Thrivent Insurance Form

What is the Thrivent Insurance Form

The Thrivent Insurance Form is a document used to apply for various insurance products offered by Thrivent Financial, a not-for-profit financial services organization. This form is essential for individuals seeking to secure insurance coverage, including life, health, and disability insurance. It collects necessary personal information and details about the insurance coverage being requested. Understanding the purpose of this form is crucial for ensuring a smooth application process.

Steps to complete the Thrivent Insurance Form

Completing the Thrivent Insurance Form involves several important steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary personal information, including your full name, address, date of birth, and Social Security number.

- Review the specific insurance products you are interested in and ensure you understand the coverage details.

- Fill out the form carefully, providing all requested information. Double-check for accuracy to avoid delays.

- Sign and date the form, ensuring that you meet all legal requirements for your signature.

- Submit the completed form through the designated method, whether online, by mail, or in person.

How to obtain the Thrivent Insurance Form

The Thrivent Insurance Form can be obtained in several ways. You can visit the official Thrivent Financial website, where the form is typically available for download. Alternatively, you may request a physical copy by contacting Thrivent Financial directly. Local representatives can also provide you with the necessary forms and assist you in the application process.

Legal use of the Thrivent Insurance Form

The Thrivent Insurance Form is legally binding once completed and signed according to the applicable laws governing insurance contracts. To ensure its validity, it is important to comply with all state regulations and requirements. This includes providing accurate information and adhering to any additional documentation that may be required based on your specific circumstances.

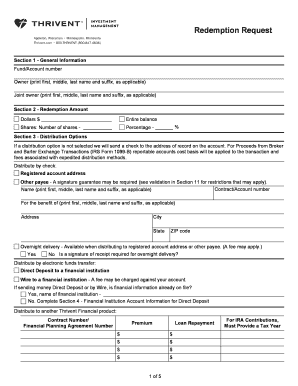

Key elements of the Thrivent Insurance Form

Understanding the key elements of the Thrivent Insurance Form is vital for a successful application. The form typically includes:

- Personal identification information, such as name and contact details.

- Insurance product selection, detailing the type of coverage desired.

- Health and lifestyle questions to assess eligibility and risk factors.

- Beneficiary information to designate individuals who will receive benefits.

- Signature and date fields to validate the application.

Form Submission Methods

Submitting the Thrivent Insurance Form can be done through various methods to accommodate user preferences. Options typically include:

- Online submission through the Thrivent Financial website for a quick and efficient process.

- Mailing the completed form to the designated Thrivent office address.

- In-person submission at a local Thrivent Financial representative's office for personalized assistance.

Eligibility Criteria

Eligibility for submitting the Thrivent Insurance Form varies based on the type of insurance being applied for. Generally, applicants must meet specific age, health, and residency requirements. It is important to review the eligibility criteria outlined on the form or consult with a Thrivent representative to ensure compliance and increase the chances of approval.

Quick guide on how to complete thrivent insurance form

Effortlessly Prepare Thrivent Insurance Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Thrivent Insurance Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Simplified Editing and eSigning of Thrivent Insurance Form

- Find Thrivent Insurance Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and eSign Thrivent Insurance Form and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the thrivent insurance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Thrivent Insurance Form and how does it work?

The Thrivent Insurance Form is a document used for various insurance-related applications and transactions with Thrivent. With airSlate SignNow, you can easily fill out, send, and eSign the Thrivent Insurance Form, streamlining the process for both you and your clients. This digital solution simplifies document management while ensuring compliance and security.

-

How much does it cost to use airSlate SignNow for the Thrivent Insurance Form?

Using airSlate SignNow for the Thrivent Insurance Form is cost-effective, with pricing plans tailored to fit different business needs. Our pricing includes features designed for seamless eSigning and document management, ensuring you can maximize productivity without breaking the bank. You can choose from various subscription levels to find the right fit for your team.

-

What are the key features of airSlate SignNow for completing the Thrivent Insurance Form?

AirSlate SignNow offers numerous features for managing the Thrivent Insurance Form effectively. These include easy eSigning, customizable templates, automated workflows, and secure document storage. With these tools, you can enhance efficiency and ensure your processes are streamlined.

-

How can I integrate airSlate SignNow with other tools to manage the Thrivent Insurance Form?

AirSlate SignNow integrates seamlessly with various applications to help manage the Thrivent Insurance Form. You can connect it with platforms like Google Workspace, Microsoft Office, and CRM systems for enhanced functionality. This integration allows you to automate workflows and improve collaboration across your business.

-

What are the benefits of using airSlate SignNow for the Thrivent Insurance Form?

Using airSlate SignNow for the Thrivent Insurance Form offers multiple benefits, including faster processing times and reduced paperwork. It enhances document security, helps maintain compliance, and improves overall customer experience. By leveraging our platform, you can boost your operational efficiency.

-

Is it easy to use airSlate SignNow for the Thrivent Insurance Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to use when completing the Thrivent Insurance Form. Our intuitive interface allows users to navigate through the process of filling out, sending, and signing documents effortlessly. Training resources are also available to ensure a smooth onboarding experience.

-

Can I track the status of the Thrivent Insurance Form once it's sent?

Absolutely! With airSlate SignNow, you can track the status of the Thrivent Insurance Form in real-time. This feature allows you to see when the document has been viewed, signed, or requires further action, ensuring that you stay informed throughout the entire process.

Get more for Thrivent Insurance Form

- Leosa in delaware form

- Natural selection crossword puzzle form

- Use of logo agreement template form

- Cms 1500 template ohio state university form

- Oregon form 40 resident individual income tax return

- Oregon tax forms printable state form or 40 and 757727598

- Forms w 2 and w 3 electronically on the ssas employer

- Form 1065 u s return of partnership income

Find out other Thrivent Insurance Form

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement