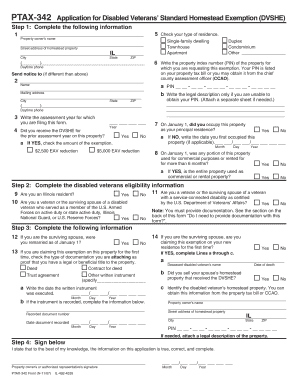

Ptax 342 Form

What is the Ptax 342 Form

The Ptax 342 Form is a specific document used in the United States for property tax assessment purposes. This form is typically utilized by property owners to report changes in property ownership or to appeal property tax assessments. It is essential for ensuring that property taxes are accurately assessed based on current ownership and property conditions. Understanding the purpose of this form is crucial for property owners who wish to maintain fair taxation on their real estate assets.

How to use the Ptax 342 Form

Using the Ptax 342 Form involves several straightforward steps. First, gather all relevant information about the property, including ownership details, property description, and any changes that may affect its assessment. Next, accurately fill out the form, ensuring that all sections are completed with the required information. After completing the form, submit it to the appropriate local tax authority. It is advisable to keep a copy of the submitted form for your records. This process helps ensure that your property is assessed correctly and that you are not overpaying on taxes.

Steps to complete the Ptax 342 Form

Completing the Ptax 342 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Ptax 342 Form from your local tax authority.

- Provide accurate property information, including the address and parcel number.

- Detail any changes in ownership or property improvements that may affect the tax assessment.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to ensure timely processing.

Legal use of the Ptax 342 Form

The legal use of the Ptax 342 Form is governed by state and local tax laws. It is essential for property owners to understand that submitting this form can impact their property tax obligations. The form must be filled out accurately and submitted within the designated time frames to be considered valid. Failure to comply with these legal requirements may result in penalties or incorrect tax assessments. Therefore, understanding the legal implications of the Ptax 342 Form is vital for property owners.

Required Documents

When completing the Ptax 342 Form, certain documents may be required to support the information provided. These may include:

- Proof of property ownership, such as a deed or title.

- Documentation of any recent property improvements or changes.

- Previous property tax assessments for reference.

Having these documents ready can streamline the process and ensure that your submission is complete and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 342 Form vary by state and local jurisdiction. It is crucial for property owners to be aware of these dates to avoid penalties or late fees. Typically, deadlines align with property tax assessment cycles, so checking with your local tax authority for specific dates is advisable. Staying informed about important deadlines ensures that you can submit your form on time and maintain compliance with tax regulations.

Quick guide on how to complete ptax 342 form

Effortlessly prepare Ptax 342 Form on any device

The management of online documents has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly option compared to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Ptax 342 Form on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to adjust and electronically sign Ptax 342 Form with ease

- Obtain Ptax 342 Form and then click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Mark essential sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any preferred device. Edit and electronically sign Ptax 342 Form and guarantee excellent communication at all stages of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 342 Form and why is it important?

The Ptax 342 Form is a crucial document used for property tax assessments in certain jurisdictions. It plays a signNow role in ensuring that property taxes are calculated accurately. Understanding this form can help property owners manage their tax liabilities effectively.

-

How can airSlate SignNow help with the Ptax 342 Form?

airSlate SignNow enables users to eSign the Ptax 342 Form quickly and securely. Our platform simplifies the process of filling out and submitting this form, ensuring compliance with local regulations. With airSlate SignNow, you can streamline your document workflows efficiently.

-

Is the Ptax 342 Form available in airSlate SignNow?

Yes, the Ptax 342 Form is available in airSlate SignNow's extensive library of templates. You can access, customize, and send this form directly from our platform. This makes managing property tax documents easier for everyone involved.

-

What are the pricing options for using airSlate SignNow for the Ptax 342 Form?

airSlate SignNow offers various pricing plans to accommodate different business needs when managing the Ptax 342 Form. Our plans are designed to be cost-effective, ensuring you only pay for the features that matter to you. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools for the Ptax 342 Form?

Absolutely! airSlate SignNow supports integrations with numerous tools that can assist with the Ptax 342 Form and other documents. This flexibility allows users to enhance their workflow and increase productivity by connecting with their favorite applications.

-

What are the benefits of eSigning the Ptax 342 Form using airSlate SignNow?

eSigning the Ptax 342 Form with airSlate SignNow offers several benefits, including increased efficiency and secure document management. Our platform provides real-time tracking and notifications, ensuring all parties are informed throughout the process. Enjoy the convenience of completing your documents anytime, anywhere.

-

Is it safe to eSign the Ptax 342 Form with airSlate SignNow?

Yes, eSigning the Ptax 342 Form with airSlate SignNow is secure and compliant with industry standards. Our platform uses advanced encryption to protect your data. You can trust that your sensitive information will remain confidential.

Get more for Ptax 342 Form

- Stress questionnaire for students pdf form

- Records code psecf xbcr form

- Confirmation of the claim of refund form vat 352 see rule

- Affidavit of parental consent to marriage form

- Ecology packet answer key form

- Broker renewal application re 208 california department of 448287081 form

- Auction sponsorship levels form

- Va form 21 4138

Find out other Ptax 342 Form

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT