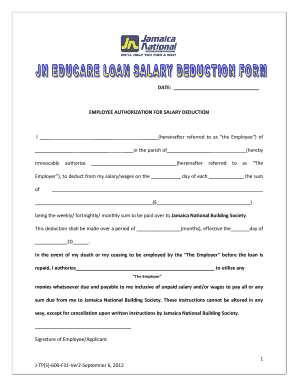

Salary Deduction Form

What is the salary deduction?

A salary deduction refers to the process of withholding a portion of an employee's earnings for various purposes, including taxes, benefits, or other obligations. This can include mandatory deductions such as federal and state taxes, Social Security, and Medicare, as well as voluntary deductions for retirement plans, health insurance, or wage garnishments. Understanding the specifics of salary deductions is crucial for both employers and employees to ensure compliance with legal requirements and to manage personal finances effectively.

How to use the salary deduction

Utilizing salary deductions involves a clear understanding of the applicable laws and regulations. Employees typically fill out forms, such as the W-4 for federal tax withholding, to indicate their preferences for deductions. Employers must ensure that these forms are processed accurately and that deductions are applied correctly in payroll systems. Additionally, employees should regularly review their pay stubs to confirm that the deductions align with their expectations and any agreements made regarding benefits or other contributions.

Key elements of the salary deduction

Several key elements define the salary deduction process. These include:

- Types of Deductions: Mandatory versus voluntary deductions.

- Legal Compliance: Adhering to federal and state laws regarding deductions.

- Employee Consent: Obtaining necessary approvals for voluntary deductions.

- Documentation: Maintaining accurate records of deductions for tax and compliance purposes.

Understanding these elements helps ensure that both employees and employers navigate salary deductions effectively and legally.

Steps to complete the salary deduction

Completing a salary deduction involves several steps:

- Determine the Type of Deduction: Identify whether the deduction is mandatory or voluntary.

- Fill Out Required Forms: Complete necessary forms, like the W-4 for tax deductions.

- Submit Documentation: Provide completed forms to the payroll department.

- Review Pay Stubs: Regularly check pay stubs to ensure deductions are applied correctly.

- Adjust as Necessary: Update forms if personal or financial circumstances change.

Following these steps helps ensure that salary deductions are managed accurately and in compliance with relevant laws.

Legal use of the salary deduction

The legal use of salary deductions is governed by various federal and state laws. Employers must comply with regulations that dictate what can be deducted from an employee's salary. For instance, the Fair Labor Standards Act (FLSA) outlines guidelines for wage deductions, while the Consumer Credit Protection Act (CCPA) limits the amount that can be deducted for wage garnishments. Employers should also be aware of state-specific regulations that may impose additional restrictions or requirements regarding salary deductions.

Required documents

To facilitate salary deductions, several documents may be required, including:

- W-4 Form: Used to determine federal tax withholding.

- State Tax Withholding Forms: Required for state income tax deductions.

- Benefit Enrollment Forms: Necessary for voluntary deductions related to health insurance or retirement plans.

- Garnishment Orders: Required for legally mandated wage garnishments.

Having these documents ready ensures a smooth process for implementing and managing salary deductions.

Examples of using the salary deduction

Salary deductions can be applied in various scenarios, including:

- Tax Withholding: Federal and state taxes are deducted from each paycheck based on the employee's W-4 information.

- Health Insurance Premiums: Employees may choose to have premiums deducted for employer-sponsored health plans.

- Retirement Contributions: Deductions for 401(k) or other retirement plans help employees save for the future.

- Wage Garnishments: Court-ordered deductions for child support or debt repayment.

These examples illustrate the diverse applications of salary deductions in managing employee compensation and benefits.

Quick guide on how to complete salary deduction

Handle Salary Deduction seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Salary Deduction on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to modify and electronically sign Salary Deduction with ease

- Obtain Salary Deduction and click Get Form to initiate.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to store your updates.

- Select your preferred method of delivering your form, whether via email, SMS, invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Salary Deduction and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salary deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample authorization letter to deduct from salary?

A sample authorization letter to deduct from salary is a document that outlines an employee's consent for their employer to deduct specific amounts from their salary. This could be for reasons such as loan repayments or other agreed-upon deductions. Utilizing our templates can help you create a clear and professional authorization letter quickly.

-

How can I create a sample authorization letter to deduct from salary using airSlate SignNow?

With airSlate SignNow, you can easily create a sample authorization letter to deduct from salary by accessing our user-friendly document editor. Simply select a template, fill in the necessary details, and customize it as needed. Once completed, you can eSign and send it securely for approval.

-

Are there any costs associated with using the sample authorization letter to deduct from salary feature?

AirSlate SignNow offers a range of pricing plans, including a free trial to explore features like the sample authorization letter to deduct from salary. Our competitive pricing ensures that you get a cost-effective solution without compromising on quality. Check our pricing page for more details on plans that fit your business needs.

-

What are the benefits of using a sample authorization letter to deduct from salary?

Using a sample authorization letter to deduct from salary streamlines the approval process and ensures clear communication between employer and employee. It minimizes misunderstandings about salary deductions and provides a formal record of consent. This contributes to better financial management and enhances trust in workplace relationships.

-

Can I integrate airSlate SignNow with other apps for processing salary deductions?

Yes, airSlate SignNow seamlessly integrates with various applications to help you manage processes related to salary deductions. You can connect with HR systems, payment platforms, and more to ensure your sample authorization letter to deduct from salary fits into your existing workflows. Check our integration list for available options.

-

Is it legal to use a sample authorization letter to deduct from salary?

Yes, using a sample authorization letter to deduct from salary is legal, provided that it complies with local labor laws. Employers should ensure that the deductions are clearly stated and agreed upon by the employee. Consulting with a legal expert is advisable to ensure full compliance with regulations.

-

How can I ensure my sample authorization letter to deduct from salary is professional?

To ensure your sample authorization letter to deduct from salary appears professional, use a standard business format and include all necessary information, such as the employee's details, deduction amount, and purpose. AirSlate SignNow provides templates that are designed for clarity and professionalism, helping you to create a polished document effortlessly.

Get more for Salary Deduction

- Release letter from bank malaysia form

- Bank of baroda joining letter format download

- Nfl mock draft form

- Nc wdir 100 form 367774798

- Clovis usd sports pre participation screening form

- Massachusetts certified payroll form

- Scholastic scope argument essay form

- Area lebanon u s department of veterans affairs form

Find out other Salary Deduction

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free