TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa Cref

What is the TIAA CREF Funds IRA Distribution Form TIAA CREF

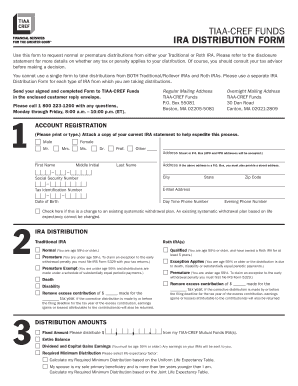

The TIAA CREF Funds IRA Distribution Form is a crucial document for individuals looking to withdraw funds from their TIAA CREF Individual Retirement Account (IRA). This form facilitates the process of requesting a distribution, whether it be for retirement income, emergencies, or other financial needs. Understanding the purpose of this form is essential for ensuring that the distribution process aligns with your financial goals and complies with IRS regulations.

How to Use the TIAA CREF Funds IRA Distribution Form TIAA CREF

Using the TIAA CREF Funds IRA Distribution Form involves several straightforward steps. First, gather all necessary personal information, including your account number and identification details. Next, complete the form by providing the required information regarding the type of distribution you are requesting. After filling out the form, review it carefully for accuracy. Finally, submit the form through the designated method, whether online, by mail, or in person, to ensure your request is processed efficiently.

Steps to Complete the TIAA CREF Funds IRA Distribution Form TIAA CREF

Completing the TIAA CREF Funds IRA Distribution Form requires attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and account number.

- Specify the type of distribution you are requesting, such as a lump sum or periodic payments.

- Provide any additional information required, such as tax withholding preferences.

- Sign and date the form to validate your request.

Legal Use of the TIAA CREF Funds IRA Distribution Form TIAA CREF

The legal use of the TIAA CREF Funds IRA Distribution Form is governed by federal and state regulations regarding retirement accounts. To ensure the form is legally binding, it must be completed accurately and submitted in accordance with applicable laws. The form must also comply with IRS requirements to avoid penalties or issues with your account. Utilizing a secure platform for electronic signatures can further enhance the legal validity of your submission.

Key Elements of the TIAA CREF Funds IRA Distribution Form TIAA CREF

Understanding the key elements of the TIAA CREF Funds IRA Distribution Form is vital for accurate completion. Important components include:

- Personal Information: Your name, address, and account number.

- Distribution Type: Options for how you wish to receive your funds.

- Tax Withholding: Choices regarding federal and state tax deductions.

- Signature: Your signature is required to authorize the distribution.

Form Submission Methods (Online / Mail / In-Person)

The TIAA CREF Funds IRA Distribution Form can be submitted through various methods, providing flexibility based on your preferences. You may choose to submit the form online through the TIAA CREF website, ensuring a quick processing time. Alternatively, you can mail the completed form to the designated address or deliver it in person at a TIAA CREF office. Each submission method has its own processing timeline, so consider your needs when selecting the best option.

Quick guide on how to complete tiaa cref funds ira distribution form tiaa cref

Finish TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without interruptions. Handle TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref with ease

- Find TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your adjustments.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and electronically sign TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tiaa cref funds ira distribution form tiaa cref

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

The TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF is a document used by individuals to request distributions from their TIAA CREF IRA accounts. This form simplifies the process of withdrawing funds, ensuring that all necessary information is collected for processing. By using this form, you can easily manage your retirement funds.

-

How can I obtain the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

You can obtain the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF directly from the official TIAA CREF website or through your account portal. Additionally, airSlate SignNow provides an easy way to access and eSign this form securely, making the process more efficient for you.

-

What are the benefits of using the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

Using the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF allows for a streamlined distribution process. It ensures compliance with regulations and helps prevent any potential errors during fund distribution. Moreover, utilizing airSlate SignNow to eSign this form can save you time and effort.

-

Are there any fees associated with the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

There are generally no fees specifically associated with submitting the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF itself. However, it is advisable to check with TIAA CREF regarding potential withdrawal fees or other charges. Using airSlate SignNow can help you avoid additional costs related to document handling.

-

What information is required on the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

The TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF typically requires personal identification information, details about the IRA account, and your distribution preferences. Make sure to provide accurate information to prevent delays in processing. Using airSlate SignNow makes sign-off on the required information simple and secure.

-

Can I submit the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF online?

Yes, you can submit the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF online through your TIAA CREF account. Additionally, after filling out the form, you can use airSlate SignNow to eSign and streamline the submission process further, making it quick and hassle-free.

-

How long does it take to process the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF?

The processing time for the TIAA CREF Funds IRA DISTRIBUTION FORM TIAA CREF can vary, but it generally takes several business days after submission. Factors that may affect processing time include completeness of the form and current workload at TIAA CREF. To ensure prompt processing, make sure all information is correctly filled out.

Get more for TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref

Find out other TIAA CREF Funds IRA DISTRIbUTION FORm Tiaa cref

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement