Form Lq2 9501 Year

What is the Form Lq2 9501 Year

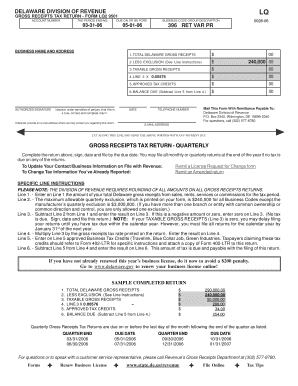

The Form Lq2 9501 Year is a specific document used for reporting gross receipts tax in the state of Delaware. This form is essential for businesses to accurately declare their revenue and comply with state tax regulations. The gross receipts tax is a tax on the total revenue of a business, regardless of the source, and is calculated based on the gross income earned during a specific period. Understanding this form is crucial for ensuring compliance and avoiding penalties.

Steps to complete the Form Lq2 9501 Year

Completing the Form Lq2 9501 Year involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and revenue reports. Next, fill out the form by entering your total gross receipts for the reporting period. Be sure to include any applicable deductions or exemptions. After completing the form, review it for accuracy before submitting it to the appropriate state agency. This careful approach helps prevent errors that could lead to fines or audits.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form Lq2 9501 Year. Typically, the form must be submitted by a specific date each year, which can vary based on the fiscal year of the business. Missing these deadlines can result in penalties or interest on unpaid taxes. Businesses should mark their calendars and ensure they are prepared to file on time to maintain compliance with Delaware tax laws.

Legal use of the Form Lq2 9501 Year

The legal use of the Form Lq2 9501 Year is governed by Delaware tax regulations. This form must be filled out accurately and submitted to ensure that the gross receipts tax is properly reported. Failure to use the form correctly can lead to legal repercussions, including fines or audits. It is essential for businesses to understand the legal implications of their filings and maintain accurate records to support their reported figures.

Required Documents

To complete the Form Lq2 9501 Year, several documents are required. Businesses should have their financial statements, including income statements and sales records, readily available. Additionally, any documentation supporting deductions or exemptions claimed on the form should be included. Having these documents organized and accessible can streamline the filing process and enhance accuracy.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form Lq2 9501 Year can result in significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these consequences. Understanding the penalties associated with non-compliance can motivate timely and accurate submissions.

Who Issues the Form

The Form Lq2 9501 Year is issued by the Delaware Division of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Delaware. For any questions regarding the form or its requirements, businesses can reach out to the Division of Revenue for guidance and support.

Quick guide on how to complete gross receipts tax

Prepare gross receipts tax effortlessly on any device

Digital document management has become favored by enterprises and individuals alike. It serves as an ideal green alternative to conventional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage gross receipts tax on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and electronically sign delaware gross receipts tax return form lq4 9501 with ease

- Locate form lq2 9501 year 2020 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive data using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign form lq2 and delaware and 2020 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to gross receipts tax

Create this form in 5 minutes!

How to create an eSignature for the delaware gross receipts tax return form lq4 9501

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form lq2 and delaware and 2020

-

What is the Delaware gross receipts tax return form LQ4 9501?

The Delaware gross receipts tax return form LQ4 9501 is a legal document required for businesses operating in Delaware to report their gross receipts. This form helps the state determine appropriate tax obligations based on a company's revenue. Using airSlate SignNow can simplify the process of signing and submitting this form electronically.

-

How can airSlate SignNow help me with the Delaware gross receipts tax return form LQ4 9501?

airSlate SignNow provides a seamless platform to eSign and manage your Delaware gross receipts tax return form LQ4 9501. With its user-friendly interface, you can quickly prepare, send, and sign documents, ensuring compliance without the hassle of paperwork. This efficiency saves time and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for filing the Delaware gross receipts tax return form LQ4 9501?

Yes, airSlate SignNow offers a cost-effective solution for managing your Delaware gross receipts tax return form LQ4 9501. Compared to traditional methods that may involve printing and mailing costs, our digital service streamlines the process while keeping expenses low. Subscription plans are designed to fit various business needs and budgets.

-

What features does airSlate SignNow offer for the Delaware gross receipts tax return form LQ4 9501?

airSlate SignNow includes features such as templates, real-time tracking, and automated reminders for the Delaware gross receipts tax return form LQ4 9501. These tools enhance accessibility and organization, helping you ensure that your form is completed accurately and submitted on time. Users can also integrate with existing software for greater efficiency.

-

Can I store my Delaware gross receipts tax return form LQ4 9501 securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure storage options for your Delaware gross receipts tax return form LQ4 9501. Your documents are encrypted and stored in the cloud, ensuring that they are safe from unauthorized access. This feature allows you to manage and retrieve your forms easily whenever needed.

-

How does airSlate SignNow enhance collaboration for the Delaware gross receipts tax return form LQ4 9501?

airSlate SignNow enhances collaboration by allowing multiple users to eSign and review your Delaware gross receipts tax return form LQ4 9501 simultaneously. This feature improves communication among team members, streamlining the review and approval process. Additionally, you can easily track changes and gather feedback in real-time.

-

What integrations does airSlate SignNow offer for managing the Delaware gross receipts tax return form LQ4 9501?

airSlate SignNow integrates seamlessly with various applications and services to help manage your Delaware gross receipts tax return form LQ4 9501. Whether you use accounting software, CRM tools, or cloud storage services, our platform can connect with them to ensure all your documents are in one place. This flexibility allows for optimized workflows.

Get more for gross receipts tax

- Transcript requirements procedures messick adult center form

- Tiaa cref funds ira distribution form tiaa cref

- Ta evaluation form

- Recement crown consent form

- Form i 800a application for determination of suitability to adopt a photos state

- Request to change child support form ps 02

- Cosmetic surgery form

- College lesson plan template form

Find out other delaware gross receipts tax return form lq4 9501

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online