Massachusetts Department of Revenue Form 355SC Domestic or Mass 2015

What is the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

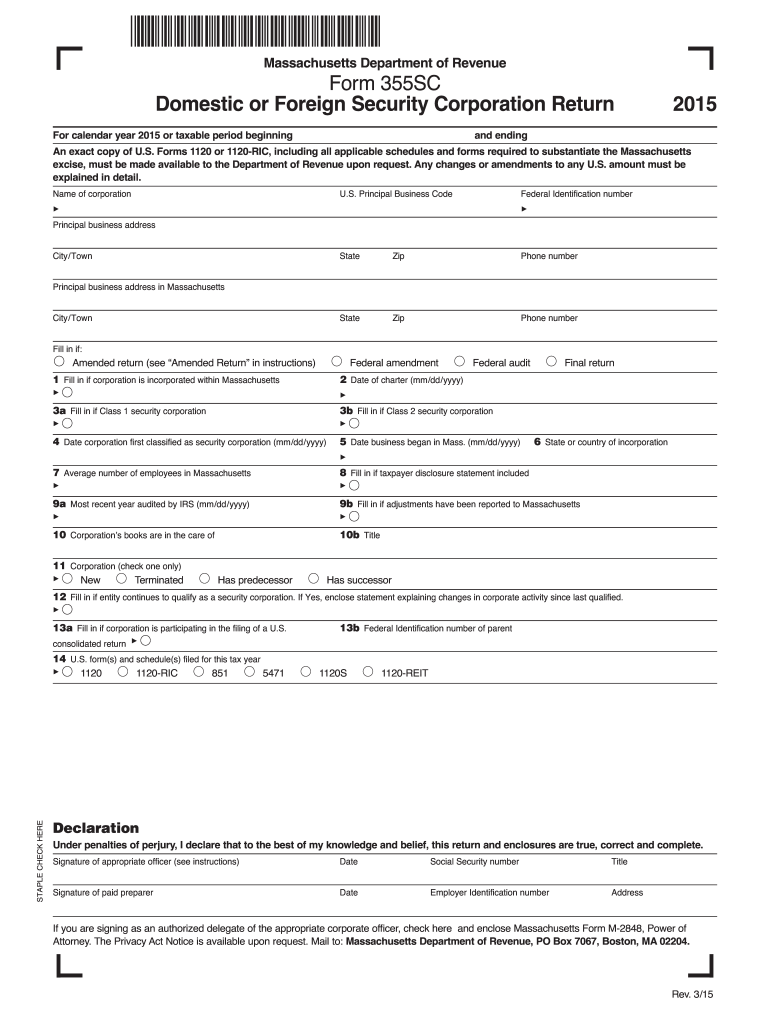

The Massachusetts Department Of Revenue Form 355SC Domestic Or Mass is a tax form specifically designed for domestic corporations operating within Massachusetts. This form is used to report income, deductions, and credits, allowing corporations to calculate their tax liability accurately. It is essential for ensuring compliance with state tax laws and regulations. The form includes sections for various types of income, adjustments, and tax credits that may apply to the corporation.

How to use the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

To use the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass effectively, begin by gathering all necessary financial documents, including income statements, expense reports, and previous tax returns. Carefully read the instructions provided with the form to understand the specific requirements for your corporation. Fill out the form accurately, ensuring that all figures are correct and all applicable sections are completed. Once completed, the form can be filed electronically or submitted by mail, depending on your preference and the requirements set forth by the Massachusetts Department of Revenue.

Steps to complete the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

Completing the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Review the form's instructions carefully to understand the required information.

- Fill in the corporate information, including name, address, and federal identification number.

- Report all sources of income, including gross receipts and any other income earned.

- Detail any deductions and credits that apply to your corporation.

- Double-check all calculations for accuracy.

- Sign and date the form before submission.

