1099g Edd Form

What is the 1099G EDD?

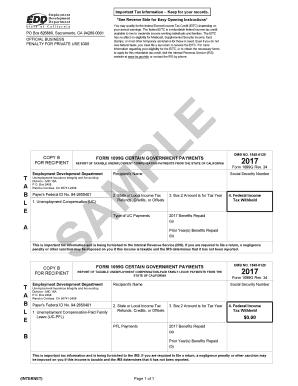

The 1099G EDD is a tax form used in the United States to report certain types of income received from the Employment Development Department (EDD) in California. This form is primarily issued to individuals who have received unemployment benefits, state tax refunds, or other government payments. It provides essential information for taxpayers to accurately report their income when filing their federal and state tax returns.

How to Obtain the 1099G EDD

To obtain the 1099G EDD, individuals can access their forms through the California EDD website. Here are the steps to follow:

- Visit the California EDD website.

- Log in to your account using your credentials.

- Navigate to the 'Tax Information' section.

- Select the option to view or download your 1099G form.

Additionally, if you are unable to access your form online, you can request a copy by contacting the EDD directly through their customer service channels.

Steps to Complete the 1099G EDD

Completing the 1099G EDD involves several key steps to ensure accuracy and compliance:

- Gather all relevant income information, including unemployment benefits received.

- Fill in your personal details, including your name, address, and Social Security number.

- Report the total amount of income received as indicated on the form.

- Double-check all entries for accuracy before submission.

Once completed, the form can be submitted electronically or printed and mailed to the appropriate tax authority.

Legal Use of the 1099G EDD

The 1099G EDD is legally binding when filled out correctly and submitted to the appropriate tax authorities. It is crucial for taxpayers to report the income accurately to avoid penalties. The form must be submitted by the tax filing deadline to comply with IRS regulations. Failing to report this income can lead to fines or other legal consequences.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099G EDD is essential for timely compliance. Typically, the EDD issues the 1099G forms by January 31 of each year. Taxpayers must include this form when filing their federal and state tax returns, which are generally due by April 15. It is advisable to check for any updates or changes to deadlines each tax year.

Who Issues the Form

The 1099G EDD is issued by the Employment Development Department of California. This department is responsible for managing unemployment insurance and other benefit programs. Taxpayers should expect to receive their forms directly from the EDD if they have received qualifying payments during the tax year.

Quick guide on how to complete 1099g edd

Complete 1099g Edd effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, enabling you to obtain the correct template and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 1099g Edd on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1099g Edd effortlessly

- Obtain 1099g Edd and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign 1099g Edd and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099g edd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 1099g edd and why do I need it?

The form 1099g edd is a tax form used to report unemployment benefits in California. You need it to accurately declare your earnings and fulfill tax obligations each year. It ensures you provide the right information to the IRS, avoiding potential penalties or audits.

-

How can airSlate SignNow help me with form 1099g edd?

airSlate SignNow streamlines the process of completing and signing your form 1099g edd electronically. Our intuitive platform allows you to fill, eSign, and send documents with ease, reducing the hassle of paperwork. This means you can manage your unemployment benefit forms efficiently and securely.

-

Is there a fee for using airSlate SignNow to handle form 1099g edd?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, starting with a free trial. This means you can explore the features without immediate commitment. Investing in our service provides you with a secure and convenient way to manage your form 1099g edd and other documents.

-

Can I integrate airSlate SignNow with other tools for my form 1099g edd?

Absolutely! airSlate SignNow offers seamless integrations with popular platforms such as Google Drive, Dropbox, and more. This allows you to access and manage your form 1099g edd within your existing workflows, enhancing efficiency and collaboration.

-

What security measures does airSlate SignNow have for my form 1099g edd?

airSlate SignNow employs robust security measures to protect your sensitive information when handling form 1099g edd. This includes data encryption, secure access controls, and compliance with industry standards. Your documents are safe with us, allowing you to focus on getting your taxes done.

-

How do I start using airSlate SignNow for my form 1099g edd?

To get started, simply visit our website and sign up for a free trial. Once registered, you can upload your form 1099g edd, fill it out, and eSign it in just a few clicks. Our user-friendly interface and tutorials make the onboarding process fast and easy.

-

Can I track the status of my form 1099g edd with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 1099g edd in real-time. You can see when it’s been viewed, signed, and completed, providing you with peace of mind and ensuring that all documents are processed in a timely manner.

Get more for 1099g Edd

- Ds 260application forms

- Consent letter of trustees format

- Inicalcertification form

- Required minimum distribution rmd lincoln financial group form

- Calculate self employment tax with schedule se form

- Attachment 5 background investigation security forms

- Emrform

- Form va vwc 61 a fill online printable fillable blank

Find out other 1099g Edd

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself