, you can also integrate this document into your existing workflows effortlessly.

-

What are the benefits of using airSlate SignNow for the 410V1VATCertgas&elect?

Using airSlate SignNow for the 410V1VATCertgas&elect offers numerous benefits, including reduced processing time and improved accuracy in document handling. Our platform is user-friendly, allowing you to eSign documents quickly and securely. Additionally, it helps in maintaining compliance with VAT regulations, giving you peace of mind.

-

Can I integrate the 410V1VATCertgas&elect with other software?

Yes, airSlate SignNow allows for seamless integration of the 410V1VATCertgas&elect with various software applications. This capability enhances your workflow by connecting with CRM systems, document management tools, and more. Our API makes it easy to incorporate eSigning into your existing processes.

-

Is the 410V1VATCertgas&elect secure?

Absolutely! The 410V1VATCertgas&elect is secured with advanced encryption and complies with industry standards for data protection. airSlate SignNow prioritizes the security of your documents, ensuring that your sensitive information remains confidential throughout the signing process.

-

How can I track the status of my 410V1VATCertgas&elect?

With airSlate SignNow, you can easily track the status of your 410V1VATCertgas&elect in real-time. Our platform provides notifications and updates on document progress, so you always know when it has been viewed, signed, or completed. This feature enhances transparency and keeps all parties informed.

Get more for 410V1VATCertgas&elect

Find out other 410V1VATCertgas&elect

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement