Ceres Declaration of Gross Receipts Fillable Form

What is the Ceres Declaration of Gross Receipts Fillable Form

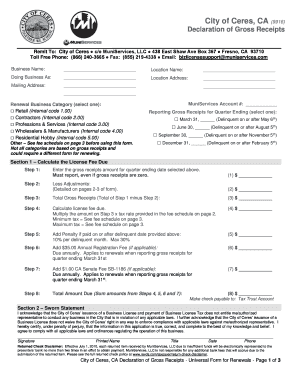

The Ceres Declaration of Gross Receipts fillable form is a crucial document used by businesses operating within the city of Ceres, California. This form is designed to report the gross receipts of a business for a specific fiscal period. It is essential for compliance with local tax regulations and helps determine the appropriate business taxes owed to the city. The fillable format allows users to complete the document electronically, ensuring ease of use and accuracy in reporting financial information.

How to Use the Ceres Declaration of Gross Receipts Fillable Form

Using the Ceres Declaration of Gross Receipts fillable form involves several straightforward steps. First, access the form online through a reliable platform. Next, fill in the required fields, which typically include business identification details, revenue figures, and any deductions applicable. Ensure that all information is accurate to avoid potential penalties. Once completed, the form can be electronically signed and submitted as per the guidelines provided by the city of Ceres.

Steps to Complete the Ceres Declaration of Gross Receipts Fillable Form

Completing the Ceres Declaration of Gross Receipts fillable form involves the following steps:

- Download or access the fillable form from a trusted source.

- Enter your business name, address, and identification number.

- Report your total gross receipts for the reporting period.

- Include any allowable deductions to calculate the taxable amount.

- Review the form for accuracy and completeness.

- Sign the form electronically using a secure eSignature solution.

- Submit the completed form according to the submission guidelines.

Legal Use of the Ceres Declaration of Gross Receipts Fillable Form

The Ceres Declaration of Gross Receipts fillable form serves as a legally binding document when completed and submitted correctly. It is important to adhere to the local laws governing business operations in Ceres. The form must be signed by an authorized representative of the business, ensuring that the information provided is truthful and accurate. Compliance with the legal requirements surrounding this form helps avoid penalties and ensures the business remains in good standing with local authorities.

Penalties for Non-Compliance

Failing to complete and submit the Ceres Declaration of Gross Receipts fillable form on time can result in significant penalties. Businesses may face fines based on the amount of gross receipts reported and the duration of the delay. Additionally, non-compliance may lead to increased scrutiny from tax authorities, which can result in further legal complications. It is essential for businesses to stay informed about filing deadlines and ensure timely submission to avoid these consequences.

Form Submission Methods

The Ceres Declaration of Gross Receipts fillable form can be submitted through various methods to accommodate different preferences. Businesses may choose to submit the form online via an electronic filing system, which is often the quickest and most efficient option. Alternatively, the form can be printed and mailed to the appropriate city department. In some cases, in-person submissions may also be accepted, allowing for direct interaction with city officials. Each method has its own guidelines and requirements, so it is important to follow the instructions provided by the city of Ceres.

Quick guide on how to complete ceres declaration of gross receipts fillable form

Effortlessly Prepare Ceres Declaration Of Gross Receipts Fillable Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Ceres Declaration Of Gross Receipts Fillable Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Ceres Declaration Of Gross Receipts Fillable Form with Ease

- Find Ceres Declaration Of Gross Receipts Fillable Form and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Select pertinent sections of your documents or obscure confidential details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and eSign Ceres Declaration Of Gross Receipts Fillable Form while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ceres declaration of gross receipts fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ceres declaration of gross receipts fillable form?

The Ceres declaration of gross receipts fillable form is a document that businesses use to report their gross receipts for tax purposes. This form simplifies the reporting process by allowing you to fill out the needed information digitally, ensuring accuracy and compliance. Utilizing our platform, you can easily edit and sign this form online.

-

How can airSlate SignNow help with the Ceres declaration of gross receipts fillable form?

AirSlate SignNow provides an efficient platform for filling out and eSigning the Ceres declaration of gross receipts fillable form. Our services streamline the document management process, allowing users to fill the form swiftly and securely online. With intuitive tools, you save time while ensuring your forms are correctly completed.

-

Is there a cost associated with using the Ceres declaration of gross receipts fillable form on airSlate SignNow?

Yes, using airSlate SignNow involves a subscription fee which grants access to various features including the Ceres declaration of gross receipts fillable form. We offer different pricing plans based on your needs, ensuring you can choose a service that fits your budget. The cost is competitive, especially considering the time and effort saved.

-

Can I integrate airSlate SignNow with other applications for managing the Ceres declaration of gross receipts fillable form?

Absolutely! AirSlate SignNow supports a variety of integrations with popular applications, making it easy to manage the Ceres declaration of gross receipts fillable form alongside your existing tools. Seamless integration with platforms like Google Drive and Dropbox enhances your workflow and optimizes document management.

-

What features does airSlate SignNow offer for the Ceres declaration of gross receipts fillable form?

AirSlate SignNow includes features such as customizable templates, advanced editing options, and secure eSigning for the Ceres declaration of gross receipts fillable form. These features make it easy to tailor the document to your specific needs while maintaining compliance with requirements. Additionally, the platform offers tracking and reminders to keep your workflow organized.

-

How secure is my information when using the Ceres declaration of gross receipts fillable form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When filling out the Ceres declaration of gross receipts fillable form, your data is protected through encryption and secure storage protocols. You can confidently manage sensitive information knowing that our platform complies with industry standards for data protection.

-

Can I share the Ceres declaration of gross receipts fillable form with others for collaboration?

Yes, airSlate SignNow allows you to easily share the Ceres declaration of gross receipts fillable form with colleagues or clients for collaboration. You can send links to the document, enabling others to review, fill out, or eSign as needed. This collaborative feature enhances teamwork and ensures everyone is aligned during the document completion process.

Get more for Ceres Declaration Of Gross Receipts Fillable Form

Find out other Ceres Declaration Of Gross Receipts Fillable Form

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online