Legal use of the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

The Massachusetts Department Of Revenue Form 355SC Domestic Or Mass is legally valid when filled out correctly and submitted in accordance with state regulations. It is crucial for corporations to adhere to the guidelines set forth by the Massachusetts Department of Revenue to avoid penalties or legal issues. The form must be signed by an authorized representative of the corporation, ensuring that the information provided is accurate and truthful.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass are typically aligned with the corporate tax year. Corporations must file the form by the fifteenth day of the fourth month following the end of their tax year. It is advisable to check the Massachusetts Department of Revenue's official website for any updates or changes to deadlines, as well as any extensions that may be available for specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts Department Of Revenue Form 355SC Domestic Or Mass can be submitted through various methods. Corporations have the option to file electronically using the Massachusetts Department of Revenue's online portal, which offers a streamlined process and quicker processing times. Alternatively, the form can be printed and mailed to the appropriate address provided in the form instructions. In-person submissions may also be possible at designated tax offices, but it is recommended to verify availability before visiting.

Quick guide on how to complete massachusetts department of revenue form 355sc domestic or mass

Your assistance manual on how to prepare your Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

If you’re curious about how to generate and dispatch your Massachusetts Department Of Revenue Form 355SC Domestic Or Mass, here are some brief guidelines on how to simplify tax submission.

To begin, you just need to sign up for your airSlate SignNow account to reform how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, create, and finalize your tax papers effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust responses where necessary. Streamline your tax handling with sophisticated PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Massachusetts Department Of Revenue Form 355SC Domestic Or Mass in no time:

- Set up your account and start editing PDFs almost instantly.

- Browse our directory to find any IRS tax form; review different versions and schedules.

- Click Get form to access your Massachusetts Department Of Revenue Form 355SC Domestic Or Mass in our editor.

- Populate the required fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to include your legally-binding eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Store changes, print your version, deliver it to your recipient, and save it to your device.

Leverage this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to errors in returns and delay refunds. As always, before e-filing your taxes, consult the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form 355sc domestic or mass

FAQs

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 355sc domestic or mass

How to make an eSignature for your Massachusetts Department Of Revenue Form 355sc Domestic Or Mass online

How to create an eSignature for your Massachusetts Department Of Revenue Form 355sc Domestic Or Mass in Chrome

How to make an electronic signature for putting it on the Massachusetts Department Of Revenue Form 355sc Domestic Or Mass in Gmail

How to generate an eSignature for the Massachusetts Department Of Revenue Form 355sc Domestic Or Mass from your smart phone

How to create an eSignature for the Massachusetts Department Of Revenue Form 355sc Domestic Or Mass on iOS

How to create an electronic signature for the Massachusetts Department Of Revenue Form 355sc Domestic Or Mass on Android devices

People also ask

-

What is the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. used for?

The Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. is primarily used by S corporations operating in Massachusetts to report income, deductions, and taxes owed. This form aids businesses in adhering to state tax laws and ensures compliance, which is crucial for successful operation.

-

How can airSlate SignNow assist with the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass.?

airSlate SignNow offers an intuitive platform that streamlines the signing and submission process for the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. Our eSignature functionality ensures quick turnaround times, making it easy to get required signatures and submit forms promptly.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass.?

Yes, airSlate SignNow provides various pricing plans designed to fit different business needs. These plans include features specifically tailored to efficiently manage documents like the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass., ensuring a cost-effective solution for professionals.

-

Can I integrate airSlate SignNow with other software for handling the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass.?

Absolutely! airSlate SignNow offers integrations with various productivity tools and software, making it seamless to manage and eSign the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. alongside your existing workflows. This integration enhances efficiency and documentation management.

-

What features does airSlate SignNow offer to manage the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. effectively?

airSlate SignNow provides features such as customizable templates, bulk sending, and real-time tracking that simplify the management of the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. These tools ensure that your documents are organized, accessible, and signed in a timely manner.

-

How can airSlate SignNow improve the efficiency of completing the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass.?

Using airSlate SignNow improves efficiency by reducing the time needed to complete and sign the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. Its easy-to-use interface allows users to complete forms quickly, minimizing delays in tax submission and improving overall compliance.

-

Is airSlate SignNow secure for handling sensitive information related to the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass.?

Yes, airSlate SignNow prioritizes security, utilizing encryption and secure authentication measures to protect sensitive information related to the Massachusetts Department Of Revenue Form 355SC Domestic Or Mass. Our platform complies with industry standards to ensure your data remains safe.

Get more for Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

Find out other Massachusetts Department Of Revenue Form 355SC Domestic Or Mass

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application